Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

While many investors are aware of the more common portfolio risks – such as market volatility, low interest rates and inflation – there are others that can be just as dangerous (or even more so) to your future financial security. One of these is long-term care.

As people get older, the need for health care services becomes more prevalent – and without a plan in place to pay for these, even a sizeable asset base could quickly be exhausted within a short period of time.

Will your retirement income and assets be depleted if you (and/or your spouse) have a long-term care need?

According to a recent Fidelity Investments study, a 65-year-old couple who is retiring this year (in 2020) can expect to pay just under $300,000 in out-of-pocket health care costs throughout their remaining years – and this figure does not include the cost of long-term care. These added expenses can take a number of different forms, such as:

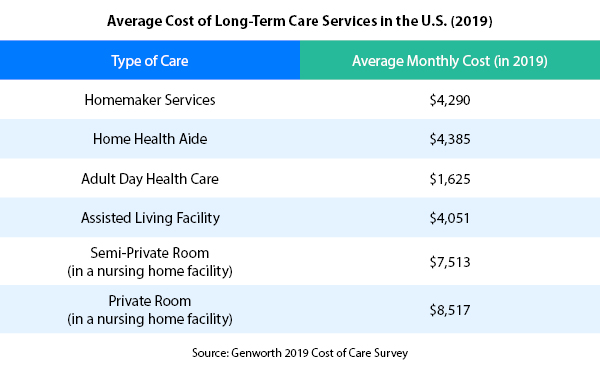

If you and/or your spouse require long-term care, you can expect to pay more – in fact, much more, depending on how and where you receive those services. For example, the 2019 Genworth Cost of Care Survey estimates that the average price tag for just one month in a private skilled nursing home room is over $8,500. This equates to more than $100,000 per year. (You could “save” roughly $1,000 per month, though, if you go with a semi-private room).

Home health care can cost less, but at an average of more than $4,000 per month, it can still be steep. Given that many retirees struggle to maintain their standard of living – even without these added costs – many don’t know where to turn if they are faced with these additional expenses.

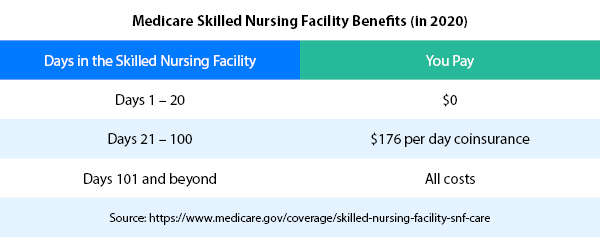

Even though Medicare pays for a long list of medical and health care needs, it covers very little for long-term care services – and that’s only if you qualify. For instance, in order to be eligible for Medicare’s skilled nursing facility benefits, you must first meet the following criteria:

Provided that you meet the above criteria, though, you could still end up paying more than $14,000 out-of-pocket for coinsurance requirements within just the first 100 days (80 days multiplied by $176 coinsurance per day equals $14,080).

Medicare also pays very little for home health care needs, and it requires that you meet some strict criteria that include a doctor’s certification that you are homebound and only able to leave your home for short periods of time for receiving medical treatment and/or attending religious services.

Another potential long-term care payment option is Medicaid. This, however, should only be considered as a last resort, because it requires that you qualify based on your care needs, as well as that you have very limited financial resources.

Throughout the years, many people have purchased stand-alone long-term care insurance to help with covering their potential needs. Unfortunately, though, these plans can be extremely expensive.

Plus, there is no guarantee that the premium won’t go up in the future. In addition to that, there is also the possibility that a great deal of money may be spent on premiums, yet the policy may never be needed.

So, what are some ways that you can leverage your current assets for helping to pay for future long-term care expenses?

There are actually several potential solutions for leveraging the assets you currently have to cover some – or even all – of the cost of long-term care. These could include:

Because everyone’s situations and needs are different, there isn’t just one single long-term care payment plan that is right for all people across the board. With that in mind, it is recommended that you first discuss your short- and long-term objectives, as well as the current assets that you have, with a retirement planning specialist.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.