Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

We all know how expensive college education is these days. We also know how critical a college degree can be for achieving a high standard of living. As a grandparent, you may want to help send your grandchildren to college. Life insurance can help achieve this goal. Let’s review how this can work, as well as a few advantages life insurance has for this purpose.

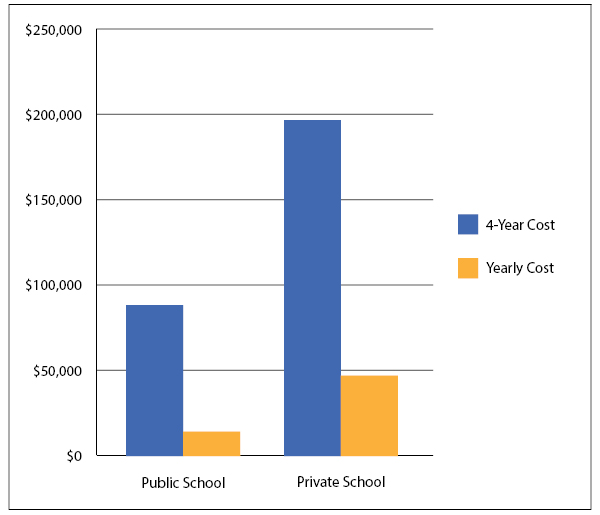

You’re not alone in worrying about paying for a good college education. With the average cost of a four-year degree $85,000 for in-state public schools and more than $194,000 for private schools, college feels out of reach for many young people today.

If you’re in a position to help your grandkids out, using life insurance could be a smart option for you. You can help pay for college expenses in either or both of two ways:

The most straight-forward way to fund college education would be to purchase a life insurance policy, or re-purpose an existing policy, and make a trust the beneficiary. By making the trust the beneficiary, you can make explicit instructions for how the funds will be used. Your trustee is required to put your instructions into effect.

You can specify a set amount per grandchild. You can make only certain amounts available in any given year to incorporate some elements of spendthrift protection. This way the money won’t be withdrawn in a lump sum and wasted on needless expenses. In short, using life insurance in combination with a trust can help you attain your goal of paying for college while making sure the money is used responsibly.

Another option, especially if you have grandchildren who will be college age during your lifetime, is to use policy loan or withdrawal features to help pay for college. Using these features has two major benefits:

Most policy loans are tax-free under current law. These amounts are not considered income. You pay a low rate of interest to the insurance company to pay the loan back. If you don’t pay it back, or if some of it is still outstanding at your death, the death benefits paid to your beneficiaries are reduced by the amount of the outstanding loan.

Policy withdrawals can also be tax-free. For this to be the case, the amount withdrawn must be less than the total amount of premiums paid for the policy. With either a policy loan or withdrawal, since you’re still living, you retain complete control over how, or when, those funds are used. You can ensure that they will be used responsibly rather than wasted during an immature phase in your grandchildren’s life.

Let’s first discuss what kind of life insurance is not suitable to this strategy: term life. Term life is only in force for a fixed amount of time (the term). While term insurance is the lowest-cost option for many people, it’s not suitable for two reasons:

If you knew you would die within the term of your term life insurance, you could use the policy to fund a trust as we discussed earlier. However, we have no way of knowing exactly how long we’ll live; what if you live decades after your term ends? You will have the option to keep paying premiums (these are known as one-year term premiums) but these are prohibitively expensive for people in their 60s or older.

You also won’t be able to use the policy loan or withdrawal options since term policies don’t build cash value. With term insurance, you have to die in order for your beneficiaries to receive any money. And, there’s a good chance you’ll no longer have your term coverage in place when you do die.

Instead, you want to use policies that are either permanent or that accumulate cash value. You have two options here:

Whole life insurance is often thought of as traditional life insurance. This insurance will stay in force until you die, or attain some great age like 100. It also builds cash value. The cash in your policy grows by earning interest, and sometimes dividends.

Universal life insurance is similar to a term policy; however, universal life insurance earns interest. By building interest, you are able to pay a level premium for this coverage and maintain the policy in-force. Universal life insurance is available in three different varieties:

Variable and indexed universal life insurance accumulates cash by having exposure to financial markets like the stock and bond market. They may also pay a fixed rate of interest, but amounts exposed to financial markets will earn a variable rate of return. This is exactly opposite to whole life, which does pay a fixed interest rate.

These kinds of policies can come with high fees and surrender charges. They may also build cash slowly (especially whole life). For this reason, you need to be sure of your commitment to using this strategy. If you abandon the effort after only a few years, you will likely pay hefty surrender fees.

Proper planning is essential when it comes to using life insurance to fund a college education. For one thing, you need to make sure that you have enough life insurance in place to meet your other estate planning goals, like paying off debts and funeral expenses.

Besides this, you want check that you’ll be able to pay the premiums that your life insurance policy will charge. As we discussed earlier, policy fees and charges can be steep in early years; you don’t want to stop paying the premiums, or you could end up wasting a lot of money.

As with all aspects of retirement and estate planning, make sure your advisor knows you’re interested in using life insurance to help pay for your heir’s education. They can work with you to choose the strategy that best fits your needs and accomplishes your goals.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling 833-219-6884 today.