Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

The idea of passing away is something that most of us tend not to dwell on, but when it comes to life insurance, it’s something that every adult should take the time to consider. What would happen to your family, should you suddenly pass away? How would your debts or sudden loss of income affect them? Would they be able to get by? Or would they be burdened financially while trying to mourn? Purchasing a life insurance policy is a responsible safety net that can help protect your family should you no longer be around.

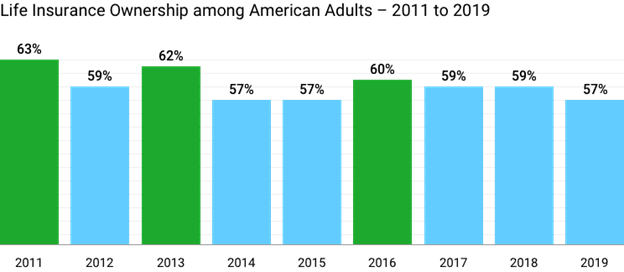

If you do not currently hold a life insurance policy, you are far from alone. It’s estimated that only 57% of Americans have life insurance, and only 30% of Americans have sufficient coverage. Those numbers equate to millions of families being financially strained when a loved one passes away. Recently, top life insurance industry leaders were interviewed to discuss the importance of carrying a life insurance policy.

When you’re in your 20s, or perhaps even your 30s, it’s easy to place the need for life insurance on the back burner. However, life insurance plays a crucial part in planning for your future, no matter your age or health. Life insurance offers a financial safety net to your family members when they may need it the very most. The COVID-19 pandemic has brought a newfound awareness of the need for life insurance. Life is precious, and our lives are filled with the unknown.

Barbara Turner, president and chief operating officer for Ohio National Financial Services, recently shared her views on the importance of carrying a life insurance policy: “People should own life insurance because it’s a vehicle to protect your loved ones when you’re no longer around. It’s a way to show love. It’s a way to help your family meet obligations and fulfill dreams and hopes. It’s a way to demonstrate love, and it’s for the living. It’s not necessarily for the dead.”

Life insurance policies are also a great way to ensure that your family’s preferred lifestyle will be held intact after you’re no longer there to help provide for them. Grief is one of the hardest parts of life, and the last thing your family should need to worry about during that difficult time is whether or not their mortgage will get paid. However, your bills aren’t the only thing that life insurance can assist your family with. Life insurance payouts can help your children or grandchildren pay for college or put a down payment on their first home. Life insurance can set up a rainy-day fund should disaster strike your family or be made as a donation to a charity you valued.

Conor Murphy, executive vice president and chief operating officer of Brighthouse Financial, also shared his thoughts on this topic of his industry by saying: “It’s a very personal decision for people. In many cases, it starts with wanting to protect loved ones if you’re not around to provide for them. Would your family still be able to live in their home? Would your spouse be able to survive financially? Who would look after your kids if your spouse had to work more? Would there be enough money to send your kids to college?”

Life insurance policies are essential for everyone to have; however, one size does not fit all. Your financial needs aren’t the same as your neighbor’s down the street, so you must talk to a professional who is equipped to advise you on how much coverage you would need. For some policyholders, their family’s financial stability is their top priority; for others, they may want to use their life insurance to support a specific cause and leave a legacy after they’re gone.

Another life insurance industry leader, Dave Wilken of Global Atlantic Financial Group and president of the firm’s life insurance business, portrayed his advice about carrying adequate coverage by saying: “Most of us have a family that we’re raising in various stages, and if you have a young family you probably need as much as 25 times your income as income replacement in case you unfortunately die. As you get older and still have a family, that can grade down to something like 10 times your current salary.”

People who don’t have life insurance policies usually have reasons why they don’t carry it. However, some of those reasons may be misguided. It’s common for people to think of life insurance as an unnecessary expense because they’re young or in excellent health. When you’re young, and in good health, the truth of the matter is that it’s often the ideal time to buy a policy to ensure more affordable premium costs.

Ohio National's Turner has thoughts on life insurance misconceptions that she shared: “Some common misconceptions about life insurance are, number one, that it’s not affordable. It is affordable. Another is that it’s only for individuals who have a lot, although it’s for everyone. It’s not inaccessible because it’s available for all. You don’t have to be in perfect health; you don’t have to be wealthy – it’s for everyone.”

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.