Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

One of the safest ways to invest your money is to trust in the United States government and purchase treasury bonds.

A bond, according to the U.S. Securities and Exchange Commission, is a type of IOU debt security. When purchasing a bond, the issuer could be a government or corporation that promises to pay a set rate of interest during the life of the bond and repay the face value of the bond when it matures over a certain period.

A treasury bond is also known as a T-bond. They are government debt securities from the federal government that set maturity dates for a range of 10 to 30 years. They are generally considered risk-free since the U.S. can tax its citizens to pay back the bonds.

Investors who are especially risk-averse typically buy bonds to gain a steady income stream. They are usually given back their principal, as well as an interest payment twice a year. It is a great way to receive the entire principal back and preserve capital while continuing to invest in other assets. Governments tend to issue bonds to attain operating cash flow, fund capital investments and finance debts.

Several types of U.S. Treasury debt carry the full credit and faith of the U.S. government. These include the following:

There are many advantages to investing in treasury bonds, and it is vital to understand both the benefits and risks of achieving your financial goals. Examples include:

Tax perks: Treasury bonds are exempt from local and state taxes, though you need to pay federal income taxes. Keep in mind when selling your treasury bonds or redeeming them when they mature, some components can be taxed.

Moreover, you can buy a bond at an Original Issue Discount (OID) or through a market discount via a secondary market. If you purchase a bond at an OID and sell it or wait until it reaches maturity, your profits will fall into a varying type of income compared to if you bought a bond at a market discount for a price that is less than the face value.

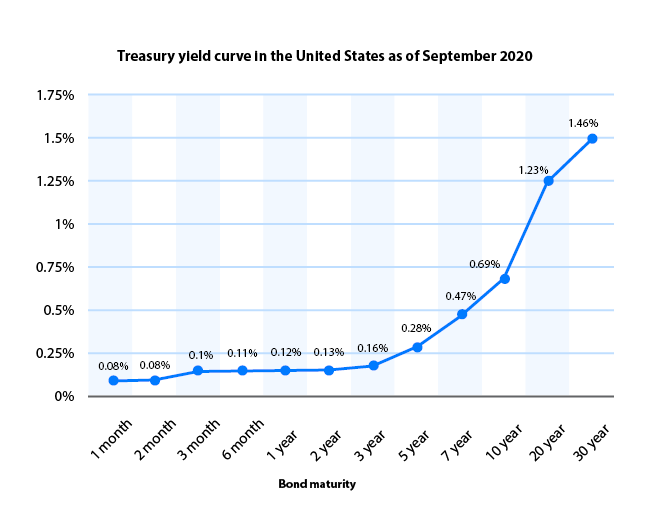

According to Statista, the treasury yield curve as of September 2020 shows how treasury bonds with longer maturities overall produce higher yields.

It is essential to think about your financial goals and whether the disadvantages of investing in treasury bonds are the way to go. Things to think about include the following:

Lower returns: Because treasury bonds have a low risk, they also come with lower returns in comparison to other investments such as stocks. However, investing in stocks does come with higher risks. The formula you can use to calculate your return on investment in treasury bonds held to maturity would be:

Treasury Yield = [Coupon Rate + ((Face Value – Purchase Price)) / Time to Maturity] / [(Face Value + Purchase Price)/2]

To buy treasury bonds, you can go to the U.S. Treasury Direct website as long as you have a U.S. tax identification number. You will also need to access your bank account to fund your purchases and an email address to start your account. Treasury bonds are sold at online auctions four times each year on the first of Wednesday in February, May, August and November. You can do two types of bidding:

The minimum price for buying a treasury bond is often set at $100 and raises in increments of $100. The maximum amount you can invest in is $5 million.

You can also buy treasury bonds through a bank or brokerage. The financial institution will watch the U.S. Treasury’s auctions and place bids for you, though you may be charged an added fee to place bids with them. They can also help you buy older treasury bonds through a secondary market such as a major stock exchange for an extra fee.

There are many benefits to investing in treasury bonds, especially if you are looking for a low-risk alternative and are highly conservative. It can also be a way to diversify your financial holdings and mix your assets. Choosing to invest in treasury bonds can be great for your portfolio if you work with the right financial institution that is looking after your best interests.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.