Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Although there are millions of investors from coast to coast, and around the world, each and every individuals’ investment decisions matter – but not just to the investor. In fact, the decisions and attitudes of investors can impact the way that financial markets perform. This is particularly the case during challenging economic times.

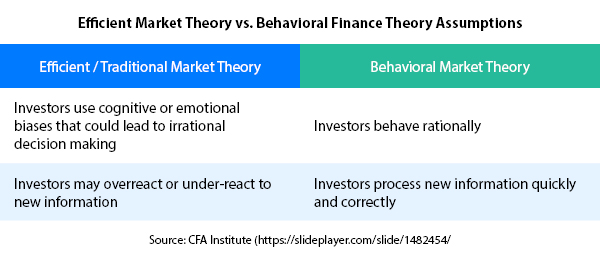

In the past, financial markets were understood to be “efficient,” based on the traditional efficient market theory. This is the hypothesis that stocks always trade at their fair value on market exchanges, which makes it impossible for investors to purchase undervalued stocks or to sell stocks for inflated prices.

This theory essentially means that it is not possible to outperform the overall stock market – even if investors “time the market” and/or purchase shares based on expert selection. In fact, based on this particular theory, the only way that an investor can achieve higher returns is by purchasing riskier investments.

The idea behind the efficient market theory is that certain market indicators always move in correlation with each other. So, for instance, if stocks are going down, the value of bonds will go up and vice versa. But, given today’s volatile market and low interest rate environment, this isn’t necessarily the case.

There are several factors that can impact the efficiency of the market, such as:

In addition, over time, more investors have based their financial decisions on emotion, rather than solely on the current or past performance and the anticipated future outcome of various financial vehicles.

This, in turn, can actually make the market even more volatile and unpredictable – and it can be intensified substantially when other items are factored in, such as the COVID-19 pandemic. This is where behavioral market theory comes in.

The proponents of this theory view investing from more of a psychological perspective. In this case, unlike the thoughts behind the efficient market theory, stock prices are not driven by rational expectations of future returns.

Behavioral market theory also addresses many market anomalies that the efficient market theory ignores, such as excess market volatility. For instance, if much of the stock market’s volatility is unexplained, the efficient market theory can easily be challenged.

As an example, while the efficient market theory states that the prices of assets can be forecast using the present discounted value of future returns, the forecasts of share prices based on the efficient market theory tend to be more unreliable.

In addition, the behavioral market theory promotes that the only way to truly reduce market risk is to move money out of the market altogether. But even though this strategy may have worked in the past, today’s investors cannot necessarily count on bonds to be performing well when stocks are performing poorly.

By moving money out of the stock market and into “safe” investment options like bonds or CDs (certificates of deposit), investors may believe that their portfolios won’t lose value. Unfortunately, though, given today’s unique and unpredictable markets – along with low interest rates – CDs and other deposit accounts won’t generate enough earnings to even meet much less beat inflation. And this can have a negative impact on the current portfolio’s performance, as well as on whether or not a sufficient amount of income can be generated for retirees.

Therefore, people are left wondering what to do in terms of opportunities for financial growth while at the same time keeping their money safe from negative market movements. One solution is the fixed index annuity.

Fixed index annuities can provide a “happy medium” of consistent, modest returns, but without any risk to principal in a downward moving market. The return on a fixed index annuity is correlated to the performance of an underlying index, such as the S&P 500.

When the index performs well in a given period, a positive return is credited to the fixed index annuity – usually up to a set maximum, or “cap.” Yet, if the index performs poorly, the annuity is still credited with a guaranteed minimum “floor,” usually in the range of 0% to 2%.

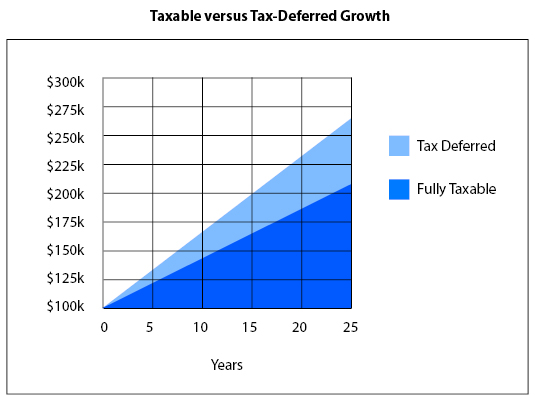

This protection of principal allows the annuity to continue building on past gains when the index moves up again. Plus, like other types of annuities, the growth that takes place in a fixed index annuity is tax-deferred.

This means that there is no tax due on the gain until the time of withdrawal. Therefore, the annuity’s return can continue to generate a positive return and build upon previous gains, without having to make up for any previous losses.

If or when a fixed index annuity holder is ready to start receiving income, the annuity can be converted to a steady, reliable stream of incoming cash flow, either for a defined period of time (like 10 or 20 years), or even for the remainder of his or her lifetime.

In addition to the pure financial aspect of fixed index annuities, these tools can also offer investors some enticing non-financial features, too, such as:

Not having to concern yourself with potential financial loss in a downward moving market can reduce the stress and anxiety that oftentimes come with financial losses. Because of this, investors and retirees can focus on other, more important things, like spending time with loved ones and taking part in fun activities.

In fact, generating a stable and reliable income in retirement can oftentimes be the difference between living well and being in a state of constant worry, wondering if you will outlive your assets and income in retirement.

Coordinating your financial plan to optimize growth while also keeping your principal safe can be somewhat challenging. But an experienced financial professional can help you to wade through all of the “fine print” and choose the financial vehicles that work best for you and your objectives.

If you would like to learn more about whether or not a fixed index annuity is a good fit for your portfolio, contact Alliance America for more details on how these annuities work, as well as how they can enhance your financial future.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.