Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Even if you don’t plan to leave the workforce anytime soon, the financial markets can still have a big impact on your retirement and your financial security in the future. There are a number of risks you can face with your money. Some of the biggest of these can include stock market volatility and low interest rates.

Oftentimes, when the stock market is – or is anticipated to be – in a downward trend, investors “flee to safety” by moving money out of equities and into more conservative financial vehicles like bonds and CDs. Unfortunately, though, during a time of low interest rates, going this route can also induce some challenges.

For well over a decade now, the U.S. has faced exceptionally low interest rates. And, while a low interest rate environment can certainly have its advantages if you’re securing a home mortgage or financing the purchase of a new car, low rates can wreak havoc on your retirement income plan.

This is especially true given that people are living longer these days and need income to last for a longer period of time (on average), as well as to increase on a regular basis in order to help keep pace with rising inflation and the increased cost of goods, services, and medical/long-term care expenses.

As an example, even if you have a nest egg of $1 million, by placing these funds into financial vehicles that are only paying 1% or 2%, you would only generate $10,000 to $20,000 per year. Can you sustain your desired retirement lifestyle on that?

As an added challenge, the Fed has announced that it will be keeping rates low for an extended period of time, while allowing inflation to exceed their target of 2%. Yet, while doing so may help to “jump start” the economy, it can be dangerous for retirees who are relying on CDs, bonds, and other sources of fixed income – especially as inflation ticks higher.

Nobody has a crystal ball that can predict exactly how long you will live. Because of that, it is essential to plan ahead with one or more retirement income sources that will last as long as you need them to – no matter how long that may be.

One retirement income source that many people rely on is Social Security. If you qualify for Social Security (either through your own work record or that of your spouse), you can count on a regular monthly stream of retirement income for life.

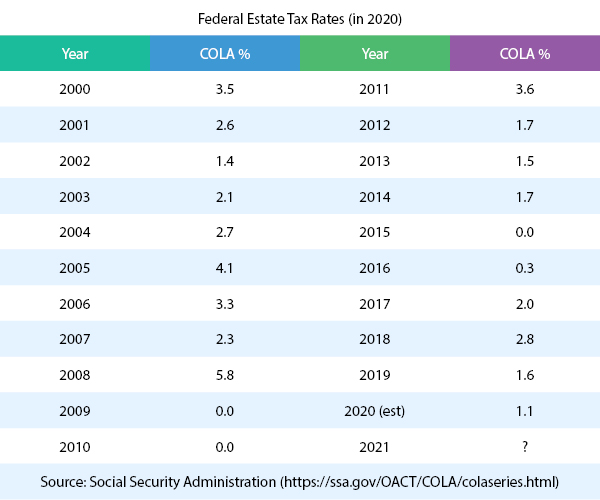

In addition, the amount of your Social Security income will typically go up every year – but that cost-of-living adjustment (COLA) isn’t guaranteed. For instance, following the economic recession in 2008, there was no raise in 2009 or 2010. These adjustments are based on the Consumer Price Index.

Source: Social Security Administration

It is also important to note that Social Security was never meant to be the sole source of income for retirees. That’s because for an average wage earner, Social Security will only replace about 40% of pre-retirement earnings. With that in mind, most people will require additional sources of ongoing retirement income.

Typically, investors and retirees must choose a financial strategy that is based on “either/or” scenarios. For instance, stocks offer the opportunity to obtain growth, but they also are at risk of loss.

Alternatively, bonds, CDs and other “safe” financial tools will protect principal, but at the cost of exceedingly low returns that often will not even meet, much less beat, ever-rising inflation going forward.

But there is one potential solution – the fixed index annuity, or FIA. This type of annuity provides the ability to generate a higher return than a regular fixed annuity and other low-rate options. It does so by basing its return on the performance of underlying market indexes like the S&P 500 and the Dow Jones Industrial Average (DJIA).

So, when the index performs well, the annuity is credited with a positive return for that contract year – usually up to a set maximum, or cap. But, if the index performs poorly, the principal – and any of the previous gains – will not be affected.

As with other types of annuities, the growth that is generated inside of an FIA is tax-deferred, meaning that no tax is due on the gains until the time of withdrawal. In addition, fixed index annuities can also pay out a reliable source of income, either for a set period of time (like 10 or 20 years), or even for the rest of your lifetime.

Many FIAs include added features, too, such as a death benefit for survivors and/or penalty-free access to your funds in certain situations like being diagnosed with a chronic or terminal illness, or the need to reside in a nursing home for at least a minimum period of time.

Overall, then, there are many benefits that can come with the purchase of a fixed indexed annuity, including:

Fixed indexed annuities can offer a long list of benefits. But even so, these financial tools may not necessarily be right for everyone. In addition, not all FIAs are exactly the same. So, it is essential to have a good understanding of how they work, and whether or not a particular fixed index annuity may be a good fit for your portfolio.

Talking with Alliance America can help you to determine if a fixed index annuity is in line with your short- and long-term financial goals.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.