Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Preparing for a comfortable transition into retirement takes hard work, time and careful planning. But what happens if you invest your money in the stock market and it crashes at the start of your golden years? Addressing the risks now can protect your retirement income for the rest of your life.

Universal life insurance policies support your financial goals by strengthening your investment portfolio. Even if your nest egg is exhausted and markets become volatile, your life insurance policy can help ensure your income needs are met.

Both risks pose a tremendous threat to your pension funds, but there are ways to manage the risks.

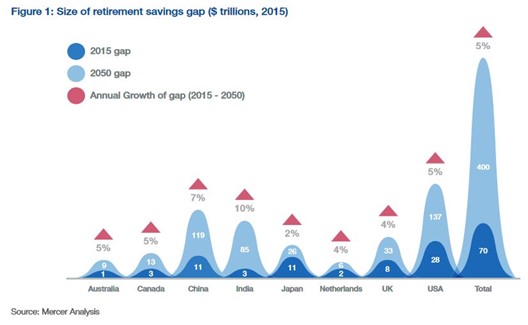

On average, retirees tend to outlive their retirement savings by a decade. This savings deficit means many seniors have to delay their retirement, cut costs or return to work. Unfortunately, the savings gap is predicted to grow.

Luckily, if you create an income protection plan early on, you can avoid these retirement setbacks and ensure that your income lasts for your entire life. For example, an indexed annuity pays a guaranteed interest rate based on a stock market index, such as the S&P 500.

Indexed annuities have the potential to protect you from inflation, and there are fewer chances of losing money if the market doesn't perform well. An indexed annuity with an income-guarantee rider can protect you from outliving your income, safeguarding you from longevity risk.

Because the stock market is continually fluctuating, you face the risk of a negative return when you're ready to retire. However, this type of volatility during your retirement's early stages could significantly reduce your overall savings. This phenomenon is known as sequencing risk.

| Unfavorable Sequence | Favorable Sequence | |

|---|---|---|

| Worst/Best | Unfavorable Sequence$29,023 | Favorable Sequence$912,241 |

| 5th/95th Percentiles | Unfavorable Sequence$78,828 | Favorable Sequence$670,139 |

| 10th/90th Percentiles | Unfavorable Sequence$103,139 | Favorable Sequence$599,802 |

| 25th/75th Percentiles | Unfavorable Sequence$194,184 | Favorable Sequence$451,448 |

Even if your long-term returns are favorable, poorly planned sequence withdrawals could quickly deplete your savings. The good news is, you can transfer part of this risk to your life insurance policy.

For example, indexed universal life (IUL) insurance with volatility control can blend your fixed income and equity to stabilize your returns. If you have an IUL policy, you can maximize the cash value by diversifying the asset allocations.

Let's talk about how you can start building a dynamic supplemental income source for your retirement. Consider the following hypothetical situation.

A married couple starts to consider different options to build their retirement savings. On the one hand, they want a solution that provides long-term income guarantees. At the same time, they'd like to potentially supplement their savings to ensure they won't have to sacrifice their standard of living in the future. An IUL policy offers the potential to save additional income. However, the couple also wants to guarantee their minimal tax-free retirement income.

In this case, combining an IUL policy with a guaranteed universal life (GUL) policy could be the best option. Let's see how diversifying your portfolio impacts the outcome.

If you're looking for a guaranteed income source during retirement, you might consider combing an IUL and GUL policy.

Market and longevity risks are often overlooked, but preparing for these potential outcomes is crucial in retirement planning. Life insurance policies offer additional security, knowing that your income, children and quality of life are secured. Consider the other advantages of adding coverage to your investment portfolio.

Permanent life insurance coverages increase in cash value over time, so it's never too early to start looking at options. You'll find that it's possible to benefit from the policy long before you retire. Accumulated cash values can be paid out on a tax-deferred basis, which you can use, for example, to pay college tuition or make a down payment on a home.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.