Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Sometimes plans go awry. Life gets in the way. We know what to do, but circumstances sometimes conspire against us, and we can’t make our goals happen. This is especially true of saving for retirement. There is such a torrent of information and advice out there about starting early, living below your means and investing for the long haul. So, we all know what we’re supposed to do.

But, for a myriad of reasons, we often fail to achieve these goals. We fall behind on saving or suffer crushing financial losses. Then, just when we’re reconciled to toiling away during our golden years, the unthinkable happens: We receive a windfall. An unexpected inheritance or sizable lottery win.

Everything changes. We resolve not to make the same mistakes this time around. But, what should we actually do with such a life-altering inheritance? We need a solid plan; one that addresses debts, expenses, retirement income and asset preservation. In this article, we’ll talk about the importance of having a smart plan for handling an unexpected windfall.

As is so often the case, it’s easy to know what we’re supposed to do. We’re supposed to be financial robots, dutifully socking away 10% of our income each and every year. And, we’re never supposed to tap into that hard-earned nest egg – no matter what.

Life is much more complicated than that, of course. This kind of advice ignores what it means to be human. As humans, we make mistakes and errors in judgment. We’re moved to compassion when our friends or family are in need, so we lend them money or take them in. We cover expenses for our grown kids. All of these can eat into our ability to save.

Even worse, genuine catastrophes occur. Houses are destroyed in natural disasters, we have car accidents and become disabled, and businesses fail. When these and other tragedies strike, our savings is at best put on hold and at worst consumed to help pay expenses.

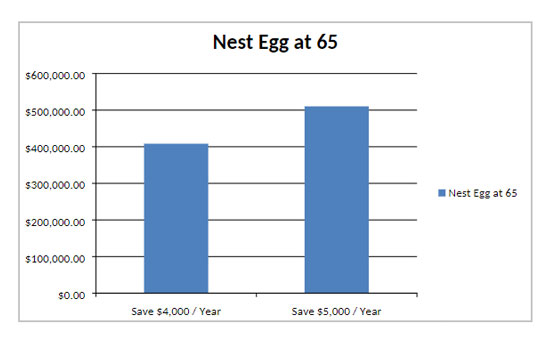

Even small changes add up over time. For example, the difference between saving $5,000 per year and $4,000 per year can be huge. In the chart below, we assume that either $5,000 or $4,000 was saved every year from age 35 to 65, a total of 31 years. We also assume a constant 7% annual return.

In this example, the difference in saving was $1,000 per year, only $83.33 per month, but the total difference over 31 years turned out to be more than $100,000. A bigger difference will produce even bigger savings shortfalls.

On top of all of these difficulties of life, we all know that stock markets can collapse with frightening speed.

Much of the last 20 years has been spent in one financial crisis or another. In short, life often gets in the way of following the abundance of financial advice out there.

So, what does it all mean in the end? When we can’t or don’t save, or when our savings evaporate? It paints a bleak picture, one in which we have to make sacrifices we’d rather not. Lack of savings later in life can mean:

There are safety nets, of course, but Social Security can only go so far. But, by reducing expenses, working longer and living within your means, we can make it work.

All this can change in a moment, though, when the unexpected happens: we get a financial windfall. It might happen in one of several ways:

We know it’s a great blessing and that the infusion of cash can make things so much better. But, that doubt can creep in: What do we do with the money? How do we put it to good use and not make mistakes managing it?

The old saying is absolutely true: Failing to plan is planning to fail. When we benefit from a sudden windfall, we must immediately start working on a plan. If we’ve struggled with sound financial decision-making in the past, it’s essential that we work with a financial professional. Having a financial professional to advise us will be critical to making the most of our opportunities afforded by the windfall.

A financial professional can help us make general, strategic plans, like:

Obviously, if this happens to you, you’ll need to follow the advice of your financial professional. However, for the rest of this discussion, we’re going to touch on the ideas of paying down debt, investing for growth and planning for retirement income. We’re going to use the specific example of someone who’s 58 years old and inherits $500,000. What should they do?

If you’re having trouble saving, or even making ends meet, before you receive your inheritance, you’ll want to have a good discussion with your financial professional about paying off some of your debts. You might not want to spend all of your money on this, but at a minimum consider paying off “bad” debts like:

These loans tend to come with the highest interest rates and really don’t provide you with an appreciating asset. As for bigger items, like your mortgage, there are conflicting opinions on that, so make sure to hash it out with your financial professional.

Besides trimming your debt load, you might be in position to invest some of this money for growth. Now, most people immediately think of the stock market when they hear the phrase “invest for growth,” but you need to be cautious here. This is where a sound asset allocation plan will be critical.

Asset allocation is the process of putting your money to work in different tools in an attempt to both make gains and protect your nest egg. Some asset classes are much riskier than others. Some examples of investment classes from generally safe to generally risky include:

Although you’ll work with your financial professional on a specific plan, a good general guideline to keep in mind is the “100 minus your age” rule. This rule states that you should have decreasing exposure to the stock market as you age. With this guideline, you subtract your age from the number 100. Whatever the result is, that’s the maximum percentage of your nest egg you should have invested in the stock market. In our example, you’re 58, so you should have no more than 42% of your nest egg invested in the market.

If your exposure to the stock market deceases each year as the “100 minus your age” rule advises, you should expect that your investment gains will also slow over time. After all, you’re heading for retirement, and you definitely don’t want to have a big loss in your next egg right before you plan to stop working.

With this being the case, you’ll need to have a plan in place for generating and managing income in retirement. It’s retirement income that will allow you stop working and yet keep meeting your expenses and finance the lifestyle you want.

You’ll likely have Social Security as part of your retirement income. Your full retirement age will be somewhere between 66 and 67. Will you work right up until that time? Or, will you retire early? If you retire early, will you also take Social Security early, perhaps at age 62? If you do, you’ll have a reduced payment. On the other hand, will you delay taking Social Security, and get a larger payment, perhaps by delaying Social Security until age 70?

These are big decisions, so working with a competent financial professional is crucial here. These decisions have big consequences, so whatever plan you make, you’ll want to stick with it no matter what.

One thing that can make these decisions easier is if you have other sources of retirement income from your nest egg. As you slowly get out of the stock market, you’ll work with your financial professional to move your money to investments that can pay you a stream of income over time. These nest-egg-provided streams of income are added to whatever Social Security benefit you receive; this is the income you’ll live on in retirement.

So far, we’ve talked about growing your nest egg and generating income in retirement as if they were two separate events. And, this is often the case when you transition from higher stock market exposure to more conservative cash-generating investments.

However, there is a specific class of assets designed to accomplish both of these objectives: indexed insurance products that combine some element of guaranteed principal with lifetime income and safe exposure to stock market life returns. These products fall generally into two types:

The key to both of these products is that instead of paying a small, fixed interest rate (which in the current market tends to be quite low), they pay an interest rate based on the performance of one or more investment indices.

With indexed life insurance and annuities, you choose one or more indices that you want to target. The interest that you earn for a given year is then tied to the actual performance of the indices you chose. Here’s the best part, though: If the indices go down (and down years do happen in the stock and bond markets), you don’t lose any money. Instead, you simply earn 0%.

What this means is that you get the best of both worlds: You can earn higher interest rates during “good” years and be totally protected from losses during “bad” years. While making high gains is always welcome, it’s avoiding losses that can really make a difference to the success of your retirement savings.

Here’s even better news: Since these are insurance products, you can convert them into streams of guaranteed income for life. You do this by “annuitizing” a fixed index annuity, which means that you stop making deposits (premium payments) and start receiving payments. Whatever the value of your annuity is at this time will determine how large your income payments are. You also have choices about how you want to receive these payments:

These income payments are guaranteed by your insurance company. Once you’ve accumulated the money in your annuity and started receiving payments, you don’t need to worry about market performance or anything like that. Just collect the payments.

With indexed universal life insurance, the mechanics would be a little different. You might withdraw some of the accumulated value of your policy. Then, take these funds and put them in an “immediate” annuity, which is one that will start paying you a monthly benefit right away. Once again, these payments are guaranteed for life.

Even better, by working with your financial professional, you can withdraw a strategic amount of money that will:

In this case, you get the benefit of some of the accumulated cash value in the form of monthly income, and your policy is still in place. When you eventually die, the remaining life insurance will then pay to your beneficiaries, which can help execute your estate plan. If you use this method, then your indexed universal life insurance policy will have fulfilled these functions:

That’s not too bad for one simple product, right?

The key point here is that you have to have a plan, it needs to be a good one, and you need to stick with it. The exact products you use should be chosen based on your circumstances. For instance, if you already have adequate life insurance, you probably don’t need another policy. Instead, you can use your windfall to start funding a fixed index annuity. You want to make the most efficient use of your windfall as possible, and all with one goal – provide the best retirement possible.

Sticking with your plan is just as important as forming one. Indexed insurance products can have high surrender charges, so you want to make sure you’re committed to using them in your plan before you buy them. If you do this, you’ll avoid the surrender charges and instead make full use of them as assets to grow your nest egg and eventually provide guaranteed income for life.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.