Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Back in the early 1900s, Henry Ford issued his famous statement that, “Any customer can have a car painted any color that he wants so long as it is black.” That didn’t leave a lot of options. Today, however, vehicles come in a plethora of colors. They can offer a wide range of features, too, so that buyers can choose the one that is best for their particular needs and their budget, even though they all essentially perform the same service – getting you from Point A to Point B.

The same holds true regarding fixed indexed annuities, or FIAs. While these financial vehicles can offer a stream of reliable income, as well as tax advantaged growth, not all of these annuities are exactly the same.

But even though these differences can allow you to pick and choose the annuity that most closely fits your objectives, unless you have a good understanding of how FIAs work, you also run the risk of picking the wrong one – and if this is the case, it can be fairly expensive to get out of it and into a better alternative.

Much like houses all have some type of foundation, fixed indexed annuities can for the most part perform the same functions. These include growing the account based on the performance of one or more underlying market indexes and allowing for the payout of an income stream.

But this is where many of the similarities – at least with fixed indexed annuities – stop. In fact, there are several ways in which fixed indexed annuities can differ – sometimes quite substantially – from one another, such as:

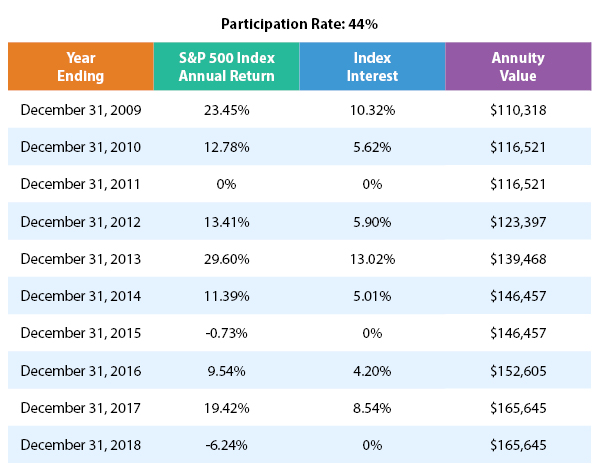

Likewise, if a spread is imposed on a fixed indexed annuity, it could also reduce the amount of interest that is credited to the account over a specific period of time. In this case, the amount of return is determined by subtracting a certain percentage from any gain that the underlying index(es) achieves within a given period of time (usually during a contract year). In this case, if the annuity imposes a spread of 4% and the index increases 10% during a contract year, then the FIA could receive a 6% return (although if there is also a cap and/or participation rate, the overall could differ, oftentimes reducing it even further).

Many investors have been enticed by fixed indexed annuities because of their ability to reign in market volatility by allowing for limited upside potential and at the same time limiting (or better yet, eliminating) losses when the tracked index(es) go into negative territory.

So, while the S&P 500 is a commonly used index for determining an FIA’s return, over the past few years, “volatility controlled” indices have also come into the limelight. This type of index will often track a “basket” of assets that change regularly, with the goal of making the index fluctuate up or down less than the S&P 500.

It is important to keep in mind, though, that different insurers will typically use their own unique indices. So, here again is yet another feature that can make fixed indexed annuities differ – sometimes significantly – from one another. Working with an annuity specialist can help you to sort this out.

Fixed indexed annuities can offer a long list of advantages – and given their ability to provide market-linked return without any of the downside risk, it can seem like these financial vehicles provide a “best of both worlds” scenario.

But that is really only partially true. In fact, regardless of the benefits offered through an annuity, if it’s not the right one for you, it could end up being a costly financial endeavor. With that in mind, discussing your short-term and long-term objectives with a retirement income specialist is the best place to start, before making a commitment to an annuity.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.