Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

The SECURE Act has big impacts for estate planning in general, and the concept of the stretch IRA in particular. Going forward, conversion to Roth IRAs may be a more attractive strategy.

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 is bringing about many changes to the retirement and estate planning field. These changes are designed to improve the ability of Americans to save for retirement, but they come with a big change to the way many people pass assets on to younger generations.

Prior to the SECURE Act, the stretch IRA was a popular estate planning tool. To use the stretch IRA, a person would name a younger, non-spouse, beneficiary (generally a child) of their IRA. By doing this it was possible for the beneficiary to receive Required Minimum Distributions (RMDs) over their longer life expectancy. This resulted in the potential for large tax savings.

For those with the right combination of circumstances, converting your traditional IRA or 401(k) to a Roth may now make more sense than it did before the passage of the SECURE Act.

Converting non-Roth funds to Roth status involves the following steps and consequences:

Converting to Roth is not a good move for everyone. It can generate a very large tax bill in the year of your conversion. You must have the ability to pay the tax bill from current savings, rather than from the funds you’re converting.

If you pay the taxes from your IRA or 401(k), you’re effectively removing money from the power of compounding returns and you might never grow your account enough to offset the loss.

Also, paying taxes out of pocket should not be considered if you intend to use the accumulated IRA or 401(k) for living expenses, or if you plan to give away a large amount of your estate to charity. Instead, consider conversion to Roth if you meet these criteria:

In short, this strategy applies to retirement accounts that you don’t really “need” in order to live the life you want in retirement.

Any funds that are in a Roth IRA or 401(k) for more than five years accumulate tax-free. And, since you paid income tax on the conversion, the principal can be distributed to them tax-free, too.

This is the exact opposite of how it works with traditional IRAs and 401(k)s, where you don’t pay taxes on contributions. But, when you take withdrawals, you pay taxes on both the contributions and the investment earnings.

With the converted Roth funds, your children will ultimately have to take RMDs when they turn 72. However, now that the funds they inherited are held in a Roth IRA, they should be able to receive their distributions tax-free.

To look at the difference Roth conversion can make to your children, we’ll look at a hypothetical example. In this example, the following assumptions will apply:

The qualified account owner dies at age 83 and leaves $500,000 in a traditional IRA or 401(k).

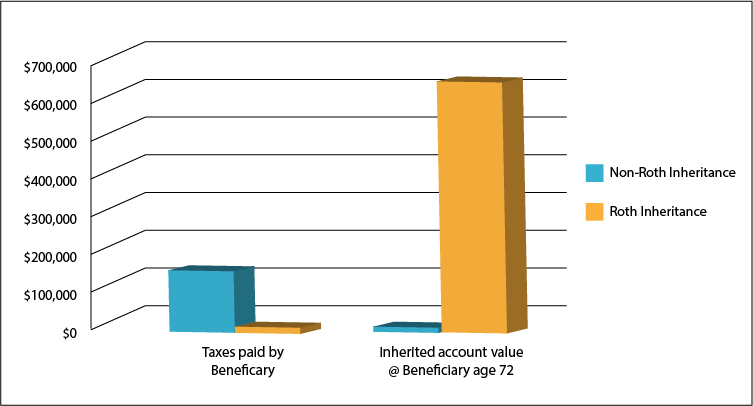

Under the SECURE Act, the beneficiary must withdraw the funds over a 10-year period. This will increase their taxable income by $50,000 per year. Based on 2020 tax rates, this extra income will raise their taxes by $12,001 per year. They will pay an extra $120,000 in income taxes over 10 years.

The qualified account owner converts the qualified account to Roth status at age 64.

The beneficiary would be required to take RMDs at age 72, by which time the funds would have grown to over $640,000 if the funds compounded at 1.5%. Importantly, these distributions are not taxable because tax was paid at the time of conversion.

As you can see, the tax savings to your heirs can be huge in a Roth-conversion scenario. Also, with even tiny investment gains of 1.5% compounded annually, the Roth funds can grow significantly, providing a huge boost to your heirs’ own retirement security.

The demise of the stretch IRA has the potential to increase taxes on inherited IRAs and other qualified retirement accounts. These taxes can be a burden to your heirs, or deplete your hard-earned savings faster than originally planned.

For those in the right circumstances, converting to Roth status can protect your children from higher taxes, and give them a nice cushion for their own retirement. Roth conversion has many variables and consequences, so be sure to discuss it with your retirement and tax advisor before making any decisions.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.