Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Buying your newborn grandchild clothes and toys can be lots of fun. However, if you want to help them toward a secure financial future, add the gift of life insurance. A life insurance policy given early in their life can be a remarkably powerful financial tool with numerous possibilities.

Anyone who has become a grandparent recognizes it as one of life’s greatest gifts. And it’s only natural for them to want to shower their newborn grandchildren with presents to commemorate their arrival.

As extended caregivers, grandparents typically have the right to purchase permanent life insurance for their grandchildren. The insurance can be purchased in the child’s name, meaning the child becomes the policy owner once they reach adulthood.

While many gifts will lose value quickly, a permanent policy’s benefits can last for a lifetime. In addition to showing love and support, a life insurance policy can provide grandchildren with a financial start and peace of mind in the future.

Here are just some of the things you should know:

Permanent life insurance (as opposed to term insurance) provides coverage for as long as the insured person lives. The premium for permanent life insurance — whether whole or universal life – is fixed for as long as the policy is in force. It makes an excellent gift for a grandchild because it will last a lifetime, as long as the premiums are paid.

In addition to a death benefit, a permanent life insurance policy accumulates cash value every year and could give your grandchild a helping hand in their financial future. And while premiums for other types of insurance increase with age, permanent life insurance premiums are locked in for life at your grandchild’s current age.

You may never have thought about life insurance as a gift for your grandchild, so the idea might seem a bit strange at first. But consider all the reasons why life insurance is the right choice:

Peace of mind: Having a child insured with a death benefit would provide financial assistance to the parents if a tragedy would happen. This benefit could cover the cost of the funeral expenses, uninsured medical bills or even family counseling, allowing the family to grieve without financial stress.

There is also peace of mind later for your grandchild since they will be covered even if they become disabled or develop a chronic illness, which might make getting life insurance all but impossible. So, buying a whole or universal life policy for your grandchild now can ensure their insurability in the future.

Financial benefits: As mentioned, permanent life insurance can accumulate cash value tax-deferred, so there is no need for your grandchild to worry about taxes until they withdraw the money. They may also borrow from the policy for any reason, including a down payment on a house, college tuition or starting a business.

Just remember that loans against the policy accrue interest and decrease the death benefit and cash value by the amount of the loan plus interest. Also, any withdrawals they make will reduce the available death benefit.

Beneficiaries and ownership: When you purchase life insurance for a grandchild, you don't have to name yourself as the beneficiary. Most grandparents name the child's parents since they would need the money to pay for expenses if something happened to the child.

You own the policy while your grandchild is a minor, but you can transfer ownership to the child when they become an adult. Some policies won't allow grandparents to keep paying for it after the child becomes an adult, although there are exceptions. One other point: If you die before your grandchild reaches the age of majority, the child's parents generally have the option to continue the insurance in their names.

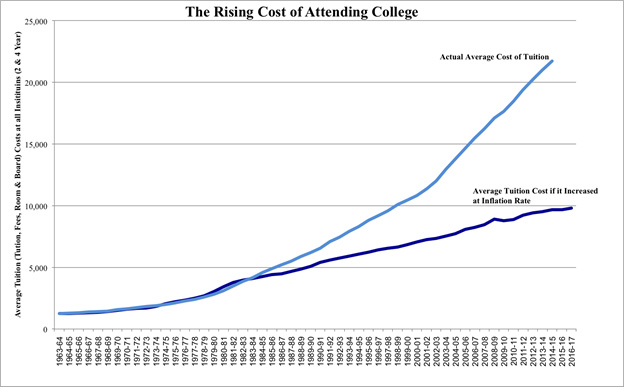

Whether college is in-person or online, your grandchild will be facing rising tuition bills either now or sometime in the future.

Image Credit: Medium

Many people are unaware of the critical role that permanent insurance could play in financing an education. While there are many excellent reasons to purchase life insurance for a newborn grandchild, giving them the ability to borrow against their accumulated cash value through policy loans could help them to supplement their college funding.

Here is the primary benefit of using a permanent life insurance policy to help pay for college: Unlike a tax-advantaged 529 plan, the cash value from a life insurance policy does not factor into college financial aid eligibility calculations. Your grandchild can get the most out of their financial aid and still have the life insurance policy as a potential future resource.

Buying a permanent life insurance policy for a grandchild provides much more than help to pay for funeral expenses if the unthinkable happens. There are benefits that he or she will use throughout life, including tax-deferred savings and guaranteed insurability.

Long after the toys are gone and forgotten, and they have outgrown the clothes, the gift of life insurance will continue to offer valuable benefits to your precious grandchild.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.