Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

An irrevocable funeral trust (IFT) is a smart way to prepay for your final expenses. An IFT can shield a portion of your assets from creditors and preserve your ability to qualify for Medicaid if necessary.

An irrevocable funeral trust is a vehicle for prepaying funeral expenses. It is a formal arrangement that must be executed with legal documents. Any assets placed into the trust must remain there; by law they cannot be withdrawn until the person who deposited the assets (the trustor, or grantor) passes away.

An IFT can be used to pay for a variety of funeral expenses, including:

An irrevocable funeral trust must have a trustee, and the trustee cannot be the person who established the trust. For IFTs funded with life insurance or annuities, the insurance company functions as trustee.

There are many ways to fund an irrevocable funeral trust. You can fund an IFT from accumulated savings or CDs. It's also possible to fund your IFT with a partial withdrawal from an annuity. If the withdrawal is less than 10% of the total value, it is free of penalty.

Life insurance is a popular funding vehicle for IFTs. You can purchase a policy by making monthly premium payments, or you can pay a single premium, big enough to fully fund the policy.

Another good option is to use cash values from an existing life insurance policy. This is known as a 1035 exchange. A 1035 exchange shields you from paying taxes on the interest earned on the policy.

There are limits on how much money can be shielded in an IFT, and a few states do not allow the use of IFTs at all.

For practical purposes, a reasonable limit to place in an IFT is $15,000. Speak with your financial advisor to discuss the limits in your state.

There are limits on how much money can be shielded in an IFT, and a few states do not allow the use of IFTs at all.

For practical purposes, a reasonable limit to place in an IFT is $15,000. Speak with your financial advisor to discuss the limits in your state.

People choose to implement irrevocable funeral trusts for two complementary purposes:

Using an IFT to prepay your funeral expense offers many benefits. The No. 1 reason people choose this route is peace of mind. Due to the irrevocable nature of the trust, you can rest easy knowing that when you pass away, a surviving spouse, or child, will not incur financial hardship for burial or cremation services.

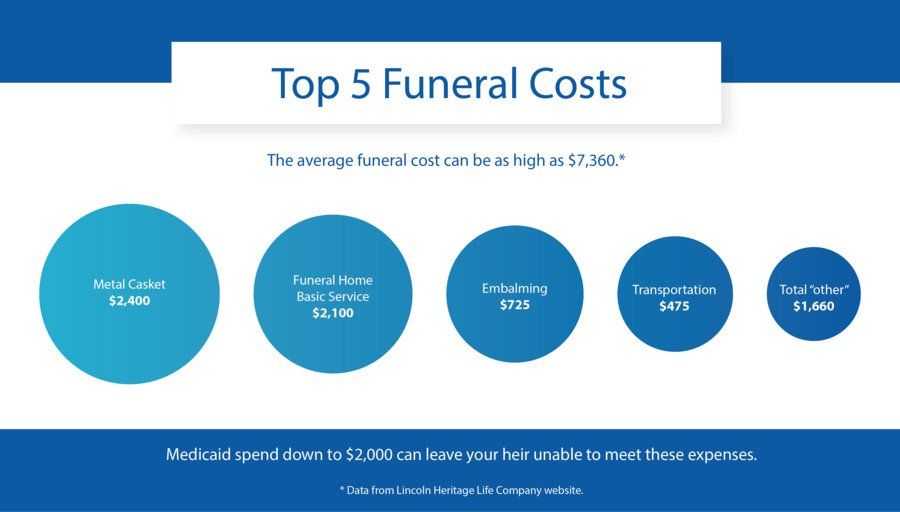

The average funeral cost is $6,500 or more, and the average cremation costs $1,100, and can run into the thousands of dollars depending on location and options chosen. Final arrangements must be made very quickly after your passing. Having a prefunded trust dedicated to paying these costs can ease a huge burden.

With an irrevocable funeral trust, the funeral or cremation provider is paid within 72 hours. You have no worries about transferring money from investment or retirement accounts. The money is already there, waiting to pay these costs.

Another benefit of the IFT is flexibility. You can use any funeral home in the country to handle your funeral services. It's not like some preneed burial plans where you're tied in to one funeral home. This is especially useful if you normally split your time between two residences.

Funding an IFT also frees up other insurance you have in place to pay living expenses to a surviving spouse or other heirs. The IFT covers burial costs, and any other in-force policies will be used as you direct in your estate plan.

Another plus is that any earnings on funds in the trust accumulate tax-free. This feature can provide a layer of inflation protection, helping your IFT keep up with rising funeral costs.

The second reason people use irrevocable funeral trusts is to protect themselves against the "spend down" provisions of Medicaid. Assets held in IFTs are not counted toward your assets in determining your eligibility for Medicaid

Since long-term care is very expensive, many people need help from Medicaid to afford this crucial service. However, you can only qualify for Medicaid if your income and total assets are below certain thresholds.

If you're asset totals are higher than the maximum, there is a provision that allows you to spend your assets down below the threshold. The threshold in most states is $2,000. This amount is not sufficient to pay for funeral expenses and also cover the settlement of any outstanding bills or other debts.

If you pass away with $2,000 or less in available assets, and no irrevocable funeral trust, you could put your surviving spouse or heir on the hook for large funeral costs during a very emotional time.

The IFT lets you easily avoid this. Up to $15,000 can be put in the trust while you spend down other assets to meet the Medicaid maximum asset criteria. Another benefit is that amounts transferred to the IFT are not added back like gifts are. Your use of the IFT is fully compliant with Medicaid rules.

The assets in your irrevocable funeral trust are shielded from creditors. So, if you pass away and you have an outstanding bill or debt to a nursing home or long term care facility, they cannot seize or levy assets in the IFT to satisfy the bill.

If your funeral costs are less than the amount in the trust, any excess can be returned to your estate. These excess amounts are then available to settle up probate, or be passed on to your heirs.

Both spouses can create and fund irrevocable funeral trusts for up to $15,000 each, allowing you to preserve a combined $30,000 from the spend down process.

Creating and funding an irrevocable funeral trust should never be undertaken without considering the impact on your overall estate plan. Chat with your financial advisor to see if an IFT is a good fit for you, as well as the best method of funding one.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.