Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

As you move into your 60s, you start looking forward to the day when you can get on Medicare – and leave the high premiums and copays of health insurance behind. As you begin to research how Medicare works and your various alternatives, the focus is first on what services are available. You try to sort out the pros and cons.

Medicare is not easy to understand until you are actually enrolled and using it. But it’s not so simple to change if you didn't make the best choice, particularly if you’re thinking of switching to Original Medicare and its supplement insurance (or Medigap) policies.

What’s equally as important as having access to the services you will need for the rest of your life is whether or not you can afford them.

By your 60s, you have a good idea of whether retirement will be fully funded, just squeaking by or a possible struggle. And that will tell you how critical it is to understand and peg down the out-of-pocket costs of Medicare coverage.

We won’t be examining the merits of your Medicare choices here. Instead, we will be focused exclusively on the costs involved. The hardest part of deciding on your future health care coverage is guessing how much you will need over the next 25 or 30 years. And your health today is not a reliable indicator of what it will be when you are 80.

(One thing to keep in mind as you start calculating costs is that several programs are available from the state and federal governments to help low-income beneficiaries meet their payment obligations.)

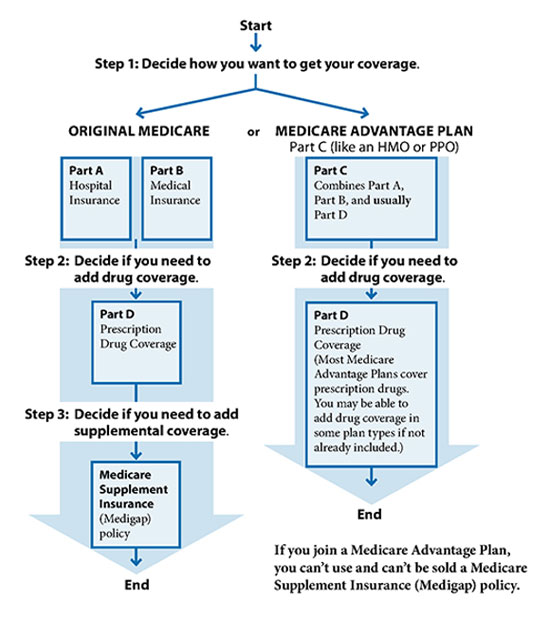

Medicare consists of four “parts,” plus a private supplement.

Your first decision will be to choose between the federal government’s Original Medicare or private insurers’ Medicare Advantage.

Original Medicare is made up of Part A and Part B. In addition, you can choose to add a private Part D policy, plus an optional Medigap policy.

Medicare Advantage (also known as Part C) replaces Part A and Part B and typically bundles Part D at no extra charge.

Here’s what the decision-making structure looks like:

Out-of-pocket costs for Medicare plans are a bit like a puzzle. To understand the costs, you'll want to understand the various elements first:

The government sets the costs for Part A (hospital insurance) and Part B (medical insurance), standardized for everyone. To reduce out-of-pocket costs, most people choose to add a Part D prescription drug plan and a supplement insurance (or Medigap) policy.

Medigap premiums vary significantly with your choice of plan and insurer and are affected by your age, gender, where you live and whether you use tobacco. As a rough indication, the most comprehensive plan costs $143 a month on average. The Medicare.gov website lets you compare the costs and benefits of different Medigap plans in your ZIP Code.

Medigap plans can play an important role here: They will pay your Part A deductible and cover 365 days of hospital costs after your benefits are used up.

The greatest downside with Part B is that it only picks up 80% of Medicare-approved costs. So you will have to pay the remaining 20%, plus any unapproved costs. And there is no out-of-pocket maximum.

Again, Medigap comes to the rescue. While it no longer pays the deductibles on any newly purchased policies, it does pay virtually all of Part B’s coinsurance of 20%.

In 2022, the standard deductible is $480 per year. Your copayments depend on what plan you choose and the medications you take. (You can determine the cost of your existing medicines on each plan's “formulary,” or price list, by visiting the Medicare.gov website. After you meet the $480 deductible, what you pay is complex, with different stages and rates, up to a maximum out-of-pocket of $7,050.

Medigap does not cover your Part D prescription drug costs in any way.

Specific pricing – As an example, a quick search of the Medicare website for a Sarasota, Florida, ZIP Code results in:

Medicare Part C is best known as Medicare Advantage. To sign up for Part C, you first have to sign up for Parts A and B. Once you do that, the federal government pays your selected insurer to provide the services you would otherwise get as Original Medicare. However, most Medicare Advantage insurers bundle in Part D, so you have no need for a Medigap or Part D standalone plan.

The insurers set the costs for Medicare Advantage plans with no guidelines from the government. However, they are working in a competitive environment, so they are motivated to make premiums affordable.

What you pay is also affected by the type of plan you choose. The options might look familiar if you had a private health care plan before Medicare: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-For-Service (PFFS) or Medicare Medical Savings Account (MSA).

Now let's look at the cost of the different Medicare parts.

Part A (hospital insurance) – Again, 99% of people are not required to pay a Part A premium, and if you are hospitalized, your plan pays the $1,556 deductible.

Part B (medical insurance) – Almost everyone pays the standard Part B monthly premium of $170.10 in 2022 or higher, based on your income. It is often deducted from your Social Security check if you have already claimed your retirement benefits. If not, you will be billed directly. However, recently some plans have started to compete by absorbing some or all of the Part B premium.

Part C (Medicare Advantage) – Monthly premiums of $0 are not uncommon, but they can also reach hundreds of dollars. (The tradeoff usually comes in the size of the deductible.) However, the national average in 2021 was $21. Low-premium plans tend to have high deductibles, and vice versa.

You can change Medicare Advantage plans easily during each year’s open enrollment period. So, it might make sense to opt for a low-premium, high-deductible plan in the early years of retirement when you are healthiest and change as your needs evolve.

Separately, you will pay copayments and coinsurance for most doctor’s visits and medical procedures, as long as the doctors and hospitals are within your plan’s network. (Outside the network, the cost is entirely yours.) But again, the amounts depend on the plan you select. In any case, in 2022, the out-of-pocket maximum is $7,550. (This does not include expenses for prescription drugs, which have a separate deductible and out-of-pocket maximum.)

Part D (integrated prescription drug coverage) – Most Medicare Advantage plans include Part D for free. If your plan does not offer prescription drug coverage, you can buy a standalone Part D policy. However, if you buy one and your Part C plan also covers it, you can lose your Medicare Advantage coverage.

The Part D annual deductible can run up to $480, but your insurer may choose to set it at less. You will pay copayments and coinsurance based on your selected plan and the prescription medications you take. After meeting the deductible, you begin a sequence of “periods” with different payment requirements until you reach the maximum of $7,050. After that, you pay a small fixed-fee residual through the end of that calendar year.

Specific pricing – Go to the Medicare.gov website to see the prices and tradeoffs of the various Medicare Advantage policies available in your ZIP Code. You can even input the medications you take today to understand better how much a Medicare Advantage policy might cost you.

As an example, a quick search of the Medicare website for a Sarasota, Florida, ZIP Code results in:

For Original Medicare, using national averages, the monthly fixed costs could be:

For Medicare Advantage, they could be:

However, these are only the fixed costs. They do not include the extra out-of-pocket expenses linked to each option.

Because of that, Medicare Advantage may not necessarily be the best option. That depends on the deductible you choose and the volume of copayments and coinsurance you might need based on your health requirements now and in the future.

While no one can give you a definite “best value” answer, by understanding the various costs you will face with Medicare, you will be able to make a more informed decision.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.