Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Baby boomers have defied all odds at each phase of their journey through life. And they fully expect to defy the odds of aging. They expect to live an active life until the day their energy wanes, and they go peacefully in their sleep.

Unfortunately, that will only be a reality for a small part of the aging population. For at least 70% of those over age 65 today, some form of long-term care will be needed before they die. Much of that care will be task-related in the form of in-home help. But some will be more medical and could mean moving to assisted living or a nursing home.

Some care will take the form of short periods of rehab after having another hip or knee replaced. But the rest will seek help because they can no longer perform two of the six “Activities of Daily Living” or ADLs. These functional skills – including eating, dressing, grooming, bathing/hygiene, mobility and toileting/continence – measure one’s level of personal independence.

Or they might need help with everyday tasks, referred to as “Instrumental Activities of Daily Living” or IADLs. These call for more complex organizational skills and include, among others, housework, managing money and taking medication. By age 75, 18% of adults already need help with at least one IADL, whereas only 11% need ADL help.

ADLs and IADLs are predictors of the need for paid in-home care or alternative living arrangements – in independent living, assisted living or nursing home environments.

Boomers are between ages 57 and 75 today, so they are most likely to be thinking about long-term care. They are starting to see the signs of physical or mental decline that can affect their ability to live at home, whether alone or accompanied. Chronic diseases can call for increasing medical care; cognitive decline can bring on safety concerns.

Here are the factors that increase your risk of needing care:

But how aging will affect you is unknown. For example, someone in excellent health can have an accident and not fully recover. On the other hand, someone who appears frail may find accommodations that permit many years of independence.

The U.S. Department of Health and Human Services (HHS) reports that, while 70% may need some long-term care during their lifetime, only 48% will ever pay for it. The others find solutions with family and unpaid caregivers. Moreover, episodes of paid care tend to be short: Only 24% of older adults receive two years or more of paid care, and only 15% are in a nursing home longer than two years.

As for gender differences, women need an average of 3.7 years of long-term care, while men need 2.2 years. (Remember, far more women than men finish their lives alone.)

Because you can’t project your long-term care needs, it’s natural to consider the worst-case scenario and worry about running out of money – even if you have significant assets. Or you may have plans to leave a legacy to your heirs and don’t want your resources being consumed by the high cost of a nursing home.

But while only 24% of older adults receive more than two years of paid long-term care, that is enough to devastate many retirement plans.

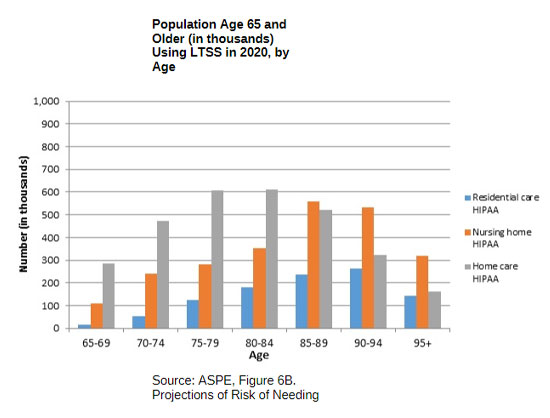

As you plan for retirement, knowing the need for different long-term care services by age groupings can help you understand at what age you’re most likely to need care. A study conducted by HHS shows just that – and it’s called “Projections of Risk of Needing Long-Term Services and Supports at Ages 65 and Older,” based on 2020 data.

Whatever long-term care you could eventually need, you will want to be able to pay for it in a way that protects your retirement plans and your loved ones. So let’s look at the costs and the possibilities.

Americans’ life expectancy continues to increase. But unfortunately, those extra years mean we could live longer with chronic health issues, too. The Social Security Administration website has a “longevity visualizer” tool that looks at different ages and tells you how long you might live. For example, of men aged 65 today, 52 percent will get to age 85, 31 percent to age 90 and 13 percent to age 95. Women will live even longer: 62 percent will get to age 85, 41 percent to age 90 and 20 percent to age 95.

Long-term care is a continuum of services and support made available to meet people’s care needs.

In-homecare – Homemaker services are “hands-off” care where someone comes to your home and provides services such as cooking, cleaning and running errands. Home health aid services are “hands-on” care where someone comes to assist you with personal needs such as bathing, dressing, eating and medicating. In both cases, paid services are usually on an agreed schedule and at a pre-determined hourly fee.

Adult day care – These centers provide companionship and care for older adults in a community setting. Participating in planned activities under the eye of caregivers gives family members and other helpers a break. Activities also tend to delay or prevent the escalation to assisted living or a nursing home. Programs can include personal care, meals, medical management and transportation.

Assisted living facility – These residential facilities provide housing, meals, personal care, supportive services and social activities to those unable to live independently but who do not require 24-hour nursing care. The environment resembles your home, with varying levels of privacy and independence. Costs vary significantly with location, size of the residential unit, amenities and available services. But prices are considerably less than nursing homes.

Nursing home facility – These residential facilities, also referred to as skilled nursing facilities (SNFs), offer the highest level of 24/7 supervision and care. Residents are helped with their day-to-day activities and receive custodial and skilled nursing care. Most enter an SNF for rehab following a minimum three-day hospital stay. Once rehabilitation and Medicare coverage ends, patients either go home, go to assisted living or remain in the SNF for long-term care.

So, what are the costs? According to Genworth Financial, which has tracked the costs of long-term care for nearly two decades, the national median costs in 2020 for a year of care are:

| In-Home Care: | |

|---|---|

| Homemaker Services: | $53,768 |

| Home Health Aide: | $54,912 |

| Community and Assisted Living: | |

|---|---|

| Adult Day Health Care: | $19,240 |

| Assisted Living Facility: | $51,600 |

| Nursing Home Facility: | |

|---|---|

| Semi-Private Room: | $93,075 |

| Private Room: | $105,850 |

Genworth also provides considerable state-level detail. Costs can vary with the particular setting and level of care needed, but also with geographic location. Examples: a semi-private room in a nursing home in Texas can cost $165 per day, in Florida $285 and in Alaska, $1,230. The Genworth tool lets you estimate the cost of care in your area.

And costs are not expected to come down, considering the increasing demand from the growing number of aging baby boomers. Also, how long the extra costs caused by the Covid-19 virus will last is not known.

AARP has estimated how much people over age 65 spend out-of-pocket on long-term care over a lifetime. Such spending is distributed as follows:

Long-term care insurance typically sets a daily dollar amount available to help cover the cost of care for a determined period in the home or long-term facility. In the past, many of these costs were covered by this insurance. By spreading the cost over large risk pools of policyholders, the premiums were affordable, and the benefits were generous.

However, the industry has changed over the last few decades, and many insurance companies were forced out of the long-term coverage business.

Today, with fewer people in the risk pools, increasing health care costs and greater longevity, companies that stayed in business raised premiums and limited benefits. As a result, policies now cap daily payments, limit the coverage term and set a maximum the policy will pay out.

And virtually all policies have elimination periods – 90 to 180 days during which you pay for the care before the policy kicks in. If your care includes a private room in a nursing home, that could be $25,000 to $50,000 you need to pay the nursing home.

Premiums start lower if you buy your policy when you’re young and healthy, but they increase as you age. You may have to pay premiums for decades before needing the care (if you ever do). And if you never need the care, all those paid-in premiums are lost.

The objection to the use-it-or-lose-it nature of long-term care policies has led to more creative solutions. Hybrid policies, for example, can combine long-term care insurance with life insurance.

Hybrid policies may cost more, but if you need the coverage at home or in a facility, the policy will pay out as a traditional one would, reflecting the daily benefit, term, maximum payout and elimination period you selected. The death benefit will be lowered or eliminated. But if you die before needing to use the long-term care coverage, your beneficiaries will receive the full death benefit.

Other asset-based long-term care strategies can involve fixed index annuities offered by insurance companies with riders that are activated if you enter a nursing home. As a result, you have the resources available for long-term care if you need them, without having to commit to sizeable annual insurance premiums for something you hope you never need.

If you are thinking of getting long-term care insurance, you will want to examine all the possibilities.

The Department of Veterans Affairs (VA) bureaucracy makes it difficult to navigate the system when you’re trying to identify possible benefits. But instead of paying unknown intermediaries to help you navigate, it recommends contacting the VA directly or using VA-recognized organizations or individuals known as Veterans Service Organizations (VSOs). Benefits are paid retroactively to the date of your application, should there be delays.

A veterans pension is available to wartime veterans (and their surviving spouses) who meet certain age or disability requirements, plus income and net worth limits. When assessing your net worth, the VA uses a three-year “look-back” period to find asset transfers at less than fair market value, for example. In 2021, the net worth limit is $130,773.

If you are eligible for or receive a VA pension (and not military retirement pay) and if a permanent disability confines you primarily to your home, the VA’s Housebound program might be a valuable benefit.

The VA’s Aid and Attendance (A&A) program may work for you if you are eligible for or receive a VA pension and either:

(You can’t receive A&A and Homebound at the same time.)

The A&A program is the most generous to help pay for in-home care, assisted living or nursing home care. A single veteran’s benefit with A&A can exceed $23,000 a year. A veteran couple, both qualifying for A&A, can receive almost $37,000.

These programs are in addition to other services offered to veterans.

Some people prefer to risk that they won’t need long-term care or pay for the care themselves if required. Payment typically comes from personal savings, investments, pensions, IRAs, 401(k)s and assets that can serve as collateral for loans, home equity loans or reverse mortgages.

Insurance policies – such as whole life insurance – can be borrowed from, surrendered for cash or monetized through life settlements. And some critical-care riders on annuities and insurance policies allow the death benefit to be distributed during life to pay for long-term care.

How fast you need the funds is determined by where you are (or your loved one is) along the care continuum: needing custodial care (provided by family and friends) or paid care (custodial or skilled) or immediate placement in a facility.

The decision to self-fund is a complicated one. The factors you need to decide intelligently include:

Because of all the assumptions you will have to make, any assessment will be subjective.

For a brief period, Medicare will pay for some care that meets precise requirements (a hospital stay, then admission into a certified nursing facility for skilled care). It is usually health-related rehabilitative care. But it does not cover traditional long-term care.

However, if you cannot pay for your nursing care, the federal government will cover the costs using its Medicaid system. The rules, regulations and practices are complex, starting with the diverse ways you can meet its requirement of limited income and limited countable assets. It’s essential to understand the “spend down” process that allows you to qualify by reducing your assets through legally spending money before applying for Medicaid. Spend down rules can vary by state, so research has to be done at the state level.

As a single person, your monthly income limit will be around $2,400, most of which goes to pay for nursing home care. It includes wages, alimony payments, pension payments, Social Security income, SSDI, IRA withdrawals and stock dividends. You are also allowed to keep $2,000 in assets. (Ideally, any excesses will have been spent down in advance on qualified expenditures.)

If you are married, the requirements are vastly different for you and for your spouse. The government is interested in accessing as much as it can from you to cover the cost of your care. But Medicaid is not intent on impoverishing your spouse at home.

Medicaid will not take any of your spouse’s income, but it will set a maximum for countable assets (for example, $130,380 for the couple’s joint assets in Florida in 2021). These include cash, stocks, bonds, investments, credit union accounts, savings and checking accounts and real estate except where you are living.

That maximum does not include what are called non-countable assets: personal belongings, household furnishings, the homestead (below a specific equity value; $603,000 in Florida in 2021), one car, an older second car, funeral plots, irrevocable prepaid funeral policies and low face-value life insurance policies.

If both married spouses are going into nursing homes, the calculations are again different.

If you intend to apply for Medicaid and your assets exceed the bare minimum, legal advice and a complete understanding of the appropriate spend down process are highly recommended. Advance planning is in order. For example, you can transfer assets or protect them with trusts (such as irrevocable asset protection trusts).

However, you will have a five-year “look back” period from your application date during which asset transfers are disallowed. Transfers made within the five years may be partially allowed, though. For example, 60% may be allowed if the transfer occurred three years before the application.

One often-overlooked detail: If your spouse undergoes the five-year look back calculation to enter a nursing home, that fact does not exempt you from the same if you later seek Medicaid support. A new five-year look back period will be triggered. Thorough planning by a financial professional, estate planner or elder law attorney should factor in that possibility.

One last factor is “Medicaid recovery” or “Medicare payback.” Medicaid is only a loan to pay for long-term care. Therefore, any assets left after your death are subject to a first lien against your beneficiaries’ inherited assets in the amount the state spent on your care.

Such liens are rare because of the thorough asset drawdown and spousal protections. But they could result from a decedent’s late inheritance or unreported assets. Also, you are allowed to retain a home (for your spouse), a car and other assets. So, once both you and your spouse have died, Medicaid can present the invoice for care the state provided to you (and possibly your spouse). But, if there is no inheritance, the invoice disappears.

However you choose to prepare (or not prepare) for the cost of long-term care, HHS has projected the funds that will be spent on such care as a percent of GDP over the next 40 years. Out-of-pocket payments represent the fastest-growing category.

In 2020, Medicaid and family out-of-pocket (OOP) made up about the same percentage (0.4% each). In the future, family OOP grows markedly while Medicaid, private long-term care insurance and other public expenditures stay about the same.

In any case, the cost of long-term care should be part of your retirement planning discussions. Even if you believe “it will never happen to me,” the worst that can happen is that you’re prepared but never need the care. There are ways you can leave the unused resources as your legacy – for loved ones or favorite causes.

And the peace of mind? Priceless.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.