Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

In response to the economic harm inflicted by COVID-19, or coronavirus, the Federal Reserve lowered its benchmark interest rate to almost zero. The Fed Funds rate is now 0% to 0.25%. In response, banks have lowered the prime rate to 3.25%. As the Fed moved, and as the stock market plummeted 30%, investors packed money into U.S. Treasury bonds. The yield on the 10-year Treasury bond hit as low as 0.318%.

The yield on the 10-year is important because mortgage rates are tied to it. The prime rate is important because commercial mortgages are tied to it. What this means for you is that payments for mortgages and other loans may be significantly lower today than they were just one month ago. These lower payments may be a boon to your savings, or make this current economic downturn easier to weather.

You can take advantage of these historically low rates by refinancing mortgages, car loans, consolidating student loans, transferring credit card balances or consolidating debts with a home equity loan.

It may be tempting to hold off on refinancing. After all, we're not yet out of the COVID-19 woods. Perhaps the Federal Reserve will lower interest rates further. Or, maybe the 10-year Treasury will drop some more.

While that is certainly a possibility, you may want to consider two different scenarios:

In the first scenario, interest rates are likely to increase rather than decline further. In the second scenario, interest rates may stay low, or decline even more, but asset prices like the appraised value of real estate may decline. A decline in appraised value could hinder your ability to qualify for a refinanced mortgage.

If the economy does snap back quickly, you might miss this opportunity to refinance into lower interest rates. With the savings from lower payments, you could have more disposable income, or save more money, which would fund a more successful retirement.

The second scenario could be more troubling. What if the economy doesn't snap back? What if the housing market begins a correction? This could make it difficult to refinance loans, even with low interest rates. This could become a problem if:

If the value of your properties decline then you may not be eligible for refinancing. If you own commercial properties, losing tenants or losing rental income could harm your ability to lower your payment obligations by refinancing. Lastly, losing your job or having your spouse lose their job could disqualify you from refinancing. You may not have high enough income to meet loan-to-income guidelines.

On one hand, missing out on lowering your payments will reduce the amount of money you can save. These forgone savings won't be invested at depressed market prices.

On the other hand, obtaining lower payments on your loans could give you more margin for safety if you or your spouse should lose a job. Or, if your pension is affected by a pension fund paying out reduced benefits due to inadequate funding. Saving even a few hundred dollars on debt payments can give you some breathing space if you're facing a loss of income.

So, how much could you save with refinancing? There is no single answer for everyone, but certainly those with existing mortgages or loans that originated prior to 2019 can stand to make substantial savings. The recent peak in 30-year mortgage rates occurred in the fall of 2018, so if you bought a house or commercial property around that time, you should consider refinancing.

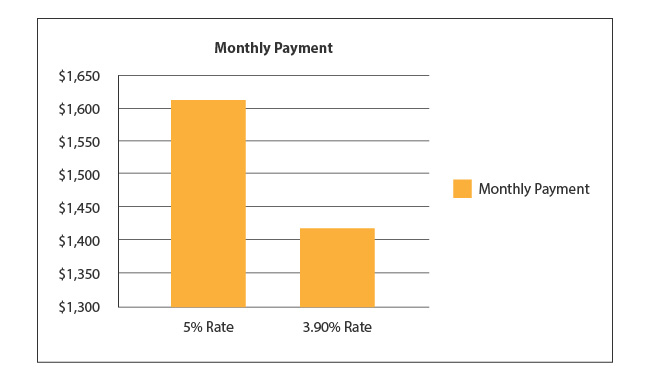

As an illustration, we'll look at a 30-year fixed mortgage of $250,000 with an original interest rate of 5%. The original payment for this mortgage is $1,610 (excluding taxes and insurance).

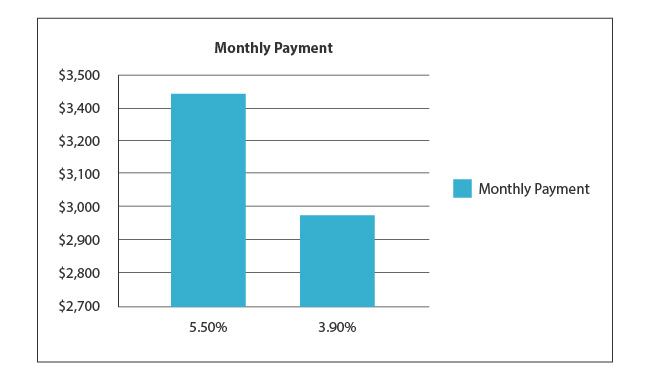

We'll also consider a commercial mortgage for $500,000 amortized for 20 years at 5.5% original interest rate. The original commercial mortgage payment is $3,439 (excluding taxes and insurance).

Commercial mortgage rates in early April 2020 could be found for APRs of 3.8% to 4%. Using 3.9% with a 20-year amortization period, your new payment would be $2,977 per month (again, excluding taxes and insurance), for a savings of $462 per month. This is $5,544 per year.

For your residential mortgage, your new monthly payment (excluding taxes and insurance) at 3.9% comes out to $1,415. This gives you a monthly savings of $195, or $2,340 per year.

If you owed both of these debts, you could save a total of $7,884 per year. This may not be the equivalent of a salary, but it could sure be put to some good, whether socking away extra cash, or helping to make ends meet.

Almost all debt can be refinanced, though some are easier than others. The easiest to refinance would be:

Other types of debt, including credit cards and student loans may be a little more difficult. Credit cards cannot be “refinanced” in the same way as a mortgage. But, you could transfer your balance to a card with a lower interest rate. If this isn't possible, you may consider taping home equity to pay off higher interest credit cards.

Student loans can be consolidated at lower interest rates. Federal student loans are much easier to consolidate than private loans. Smaller student loans that you can't consolidate might be better dealt with through the use of home equity.

Low interest rates could be a once-in-a lifetime opportunity to lock in low rates on mortgages or other loans. Lowering your monthly payments can be a source of increased savings if the economy quickly recovers, or a much-needed reduction in expenses if the pain of the COVID-19 crisis lingers. As with all aspects of your overall retirement and financial plan, you should confer with your advisor before making any final decisions.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.