Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Planning ahead financially for retirement can make a big difference in how – and how well – you live in your post-employment years. But setting aside money to save and invest is really just one component of the overall picture.

Another key piece of the puzzle is ensuring your future happiness – and this can be due in large part to the amount and timing of your income. Today, few employers provide traditional pension plans that pay income for the rest of their retirees’ lives. This responsibility is now up to the individual – which can cause a tremendous amount of stress during a time in life that should be happy and relaxing.

But retirement could be the happiest time in your life – provided that you have one or more sources of ongoing income that you can rely on. The good news is that even if you don’t have access to a traditional pension, you could still create your own guaranteed income stream – and in doing so, increase your happiness during your retirement, too.

According to retirement studies, the key difference between retirees who are happy and those who are not is whether or not the individual(s) have a steady source of lifetime income to supplement Social Security.

In the past, many retirees could rely on a set dollar amount of retirement income from one or more sources, including:

Until just a decade or so ago, many companies offered defined benefit pensions to their retired employees. Through these plans, the retiree could choose to receive income for the remainder of their lifetime – and in some cases, some or all of that incoming cash flow could continue for the life of their surviving spouse.

With defined benefit plans, it is the employer – not the retired employee – that is responsible for ensuring that income is paid. So, even if the employer’s investments did not perform well, funds would still have to be generated in order to make good on the promise of lifetime income.

This could be a big part of the reason that analyses have shown that people who have traditional defined benefit plans tend to be happier than those with traditional 401(k) plans – because the former guarantees a stream of income for life, and the latter does not.

A regular stream of income from Social Security was also a key factor in past retirees’ financial security. For many years, full Social Security benefits would be paid out to qualified individuals (as well as to their qualified spouses) upon turning age 65 – and it, too, would last for the remainder of their lifetime(s).

If any additional income was needed (or wanted) – and oftentimes it was not – these funds could oftentimes be generated from interest and/or dividends from personal savings and investments. And, with shorter life expectancy (on average) in the past, income didn’t have to last nearly as long.

But today’s (and tomorrow’s) retirement is much different than yesterday’s.

For instance, due in large part to the expense of keeping them up, most companies have done away with the defined benefit pension and have “replaced” it with defined contribution plans, such as the 401(k).

Even though there are some enticing tax-related benefits that come along with the traditional 401(k) – such as pre-tax contributions and tax-deferred growth – these plans also leave it up to the individual to make the investment decisions, as well as to convert the funds in the account into a viable retirement income stream in retirement. Unfortunately, many people just simply do not know how to do this. Nor are they aware of the income-generating options that are available.

Income from Social Security may also be on somewhat shaky ground these days. With far fewer workers paying into the system now as compared to just a decade or so ago, it is estimated that the Social Security trust fund could be depleted in the year 2030.

| Year of birth | Minimum retirement age for full benefits |

|---|---|

| Year of birth1937 or before | Minimum retirement age for full benefits65 |

| Year of birth1938 | Minimum retirement age for full benefits65 + 2 months |

| Year of birth1939 | Minimum retirement age for full benefits65 + 4 months |

| Year of birth1940 | Minimum retirement age for full benefits65 + 6 months |

| Year of birth1941 | Minimum retirement age for full benefits65 + 8 months |

| Year of birth1942 | Minimum retirement age for full benefits65 + 10 months |

| Year of birth1943 to 1954 | Minimum retirement age for full benefits66 |

| Year of birth1955 | Minimum retirement age for full benefits66 + 2 months |

| Year of birth1956 | Minimum retirement age for full benefits66 + 4 months |

| Year of birth1957 | Minimum retirement age for full benefits66 + 6 months |

| Year of birth1958 | Minimum retirement age for full benefits66 + 8 months |

| Year of birth1959 | Minimum retirement age for full benefits66 + 10 months |

| Year of birth1960 or later | Minimum retirement age for full benefits67 |

In addition, based on your birth year, you may have to wait until you are age 67 to receive the full amount of your Social Security retirement benefits – that is, if the trust fund’s shortfall is addressed. Otherwise, the dollar amount of your benefits could be reduced.

Added to that, with the volatile stock market and historically low interest rates of late, relying on “traditional” retirement income drawdown plans can be risky, at best. In this case, assets could be depleted – in some cases very quickly – in a downward moving stock market. Yet, relying on fixed rate investments that only offer 1% or 2% interest won’t be enough to meet, much less beat, future inflation and keep purchasing power on pace.

This could require you to cut back on your expenses in retirement – such as travel and other “non-essentials,” as well as items that are considered to be essential, such as housing and health care services.

All of this financial uncertainty can lead to extreme concern in retirement, which in turn, has the potential to take away from the fun, relaxation, and happiness that most people hope for at the end of their working years.

So, how can you fix this – and if there is a viable strategy, is it too late to put that plan in place?

The answer is that it’s not too late – but moving forward with the right strategy for your specific needs could require you to talk with a retirement income planning specialist who can custom-design a plan for you.

Many people – regardless of their age – admit that they would be far less stressed if they knew that they would be able to pay their living expenses from a reliable stream of income that flows in, regardless of what is happening in the stock market, or even in the economy overall.

As far back as the early 2000s, studies showed that the “secret” to a happier retirement has a lot to do with being able to count on a preset amount of income. In fact, some analysis concludes that if there was an effective way to allow people to transform their 401(k) balances into steady streams of income, their happiness might be duplicated, as well.

One particular financial vehicle – the annuity – is designed for paying out a set amount of income, either for a pre-stated period of time, such as 10 or 20 years, or for the remainder of your life – no matter how long that may be.

Annuities can help to solve for the ongoing income concern. But not all annuities are the same, so it is essential that you choose the right one for your particular needs. Otherwise, it could end up costing you to get out of it.

There are two primary types of annuities. These are immediate and deferred. With an immediate annuity, you can contribute a lump sum – either from personal savings or funds that are “rolled over” from an employer-sponsored retirement plan – and start generating income immediately (or within the following 12 months).

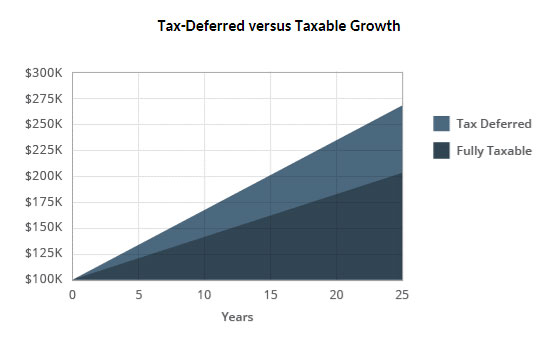

Alternatively, a deferred annuity can generate income that begins at a time in the future (although these annuities are not required to ever be converted over into an income stream). In the meantime, during the annuity’s “accumulation” period, the funds in the account grow on a tax-deferred basis. This means that there is no tax due on the gain until the time of withdrawal. This, in turn, can allow the account value to grow and compound more quickly than a comparable portfolio that is taxable – especially over a longer period of time.

There are different ways in which the return on an annuity is determined, based on whether the annuity is fixed, indexed or variable. With a fixed annuity, the insurance company states the rate of return. This rate could be locked in for a certain period of time. There is also typically a guaranteed minimum rate, below which the return will never fall – no matter what happens with interest rates in the economy.

While the return on fixed annuities is typically considered low, the principal – as well as any previous gains – is protected. Likewise, once the annuity starts paying out income, you can count of a certain dollar amount either for a set time period, or for the remainder of your lifetime. This, in turn, can help to alleviate the concern about running out of money in retirement – and this can help to increase happiness.

Variable annuities base their return on the performance of underlying equities, such as mutual funds. These financial vehicles provide the opportunity to earn a high return. But they also open you up to risk of loss – both previous gains and any of the principal you have contributed. The income stream that is paid out from a variable annuity may also rise and fall, based on market performance.

A “newer” type of annuity – the fixed index annuity, or FIA – bases its return on the performance of one or more market indexes like the S&P 500. In annuity contract years when the return on the index is positive, a return is credited – usually up to a certain limit, or “cap.”

The “tradeoff” for this limited upside potential, though, is that there is no loss of principal or previous gains – even if the underlying index attains a substantial negative return. Similar to with a regular fixed annuity, an FIA will provide you with a known dollar amount of income in retirement.

While having a steady “paycheck” in retirement can help to reduce financial-related stress in retirement (and in turn, increase happiness), it won’t necessarily guarantee that you’ll be 100% happy and fulfilled. With that in mind, there are some other factors to consider in order to ensure happiness in retirement. These can include the following:

Finding (and maintaining) a purpose

One of the best ways to enjoy retirement is by finding and fulfilling your purpose. Although many people dream of spending their retirement days on a sunny beach or playing 18 holes of golf every day, the truth is that these activities can become a bit mundane after a while. Therefore, it can help to have a specific purpose.

According to retirement experts, “In the first six to 12 months after retirement, most people are happy doing the things they didn’t have time to do before.” But after the novelty has worn off, many can become board, and in some cases, they may even wonder why they retired. That’s why it is important to have a purpose.”

This will differ for everyone, but it could include such things as:

To help with narrowing down one or more items that best fit in with your interest and your skills, you can start with making a list of the things you would like to do “someday.” Then, make them a reality when you retire.

Remaining socially active

Humans are by nature social beings. During the COVID-19 pandemic, many people realized just how difficult it is to be alone for long periods of time. Based on data from the Mayo Clinic, there are some considerable benefits to being around other people.

For instance, adults who have strong social support can reduce their risk of various health issues, such as high blood pressure, depression, and even an unhealthy body mass index. In addition, those who have a rich social life may also live longer than those who are more isolated.

Keeping a focus on your health

As we age, we tend to accumulate more health-related issues. But, while there is no way to stop time – and in turn, to prevent more birthdays from coming – you can place a focus on your health by exercising regularly and maintaining a healthy diet.

In some cases, the past few decades may have been filled with time-sensitive meetings and activities, along with a plethora of “convenient” meals picked up at drive-through windows. Over time, all of this can take a real toll on your health. But it’s never too late to start eating right and getting more exercise.

Even with limited mobility, it may be possible to take part in regular activities like swimming, walking, and/or yoga. In addition to the physical benefits of exercise, regular activity can also keep us more alert and positive mentally. So, staying active could help to prolong your life, as well as to make it more enjoyable.

It is also a good idea to have regular visits with your doctor and to create – and maintain – a health plan that is custom designed for you. If you plan to move to a new area after you retire, make sure that you are familiar with where the local hospitals and other health facilities are located.

Knowing that you have a good solid retirement income plan in place can alleviate much of the financial pressure that you would otherwise feel – especially during times of stock market volatility and low interest rates.

Being able to count on a steady stream of income that lasts as long as you need it to can help to make your retirement much more enjoyable by allowing you to focus on the things that truly matter, like spending time with those you love.

If you would like to learn more about setting up a steady, reliable retirement income stream – or, if you want to schedule a no-obligation second opinion on a plan that you currently have in place – an Alliance America financial professional can help.

At Alliance America, we specialize in retirement income planning, and we know that being able to count on incoming cash flow for life can make your future more enjoyable. So, feel free to contact us with any questions that you may have. We look forward to helping you design the retirement lifestyle of your dreams.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.