Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

The COVID-19 pandemic seems to have impacted almost every aspect of our lives in recent months. For those nearing retirement, this crisis has not only impacted financial planning, but it's also changed the way that they think about retirement years. Addressing some of these common questions about planning for retirement amidst the health crisis can help to make this life-altering event feel less uncertain and chaotic.

For people looking to retire in the next few years, the financial crisis is particularly concerning. Yet, experts seem to be optimistic and advise against making any major changes to financial planning. Equity investments might look grim now, but it's best to stay invested in those. Historical data suggests that they will recover, so right now is the time to be patient and to give investments time to bounce back.

That said, to help stay on track for retirement during this crisis, it's a good idea to reduce unnecessary expenses and to work to save as much as possible. Doing so will help to provide additional security during times of volatility and will ensure that your portfolio has time to recover. While reducing expenses sometimes sounds difficult, it doesn't necessarily have to be unpleasant. Rather than thinking of this shift as losing things you enjoy, think about it in terms of focusing on your bigger priorities. Doing so can make it easier and can help to make sure that you're financially prepared for retirement.

If you do want to be more proactive right now, you could explore refinancing your home to take advantage of lower interest rates or investing some of your cash savings in the market while it is down. To many, doing so feels counterintuitive, but investing in a bear market can be lucrative. Nevertheless, before making any changes to your financial planning, it's best to talk with a financial planner about the pros and cons of any changes. This is particularly true considering the current volatility.

Many people plan to move to a nursing home, assisted living facility or retirement community at some point during their retirement years. However, nursing homes have been hotspots amidst COVID-19, with higher rates of infection and mortality than other places. Given the increased risks for people over 65, this concern becomes even more acute for retirees considering living options. Equally concerning for some is the fact that residents have been cut off from visitors and family members.

Both the dangers and restrictions in nursing homes have many rethinking living plans in the short and long-term. The good news is that there are alternatives. One option is family members making changes to accommodate aging parents or relatives. Given the isolation and concerns that COVID-19 has brought, this is likely something that more and more seniors and their children will consider in the near future.

Other options include plans to age in place or even making plans to live in a small community with a few other retirees. Every individual and family have different circumstances, resources, and priorities. That said, as you consider where to live during retirement years, keep in mind that you do have options. Now is a good time to consider what works best for you and your family — and maybe even to get creative about coming up with the right plan for you.

For many older Americans, retirement means an opportunity to travel and increased time with family and friends. Unfortunately, these all seem on hold right now. Yet, it's important to remember that they will not be on hold forever. While some things might change, you can still achieve these goals. If you value travel and time with loved ones, you can still find a way to make that happen.

Currently, travel is obviously not safe as before the pandemic. However, when a vaccine or treatment is developed, there will be opportunities to resume travel. While there are many questions about long-term changes to the travel industry and travel habits, there will still be plenty of opportunities to see different places and experiences new things. While this will involve some flexibility, it is not something you have to give up on.

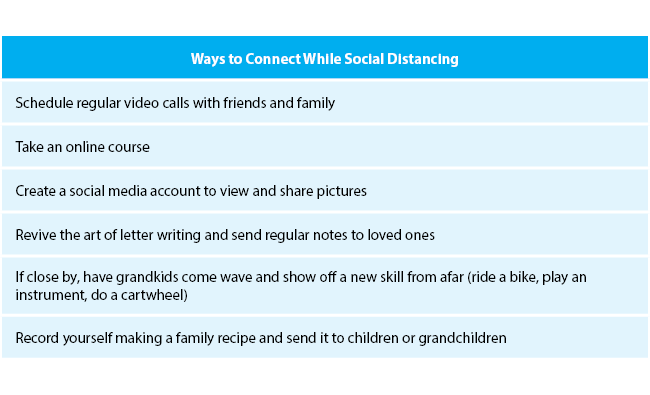

Similarly, getting time with family and friends is hard right now. The good news, however, is that for many the current crisis has highlighted how important this time is. If you prioritize family time and are currently missing it, try to get creative about ways to connect with family members, whether via video conferences, phone calls, pictures, or even letters. As difficult as it seems, remember that there are ways to connect with the people that you love even as you practice social distancing and work to stay safe.

The good news is that difficult times like these can help to remind you of what's most important and can be a great opportunity to focus your retirement planning. Now is a good time to plan for things that you want to do once you're able to return to a more normal lifestyle — whether that's scheduling events with grandchildren, planning a trip, hosting a family reunion, or connecting with others in your community.

While COVID-19 has made many things in life seem uncertain and has disrupted much of everyday life, it's encouraging to remember that it will pass and we will get back to a more normal lifestyle. As you plan for retirement, don't let the anxiety and emotions of this period distract you from your priorities. Instead, use this time as an opportunity to help you focus on what matters most to you and your family. While some aspects of your retirement plan might change and some plans might need to be reconsidered, it's reassuring to remember that your overall retirement priorities and goals don't have change.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.