Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Planning ahead for anything can have its challenges. For instance, mapping out a two-week vacation requires deciding on the route, setting milestones, knowing where you can refuel and making sure that all of the bases are covered in case of an emergency.

The same holds true with planning for retirement. There are numerous moving parts that need to be addressed - and because everyone's goals, time frames and risk tolerances differ, there isn't just one single strategy that is right for everyone across the board.

But, while getting things in order can seem strenuous now, it could be even more so if you wait until you are older to make key decisions regarding income generation and the payment of health care and potential long-term care costs.

With that in mind, you could help your future self out by making important decisions - and putting the right financial tools in place - now, rather than waiting until a time down the road when you might not be in the best frame of mind to do so.

Going this route can ultimately put - and keep - you in control of your retirement. It can also help to alleviate making last minute decisions (that might not necessarily be in your favor), and in turn, reduce a great deal of future financial stress on yourself and your loved ones.

Here is how you can go about doing so.

When asked what your most important financial goal in retirement is, you may respond that it is to save as much money as possible or to reduce your future living expenses and debt. Yet, while these are certainly essential components, too, some experts now believe that even more important than building account values and not running out of money in the future is “not having to make crucial financial decisions as you age.”

Moshe Milevsky, finance professor at York University in Toronto and author of numerous retirement planning books and publications, states that people should have key retirement factors - such as the receipt of regular income - on “autopilot.”

That way, the need to be constantly concerned with updating asset allocation and monitoring stock market volatility is reduced - or possibly even eliminated in the future - at a time when you may not be able to make the best decisions on your own.

Milevsky uses himself as an example by stating that while he is currently in his 50s and finds enjoyment in the financial portfolio construction process now, this might not be the case when he is in his 70s (or beyond). In fact, he goes on to say that, “At 80, I'm not certain I'll have the financial or technical acumen to deal with whatever investment vehicle will be around then. And at 90, I won't want to make these decisions.”

Therefore, as people age, Milevsky believes that making fewer financial decisions is extremely important - and that setting finances on automatic pilot at retirement, and living off the cash flow, is essential for success.

Plus, because major decisions have already been made, retirees can have the ability to focus on other key aspects of their lives, such as spending time with family and friends, volunteering with a favorite charity or even just sitting and relaxing.

So, how do you generate “automatic” retirement income?

One way is through a fixed or fixed index annuity. These flexible financial vehicles are unique in that they can pay out an ongoing known stream of income - regardless of what is happening in the stock market or with interest rates - for either a pre-set time period (such as 10 or 20 years), or even for the remainder of your lifetime, no matter how long that may be.

Using only stocks and bonds could never get most people through an entire retirement cycle due to their volatility, unpredictability and/or low returns. But with an annuity, you can provide yourself with much more certainty.

Further, Moshe Milevsky states, “That's one of the benefits of annuities. You just cash the check. No decisions. No asset allocation. No optimization.” Because of that, annuities should ideally make up a central component of one's overall retirement portfolio.

The amount of income that you receive from an annuity can depend on several factors, including:

It is important to note, though, that not all annuities are exactly the same. In fact, there are some major differences between various types of annuities. These financial vehicles can also have some early withdrawal penalties associated with them.

So, before you move forward and commit to one, it is recommended that you have a good understanding of how annuities work and how they may - or may not - work for you. It can help if you discuss your particular objectives with a financial professional who specializes in annuities and retirement income planning.

There are actually several different categories and types of annuities. These include immediate and deferred. With an immediate annuity, the income stream begins right away (typically within the first 12 months of obtaining the annuity).

Many retirees fund immediate annuities with money from an employer-sponsored retirement plan (like a 401k) and/or an individual retirement account (IRA). Because the “traditional” defined benefit pension plan is being offered by fewer companies today, immediate annuities can be a type of “substitute” for the ongoing income stream that these pensions no longer provide.

With a deferred annuity, income may still be generated. However, it may not begin until years in the future. Prior to that time - during the “accumulation” period - a deferred annuity may be funded with one or more contributions.

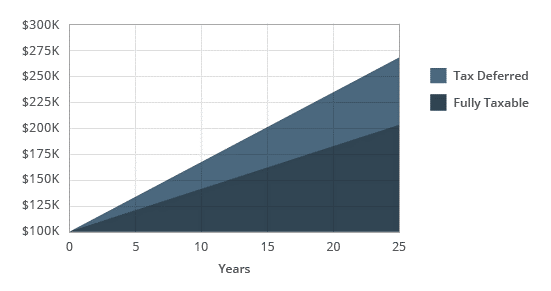

The money that is in the deferred annuity grows on a tax-deferred basis. This means that there is no tax due on the gain in the account until the time of withdrawal - and because this might not happen until years down the road, the value of the annuity could really increase, as it is generating a return on the principal, as well as on the previous gains, and on the money that otherwise would have been paid out in taxes.

The tax-deferred nature of annuities can also benefit you in other ways, too. For instance, personal IRAs (individual retirement accounts) and employer-sponsored retirement plans - which also offer tax-advantaged growth - have annual maximum contribution limits.

Therefore, once you have “maxed out” your yearly contribution to these plan, you may not fund the account(s) any more until the following year. This, however, is not the case with an annuity. So, annuities can also be used as an “extension” of other accounts that allow for tax-advantaged growth.

Given that, these financial vehicles can offer you benefits in addition to just a reliable stream of income in retirement. Many annuities may include other nice features, as well, such as:

*Note that the features above may require additional premium and/or certain qualification requirements to first be met.

If you have a deferred annuity, it is possible that you may own it for a long period of time before you retire, and in turn, convert it over into an automatic stream of income. The way that the return on your funds in the annuity contract is determined will depend in large part on the type of annuity that you have.

Annuity types can include:

As their name implies, fixed annuities offer a fixed interest rate that is set by the insurance company. While this rate is usually somewhat low, the principal and the previous gains with a fixed annuity are protected from downward movements in the stock market. So, those who are seeking safety and security may benefit from these financial vehicles.

Fixed annuities also pay out a known income stream once they are annuitized (i.e., converted over to an income stream). So, you can count of a specific dollar amount to arrive on a regular basis - either for a certain period of time, or even for the remainder of your lifetime. This, in turn, can be helpful when you are budgeting for your expenses in retirement. Plus, knowing this ahead of time can prevent you from having to make certain income-related decisions in the future.

A fixed index annuity is a type of fixed annuity. The biggest difference between the two is that the former has its return based in large part on the performance of one or more underlying market indexes, such as the S&P 500 or the Dow Jones Industrial Average (DJIA).

During certain time periods - such as an annuity's contract year - when the index performs well, a positive return is credited to the account. This gain may be limited by a “cap,” though. In return for this limit on the upside growth, there are no losses incurred during times when the underlying index(es) suffers a loss - even if the fall in value is significant.

Similar to a regular fixed annuity, the income stream that is paid out via a fixed index annuity is a known, pre-set amount, so once the annuity starts this payout, there are no further decisions that must be made going forward.

Another annuity type, variable annuities, are not generally recommended for retirees or those who are quickly approaching retirement. One reason for this is because they are considered more risky than fixed and fixed index annuities.

The return on a variable annuity is based on the performance of one or more underlying investments, such as mutual funds. With these annuities, you have the opportunity to generate a nice return - and in some cases, a substantially higher return than that of a fixed or fixed indexed annuity.

But, the “tradeoff” for this potentially higher return is the risk of loss. These losses could be incurred on your previous gains, as well as your original principal. So, if you are nearing retirement and/or you are risk averse, variable annuities are not likely a good option for you.

On top of that, variable annuities are also known for charging high fees - which can further impede on your returns. In total, the average fees on a variable annuity are 2.3% of the contract value - and the fees on some variable annuities could even exceed 3%. So, even if the underlying investment(s) has a stellar performance, it could be reduced by quite a bit due to the charges and fees on a variable annuity.

Just some of these variable annuity fees can include the following:

If you want to reduce your future financial decision making, and it appears that an annuity could fit well with your objectives, it is essential that you choose the right one for your specific goals and needs. Working with an annuity or retirement income specialist can help you to narrow down the right option(s).

Because many people tend to require more healthcare in retirement - and in some cases, this can be due to cognitive impairments - it is also important to ensure that you have possible health and long-term care services covered ahead of time, too.

One of the biggest expenses that you could incur in retirement - and one that has the potential to decimate your portfolio - is a long-term care need. This is the case regardless of whether you receive your care at home or in a facility.

In 2021, the monthly median cost of a semi-private room in a skilled nursing home facility was $7,908 and a private room ran higher at more than $9,000. Even home health care costs, on average, ran roughly $5,000 per month.

| In-home care | Community and assisted living | Nursing home facility |

|---|---|---|

| Homemaker services - $4,957 | Adult day health care - $1,690 | Semi-private room - $7,908 |

| Home health aide - $5,148 | Assisted living facility - $4,500 | Private room - $9,034 |

There are several strategies available that may be used for paying some or all of any future long-term care costs that you may incur - and that could be set up before you reach retirement.

These can include the purchase of stand-alone long-term care insurance coverage, as well as “hybrid” plans that combine long-term care and an annuity, or long-term care and life insurance. Talking with a specialist in this area can help you with deciding which option is right for you.

In putting together your future financial plan, you should also ideally branch out to professionals other than just your financial professional. For instance, these individuals may also include the following:

Retirement should ideally be a time of rest and relaxation - and this includes not having to make major financial decisions as you age, weather that is because you are unable to do so on your own or because you would like the assurance that they have already been taken care of for you.

If you would like to implement strategies now for a reliable future income stream in retirement, as well as putting other financial protections in place like the payment of potential long-term care expenses, talking with an Alliance America financial professional can help.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.