Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

When interest rates rise or remain at an elevated level, payout rates can make annuities an attractive option as a source of retirement income because insurance companies can invest the premiums at higher yields. Consequently, annuity buyers can potentially secure a larger income stream for their retirement years.

The primary appeal of annuities lies in their ability to provide a guaranteed income that can help mitigate the risk of outliving one's savings in retirement, a concern faced by many retirees. Annuities can also offer tax-deferred growth, meaning that the money invested in an annuity can grow without being subject to immediate taxation until funds are withdrawn.

Annuities are versatile financial products offered by insurance companies to help individuals secure a reliable income stream during retirement. Annuity contracts are essentially agreements between the annuity buyer and the insurer in which the buyer makes a lump-sum payment or series of payments (known as premiums) to the insurer. In return, the insurer commits to making periodic payments to the buyer, either immediately or at a future date, for a specified period or the remainder of the annuitant's life.

Annuities come in various forms, each with its unique features and benefits. Understanding the differences between the main types of annuities is crucial for potential buyers to determine which option best aligns with their financial goals and risk tolerance. The three primary categories of annuities are fixed, variable and indexed.

It's essential for annuity buyers to thoroughly review the specific terms, conditions and fees associated with each type of annuity before making a decision. Consulting with a financial professional can help individuals evaluate their options and select the type of annuity that best suits their unique retirement planning needs.

The prevailing interest rate environment has a significant influence on the benefits and attractiveness of annuities. When interest rates are high, annuities can offer several advantages that make them a compelling choice for retirement income planning.

One of the most direct impacts of high-interest rates on annuities is the potential for better payout rates. Annuity payouts are based on several factors, including the annuitant's age, life expectancy and the interest rate environment at the time of purchase. When interest rates are high, insurance companies can invest the premiums at higher yields, enabling them to offer more attractive payout rates to annuity buyers. This means that individuals purchasing annuities in high-interest rate environments may receive a larger income stream throughout their retirement years compared to those who bought annuities during periods of lower interest rates.

Higher interest rates can also positively impact the long-term growth potential of certain types of annuities. Fixed annuities, which offer guaranteed interest rates, directly benefit from high-interest rate environments. Because the insurance company can invest the premiums at higher yields, the annuity's value grows faster, resulting in a larger accumulated balance over time. This growth is particularly advantageous for individuals who purchase deferred annuities, as they allow the annuity's value to compound tax-deferred over an extended period before the payout phase begins.

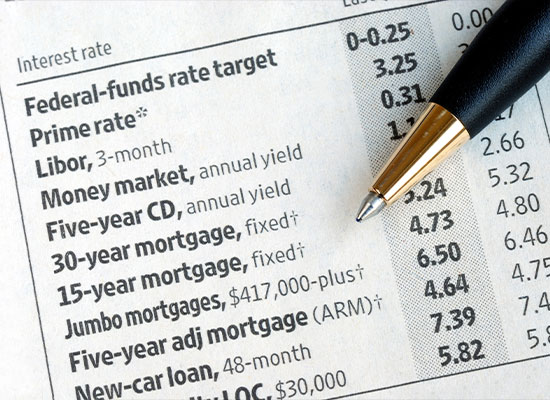

Another potential advantage is increased competitiveness compared to other investment options. In high-interest rate environments, annuities can become more attractive compared to other conservative options, such as certificates of deposit (CDs) or bonds. As interest rates rise, the yields on these traditional fixed-income investments also increase. However, annuities can often provide higher payout rates than CDs or bonds of similar maturities, due to the insurance component and the pooling of mortality risk among annuitants. Additionally, annuities offer the potential for lifetime income, which can be a significant advantage over other financial vehicles that do not provide this guarantee.

The impact of high interest rates on annuity benefits extends beyond improved payout rates and growth potential. Annuities, particularly those with lifetime income options, can help mitigate longevity risk – the risk of outliving one's savings in retirement. In high-interest rate environments, the increased payout rates can provide a larger guaranteed income stream for life, reducing the concern of running out of money in retirement. This peace of mind can be especially valuable for retirees who are worried about the potential impact of market volatility on their retirement savings.

Fixed annuities benefit from high interest rates because their payouts are directly tied to the prevailing interest rate at the time of purchase. Unlike variable annuities, which offer the potential for higher returns but also come with market risk, fixed annuities provide a guaranteed, stable income stream based on the locked-in interest rate. For risk-averse investors or those prioritizing predictable retirement income, fixed annuities in high-interest rate environments can be a particularly attractive option.

It's important to note that while high interest rates can enhance the benefits of annuities, potential buyers should still carefully consider their individual financial circumstances, risk tolerance and retirement goals before purchasing an annuity. They should also compare offerings from multiple insurance companies, as payout rates and contract terms can vary. Consulting with a financial professional can help individuals assess whether an annuity is a suitable choice for their retirement income planning, taking into account the current interest rate environment and their specific needs.

Before incorporating an annuity into your retirement strategy, it's essential to carefully consider several key factors to ensure that an annuity aligns with your unique financial situation and goals.

Ultimately, the decision to purchase an annuity should be made in the context of a comprehensive retirement plan that takes into account all sources of retirement income . By carefully evaluating your options and seeking the guidance of a qualified financial professional, you can determine whether an annuity is the right tool to help you achieve your retirement income goals in today's high-interest rate environment.

Remember, while high interest rates can enhance the benefits of annuities, they are not a one-size-fits-all solution. It's essential to approach the decision with a thorough understanding of the product, your financial situation and your long-term objectives to ensure that an annuity aligns with your unique retirement plan.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.