Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Making sure that you have enough income in retirement is an important component of your overall financial planning. But simply generating an ample amount of incoming cash flow is just one piece of the puzzle. That is because your tax obligation could have a significant impact on how much actual spendable income you net in the future.

With that in mind, being aware of the potential tax liability from various income sources, such as Social Security, interest, dividends and both long- and short-term capital gains, can play a key role in the amount you’ll have available to spend on essentials like housing and food, along with non-essentials such as travel, fun and entertainment.

It is possible that some – or even all – of the income that you generate in retirement will be taxable. For instance, if you contributed money into various savings plans on a pre-tax basis – and the gains in the account(s) were also tax-deferred – none of this income has been subject to income tax yet. Therefore, 100% of the withdrawals from these plans will be taxable.

Typically, the following retirement income sources will be taxed to some extent:

The amount of tax that you are subject to pay can also depend on how long you’ve held certain investments before selling them. For instance, the tax rates differ between long-term and short-term capital gains.

Capital gains are defined as the profit you earn on the sale of certain assets, such as stocks, bonds, mutual funds and real estate. As an example, if the selling price is higher than the price you purchased the investment(s) for, then you will have generated a capital gain.

If you held the investment for longer than one year, and you then earn a profit on it, this is considered a long-term capital gain. Conversely, assets that are held for less than one year and are sold for a profit will generate short-term capital gains.

Long-term capital gains tax rates can be dependent on the amount of income that you earn in a given year, as well as how you file your tax return. But typically, long-term capital gains tax rates are more favorable than short-term capital gains tax rates. In fact, the highest long-term capital gains tax currently (in 2021) is 20%, whereas the highest federal income tax rate is 37%.

| Tax Rate | Single | Head of Household | Married Filing Jointly | Married Filing Separately |

|---|---|---|---|---|

| Tax Rate0% | Single$0 - $40,000 | Head of Household$0 - $54,100 | Married Filing Jointly$0 - $80,000 | Married Filing Separately$0 - $40,000 |

| Tax Rate15% | Single$40,001 - $445,850 | Head of Household$54,101 - $473,750 | Married Filing Jointly$80,001 - $501,600 | Married Filing Separately$40,001 - $250,800 |

| Tax Rate20% | Single$445,851 or more | Head of Household$473,751 or more | Married Filing Jointly$501,601 or more | Married Filing Separately$250,801 or more |

A short-term capital gain is one that is generated from certain assets that are held for less than one year. Short-term capital gains tax rates on most assets that are held for less than one year correspond to ordinary income tax rates. In addition to the amount of income that you generate, the amount of income tax that you owe can also be dependent on your tax-filing status.

| Rate | Unmarried Individuals | Married Individuals Filing Jointly | Head of Household |

|---|---|---|---|

| Rate10% | Unmarried IndividualsUp to $9,950 | Married Individuals Filing JointlyUp to $19,900 | Head of HouseholdUp to $14,200 |

| Rate12% | Unmarried Individuals$9,951 to $40,525 | Married Individuals Filing Jointly$19,001 to $81,050 | Head of Household$14,201 to $54,200 |

| Rate22% | Unmarried Individuals$40,526 to $86,375 | Married Individuals Filing Jointly$81,051 to $172,750 | Head of Household$54,201 to $86,350 |

| Rate24% | Unmarried Individuals$86,376 to $164,925 | Married Individuals Filing Jointly$172,751 to $329,850 | Head of Household$86,351 to $164,900 |

| Rate32% | Unmarried Individuals$164,926 to $209,425 | Married Individuals Filing Jointly$329,851 to $418,850 | Head of Household$164,901 to $209,400 |

| Rate35% | Unmarried Individuals$209,426 to $523,600 | Married Individuals Filing Jointly$418,851 to $628,300 | Head of Household$209,401 to $523,600 |

| Rate37% | Unmarried IndividualsOver $523,600 | Married Individuals Filing JointlyOver $628,300 | Head of HouseholdOver $523,600 |

While you generally have control over when you sell personal investments like stocks and bonds, mutual funds – which could make up a significant portion of your retirement portfolio – are constantly selling equities and passing along capital gains to their owners.

This means that if mutual funds are held in non-qualified accounts (i.e., outside of traditional IRAs and employer-sponsored plans such as 401ks), you could still “receive” capital gains distributions that will be taxable to you. So, this too could have a big impact on your overall income and tax bill.

With these types of capital gains, you are essentially required to pay taxes on money that you do not actually receive – but that could still have an effect on the taxation of other income sources like Social Security.

Therefore, while it is typically preferable to generate as much income as possible, there are certain situations as a retiree where earning more income can lead to some unfavorable tax obligations. For instance, your age when you file for Social Security retirement benefits could result in up to 85% of this income being taxable.

In some cases, Social Security retirement benefits may be taxable. This is true if you are receiving Social Security before you have reached your full retirement age, and you are also receiving income from various other sources. Depending on the year you were born, your full retirement age for Social Security will be between 65 and 67.

| Year of birth | Minimum retirement age for full benefits |

|---|---|

| Year of birth1937 or before | Minimum retirement age for full benefits65 |

| Year of birth1938 | Minimum retirement age for full benefits65 + 2 months |

| Year of birth1939 | Minimum retirement age for full benefits65 + 4 months |

| Year of birth1940 | Minimum retirement age for full benefits65 + 6 months |

| Year of birth1941 | Minimum retirement age for full benefits65 + 8 months |

| Year of birth1942 | Minimum retirement age for full benefits65 + 10 months |

| Year of birth1943 to 1954 | Minimum retirement age for full benefits66 |

| Year of birth1955 | Minimum retirement age for full benefits66 + 2 months |

| Year of birth1956 | Minimum retirement age for full benefits66 + 4 months |

| Year of birth1957 | Minimum retirement age for full benefits66 + 6 months |

| Year of birth1958 | Minimum retirement age for full benefits66 + 8 months |

| Year of birth1959 | Minimum retirement age for full benefits66 + 10 months |

| Year of birth1960 or later | Minimum retirement age for full benefits67 |

For instance, you may be taxed on Social Security (in 2021) if:

Your combined income equals your adjusted gross income plus any non-taxable interest earned, plus one-half of your Social Security benefits.

Adjusted gross income

+

Non-taxable interest

+

½ of your Social Security benefits

=

Combined income

If you receive Social Security prior to your full retirement age and you are also still working, your benefits could also be subject to an earnings limit. This means that your benefit amount may be reduced if you earn more than a certain amount of other income.

For instance, if you are under your full retirement age for the entire year (in 2021), then you can have $1 of benefit deducted for every $2 that you earn above the annual limit. This limit (in 2021) is $18,960.

In the year that you reach your full retirement age, $1 from your Social Security retirement benefits will be deducted for every $3 that you earn above $50,520 (in 2021). However, beginning in the month that you reach your full retirement age, your earnings will no longer reduce the amount of Social Security benefit that you receive – no matter how much other income you earn.

It is important to note, though, that your Social Security benefits could still be subject to taxation, regardless of whether or not you have reached your full retirement age. Each year, you will receive a Social Security Benefit Statement that shows the amount of benefit you received in the prior year. This form can be used for determining whether or not your benefits will be taxable to you.

Because of this, it is important that you plan your income and withdrawals in retirement carefully, as some strategies could help you to reduce the amount of taxes you’ll owe. For example, the sale of an appreciated stock or bond can increase your current year’s taxable income, and in turn, could result in the amount of your Social Security benefits that are taxed, as well.

On the other hand, accessing non-taxable investments – such as funds from a Roth IRA or a life insurance policy loan – could keep your taxable income level lower, and in turn, reduce the amount of income tax that is owed.

While different types of income and withdrawals can have differing tax liabilities, there are other tax-related concerns that you need to be aware of both before and after you’ve retired – starting with the tax rate you are subject to.

Since 1913 – the year that the federal income tax in the U.S. was restored – the top rate has been as low as 7%, and as high as 94%. Over the past 108 years, this rate has been 70% or higher 49 times. So, depending on how much income you generate, and how much of it is taxable, you may have to hand over a sizeable amount to Uncle Sam.

| Year | Rate |

|---|---|

| Year2018 - 2021 | Rate37 |

| Year2013 - 2017 | Rate39.6 |

| Year2003 - 2012 | Rate35 |

| Year2002 | Rate38.6 |

| Year2001 | Rate39.1 |

| Year1993 - 2000 | Rate39.6 |

| Year1991 - 1992 | Rate31 |

| Year1988 - 1990 | Rate28 |

| Year1987 | Rate38.5 |

| Year1982 - 1986 | Rate50 |

| Year1981 | Rate69.125 |

| Year1971 - 1980 | Rate70 |

| Year1970 | Rate71.75 |

| Year1969 | Rate77 |

| Year1968 | Rate75.25 |

| Year1965 - 1967 | Rate70 |

| Year1964 | Rate77 |

| Year1954 - 1963 | Rate91 |

| Year1952 - 1953 | Rate92 |

| Year1951 | Rate91 |

| Year1950 | Rate84.36 |

| Year1948 - 1949 | Rate82.13 |

| Year1946 - 1947 | Rate86.45 |

| Year1944 - 1945 | Rate94 |

| Year1942 - 1943 | Rate88 |

| Year1941 | Rate81 |

| Year1940 | Rate81.1 |

| Year1936 -1939 | Rate79 |

| Year1932 - 1935 | Rate63 |

| Year1930 - 1931 | Rate25 |

| Year1929 | Rate24 |

| Year1925 - 1928 | Rate25 |

| Year1924 | Rate46 |

| Year1923 | Rate43.5 |

| Year1922 | Rate58 |

| Year1919 - 1921 | Rate73 |

| Year1918 | Rate77 |

| Year1917 | Rate67 |

| Year1916 | Rate15 |

| Year1913 - 1915 | Rate7 |

In addition to federal income tax, you could also be subject to state income taxes. In fact, only nine states – Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming – levy no personal income tax (in 2021).

There are also 13 states that tax Social Security benefits (in 2021). These are:

Making sure that you have enough spendable income in retirement is essential. The good news is that there are strategies available that could help you to reduce your income tax liability, such as:

Realized capital losses from certain types of investments may be used to reduce your annual income tax bill. These losses could offset capital gains that you owe. However, if you do not have any gains to offset the capital loss, you may be able to use the loss as an offset to your ordinary income – up to $3,000 per year.

In order to deduct losses from equities like stocks, you must complete IRS Form 8949 – Sales and Other Dispositions of Capital Assets – as well as Schedule D (Form 1040) – for your income tax return.

Tax deductions and credits could also be used for reducing your overall tax liability in retirement. Many people – both workers and retirees – may fare better using the standard deduction as versus itemizing tax deductions.

For instance, taxpayers who are at least age 65 years old (in 2021) or blind may claim an additional standard deduction of $1,350 (or $1,700 if using the single or head of household filing status). The additional deduction amount is doubled for those who are both age 65+ and blind.

| Tax Filing Status | Standard Deduction (2021) |

|---|---|

| Tax Filing StatusSingle | Standard Deduction (2021)$12,550 |

| Tax Filing StatusMarried filing separately | Standard Deduction (2021)$12,550 |

| Tax Filing StatusMarried filing jointly | Standard Deduction (2021)$25,100 |

| Tax Filing StatusHead of household | Standard Deduction (2021)$18,800 |

You may also be able to generate tax-free income from a Roth IRA and/or Roth retirement plan. Roth accounts are funded with after-tax money. But the earnings and the withdrawals are tax-free. So, accessing retirement income from a Roth account won’t increase earnings that would otherwise lead to taxation of your Social Security income.

If you don’t qualify to open a Roth account, you may be able to roll funds from a traditional retirement account into a Roth. In this case, the transfer would be taxable. However, if tax rates go up in the future, going this route could end up saving you a great deal of tax liability in the future.

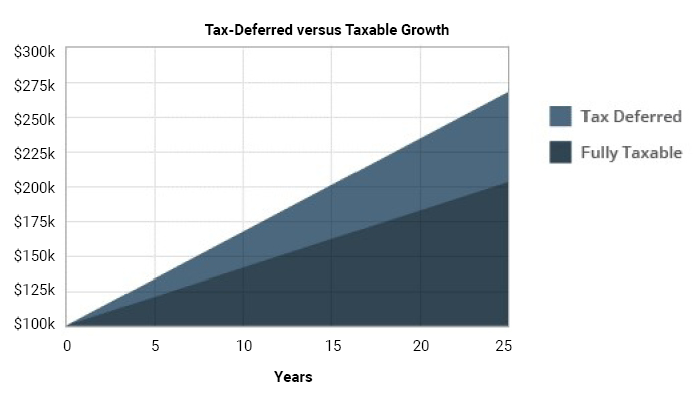

Another approach for reducing taxes both before and in retirement is to reposition some of your non-qualified money from stocks and/or mutual funds to a tax-deferred annuity. This is because the growth that takes place in an annuity is not taxed during the “accumulation” period. Because of this, not only can you avoid taxation in the current year, but you could also grow the account value more than that of a taxable account – with all other factors being equal.

In tax-deferred annuities, tax on your gains will not due until the time of withdrawal – which may not take place until a much later time. Going with this strategy could reduce the amount of taxes that you are paying and might possibly also lessen the amount that your Social Security retirement income benefits are taxed.

There is no single right or wrong way to generate retirement income. Because everyone’s objectives, risk tolerance and time frame until retirement differs, it can take a customized approach for each individual or couple.

Working with a specialist in the retirement income arena can help you to sort out your options with regard to income and withdrawals, as well as the various tax treatment you may incur. Creating an income strategy that reduces – or even eliminates – tax can leave you with much more net spendable cash to use for yourself and your loved ones.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.