Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Retirement planning, financial security and wealth expectations are crucial factors that shape the economic landscape of the United States. A recent study by opinion research organization CivicScience has shed light on a concerning trend in retirement wealth expectations among women in the U.S.

The study found that only one-third of U.S. women expect to be wealthier than their parents upon retirement, highlighting a significant gender gap in financial outlook. This article will discuss the findings of the study, compare them with related research and explore the factors contributing to this disparity in retirement wealth expectations between men and women.

The CivicScience study surveyed U.S. adults to gauge their expectations for their financial situation upon retirement compared to that of their parents. The study found that 40% of U.S. adults believe they will become wealthier than their parents by the time they reach retirement, while roughly one-third believe they will have less wealth. Higher earners with an annual household income of $100,000 or more see themselves on a wealth-growth trajectory, while lower earners making under $50,000 yearly envision going in the opposite direction.

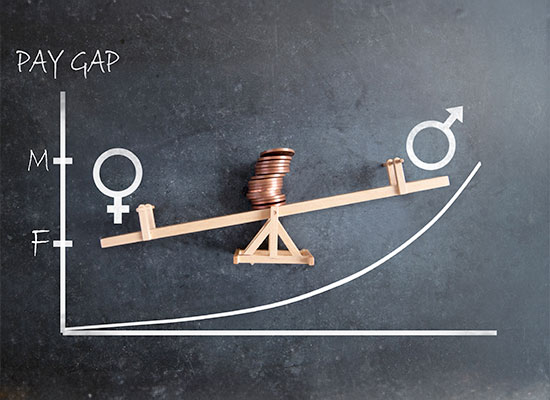

Alarmingly, the study revealed a large gap between expectations among men and women. 42% of U.S. women say they do not think they will retire with more wealth than their parents, compared to 31% of U.S. men. Women are a full 13 points less likely than men to foresee a wealthier future and are overall more inclined to believe they will have less wealth.

The CivicScience study's findings are consistent with other research that has explored the gender gap in retirement wealth expectations. A study by the Transamerica Center for Retirement Studies found that women are less likely than men to feel confident about their ability to retire comfortably, despite social and economic progress over the past half century.

“Today’s women are better educated and enjoy career opportunities that were unimaginable 50 years ago,” says a summary of the Transamerica study. “Despite this progress, women lag behind men when it comes to saving and planning for retirement. A woman’s path to a secure retirement is filled with obstacles, such as lower pay and time out of the workforce for parenting or caregiving, which can negatively impact her long-term financial situation. Statistically, women tend to live longer than men, which implies an even greater need to plan and save.”

Similarly, a report by the National Institute on Retirement Security (NIRS) found that women are 80% more likely than men to be impoverished at age 65 and older. The report attributes this disparity to a combination of factors, including the gender wage gap, time spent out of the workforce for caregiving and the likelihood of women working in lower-paying industries and occupations.

“Women face an uphill battle when it comes to retirement,” Dan Doonan, NIRS executive director, said in a news release. “The wage gap is stubbornly persistent for women and they typically live longer than men. Women are less likely to have access to a workplace retirement plan and have caregiving demands throughout their lifetime that often hurts their earning potential. Generally, women need a larger nest egg, yet most are in a weaker financial position as compared to men.

The gender pay gap has a significant negative impact on women's ability to save for and fund a secure retirement. Here are some key ways the pay gap affects women's retirement prospects:

Closing the gender pay gap is critical to improving women's retirement security and financial well-being later in life. Policy solutions like pay transparency, paid family leave, affordable child care and strengthening Social Security can help mitigate the compounding effects of the lifetime earnings gap.

The CivicScience study found that the COVID-19 pandemic had a disproportionate impact on certain segments of the population. As of 2024, women's wealth expectations have remained the same since July 2022, while men saw an increase of 5 points. Expectations among Gen X have fallen during this same time period, whereas adults under age 45 are seven points more likely to believe they will acquire more wealth than their parents during their working years.

Additional data from the study show a clear correlation between how a person's financial state changed over the course of the pandemic and their perception of the future. More than half of those who believe they will be wealthier than their parents say their financial situation has improved since the start of the pandemic, while the exact opposite is true for those not expecting to be wealthier.

These findings are consistent with other research that has highlighted the uneven economic impact of the pandemic. A report by the National Women's Law Center found that women, particularly women of color, were disproportionately affected by job losses during the pandemic. This has exacerbated existing economic disparities and may have long-term impacts on women's retirement savings and wealth accumulation.

Experts say addressing the gender gap in retirement wealth expectations requires a multi-faceted approach that includes policy changes, employer initiatives and individual actions:

Numerous studies highlight the significant gender gap in retirement wealth expectations in the United States. Women are less likely than men to believe they will be wealthier than their parents upon retirement, and this disparity was exacerbated by the COVID-19 pandemic. Addressing this gap requires a comprehensive approach that includes policy changes, employer initiatives and individual actions.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.