Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

December 2019 feels like a lifetime ago. And, in fact, it was. It was before the coronavirus came into our lives and tossed everything upside down.

But that was also when the SECURE Act (or Setting Every Community Up for Retirement Enhancement Act) was signed into law. It would be the greatest effort at reforming the retirement system in over a decade.

Most of the act’s provisions took effect in January 2020. They included:

But one change was set to take place in the fall of 2021, at the earliest.

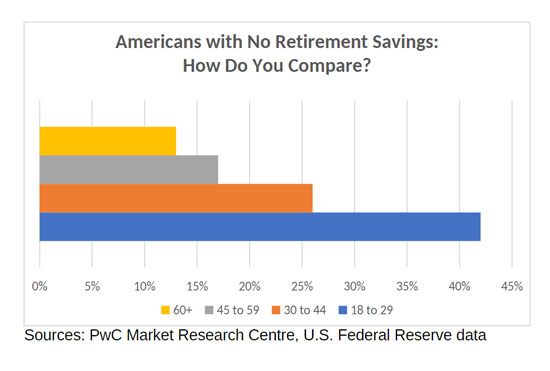

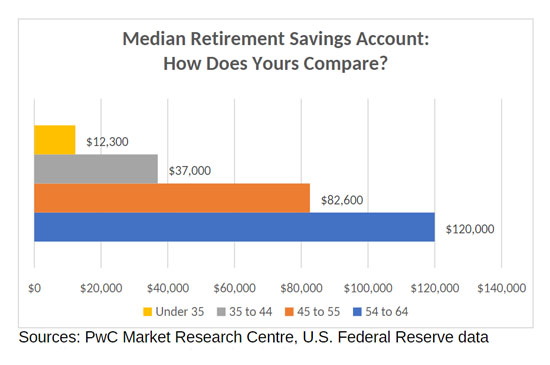

The U.S. government is concerned about the rate at which its citizens save for retirement. Too many are unprepared. It had created tax-advantaged instruments such as 401(k)s and IRAs. But people don't contribute enough or allow contributions to grow enough to finance their retirement.

Accounting firm PwC estimates that only one-quarter of adults in America have retirement savings, and that 36% would consider their retirement efforts to be "on track."

As a result, Social Security is being asked to do too much of the heavy lifting. But it was never expected to carry that much. On average, it will replace about 40% of our previous income, and the rest has to come from savings. (And don't forget that we live longer, so our savings have to carry us that many more years.)

So, as part of a government educational effort, SECURE’s legislation requires that the sponsors of defined contribution plans such as 401(k)s provide statements at least every 12 months with what's called "a lifetime income disclosure."

The goal is to make the saved money feel more "real." Just depositing it and watching a number grow has little relevance. And the saver can't imagine the difference those savings can make in retirement.

Based on the interim rule in place so far, each year, savers will receive two illustrations that show what their nest egg could provide if it were converted into an annuity. The document will estimate how much guaranteed lifetime income the amount in the saver's account could generate each month as a single annuity (until the saver dies) and as a joint annuity (with benefits extending to a surviving spouse). Calculations will be made as if the saver is presently 67 years old.

The illustration uses specific IRS mortality tables to figure out your life expectancy. And the annuity would assume to pay the interest rate at the time for the 10-year Treasury bond.

According to the Labor Department, say you have a balance of $125,000 in your retirement account, and the going interest rate is 1.8%. The illustration will show that if you buy a single annuity with the $125,000, and you are age 67, you will get $645 each month for life. But if you have a spouse, a joint annuity will pay you $533 each month until your death, and then your surviving spouse will continue to receive the same.

Here's the concern: Early on in your career, while account balances are naturally low, this information may be more discouraging than encouraging. But, with lots of years left for your balance to grow, well-thought-out materials can clearly illustrate how that can change.

The U.S. Labor Department and Congress are still defining the final legislation. Among other things, additional assumptions are being requested, such as investment returns. The goal is to provide enough information to let each saver envision what retirement will look like when the time comes.

If you have a 401(k), you can expect to see this new information on your 401(k) statement sometime between the fall of 2021 and sometime in 2022.

You can only plan so much for retirement. Some elements will be out of your control, such as how the stock market will behave. Or what kind of health challenges you or your spouse might face. Or what family dynamics might change that leave you with unexpected financial obligations.

The goal of retirement planning is to prepare for as many of the knowns as possible. And to have resources to cover the unknowns that might present themselves.

Getting to a number. The rule of thumb is that you will need, on average, between 70% and 80% of your pre-retirement income once you retire. However, you are not going to live the average retirement; you will live your unique retirement.

A vital first step is to get clarity on what life costs you today. Next, you will want to invest the time to define in detail what your retirement will look like. And lastly, you will want to estimate as closely as possible what that "envisioned lifestyle" will cost when you retire, whether that's 5, 15 or 25 years away.

| Essential expenditures | Non-essential expenditures |

|---|---|

| Essential expendituresLiving expenses | Non-essential expendituresEntertainment |

| Essential expendituresFinancial obligations | Non-essential expendituresLarge luxuries |

| Essential expendituresTaxes | Non-essential expendituresSmall luxuries |

| Essential expendituresHealth care | Non-essential expendituresVacations |

| Essential expendituresInsurances | Non-essential expendituresGifts |

Defining essential and non-essential expenditures. Whatever information was used to develop your original budgetary number can be used to divide expenses into two categories:

Identifying guaranteed and non-guaranteed income. Ideally, you want to match your essential expenditures (and hopefully more) with guaranteed income, leaving only non-essential spending to be covered by non-guaranteed sources.

| Essential expenditures = Guaranteed income | Non-essential expenditures = Non-guaranteed income |

|---|---|

| Essential expenditures = Guaranteed incomeSocial Security | Non-essential expenditures = Non-guaranteed income401(k)s |

| Essential expenditures = Guaranteed incomePensions | Non-essential expenditures = Non-guaranteed incomeIRAs |

| Essential expenditures = Guaranteed incomeAnnuities | Non-essential expenditures = Non-guaranteed incomeStocks |

| Essential expenditures = Guaranteed incomeCDs | Non-essential expenditures = Non-guaranteed incomeReal Estate |

| Essential expenditures = Guaranteed incomeBonds | Non-essential expenditures = Non-guaranteed incomeOther Instruments |

Reassurance comes from knowing that at least all your essential expenses are covered by funds that are guaranteed for life, meaning they will always be there and they will never run out. Such funds could include your Social Security benefit, defined pension plans, as well as other guaranteed sources such as certain annuities, certificates of deposit (CDs) and bond portfolios.

As for your non-essential expenses, those you cannot cover with guaranteed income you can cover with somewhat riskier sources, meaning sources subject to market conditions.

Markets offer an opportunity for continued growth that guaranteed income sources do not. That's one reason for holding part of your portfolio in a riskier format. However, it will be up to you to determine how much risk you are willing to take with these resources.

Non-guaranteed income sources can include 401(k)s, IRAs, stocks, real estate and other instruments. As you approach retirement, you will likely prefer to lower the level of risk. You will want to avoid losses too close to retirement when you no longer have the time to turn the losses around.

And before entering retirement, you might shift some resources from non-guaranteed to guaranteed, especially if you don't need additional growth to ensure you don't spend down your savings too soon. You want your portfolio to last as long as you do, ideally with something left for your loved ones and heirs.

But at least if the non-guaranteed income is designated to cover only non-essential expenditures, if a significant market fluctuation occurs during retirement, it will not put essential elements at risk. You will have minimized the disruption to your retired lifestyle.

By going through this very personal and individual analysis, you can build your retirement plan in a way that "guarantees" the essential things are covered. But even if the essentials are covered, for many retirees, drawing down a nest egg – and watching it grow smaller with time – can cause anxiety.

The fear of running out of money has led many retirees to forgo meaningful "little luxury" activities in retirement, especially those related to family and friends that add to the richness of life.

That may be another reason to shift income streams from non-guaranteed to guaranteed, especially in what seem to be today's inflationary times.

A straightforward way to increase your lifetime income stream is to maximize your Social Security benefit. That could mean delaying your claiming date until your full retirement age (between 66 and 67) and beyond. For example, your lifetime benefit increases 7% to 8% for each year you delay claiming between ages 62 and 70. And your benefit as a couple – and later for one as a survivor – can also come from well-known timing strategies.

Increased Social Security benefits have an additional advantage: cost-of-living adjustments or COLA. Although many will argue that COLAs do not fully compensate for the increased cost of living, they do move in tandem with inflation.

But if maximized Social Security – together with any pensions you might have – is not enough to cover your essential expenditures, you might want to consider an annuity to fill the gap.

Most 401(k) plans have invested your savings in target-date funds, passively managed index funds and actively managed mutual funds – all of which are driven by market conditions while you work. But, as you approach retirement, you may be seeking greater certainty.

Annuities – or lifetime income investments – may not be familiar to you. Annuities are contracts issued by insurance companies to protect one's principal and provide lifetime income.

But the Department of Labor's new interpretation of your 401(k) plan savings in terms of an annuity may have raised your curiosity. In fact, the same SECURE Act of 2019 made it easier for employer-sponsored retirement plans to include an annuity option within their plans by removing some of the earlier barriers.

For example, there's one new ruling that protects your employer and one that protects you. The fiduciary responsible for selecting insurers for your plan is no longer liable if the annuity carrier has financial problems that keep it from meeting its obligations to you. And annuity plans offered in a 401(k) are now portable. That way, if the annuity plan is discontinued as an option with your 401(k) plan, you can make a trustee-to-trustee transfer of your funds to another plan that your employer offers or to an IRA, so you don't have to liquidate the annuity and pay all the surrender charges and fees.

Whether they are within your employer's 401(k) plan or not, annuities do offer a way to convert your savings into monthly checks – either starting immediately or later – for the rest of your life. But while that sounds ideal, they do come with varying complexities. They require a certain level of knowledge to be sure you are investing in an instrument that will provide the security you are seeking at fees you are willing to pay.

Fees. A primary risk involved with annuities is the possibility of hefty fees. These are often hidden in the details of a complex contract and can reduce your funds considerably. Therefore, it is critical that you fully understand all the details or, in the absence of that, have a trusted advisor who does.

The fees are determined by the type of annuity you choose. For example, the variable type tends to have higher costs than the fixed type.

Fees cover management and administrative costs, plus the risk taken by the insurance company. And if you choose to withdraw from the annuity, the surrender charge can be significant.

Annuities are like most any other financial instrument: complex. However, annuities can play a positive role in providing regular checks for a lifetime if configured correctly. The key is selecting the right type of annuity for you and configuring it correctly.

Risk of loss. You could lose part of your investment if you die prematurely. With some annuities, you cannot leave your beneficiaries any money that remains when you die; it typically goes to the insurance company. But with others, for a fee, you can have the contract pay over your lifetime, then transfer to your spouse if you die first. Again, the details are critical.

Comparing plans. Even if you have the option of opening an annuity within your employer-sponsored retirement plan, it is not necessarily the best contract for you. Here's a list of various types of contracts that could be available to you:

Once you have decided on the best type for your needs, you still need to research the financial strength of the insurance company behind the contract. Then, the specific percentages lost to fees and left for payouts.

The purpose of this article is not to make you an expert on annuities. Instead, it is to increase your awareness of the importance of guaranteed income for your retirement years, starting with the projections shown soon on your 401(k) statements.

What other actions will you want to take? You will want to look at your non-guaranteed savings and project their future performance. You will want to consider the impact of inflation and the cost of taxation. Then, if you combine those with your newfound awareness of guaranteed income, you will have the tools you need to design the comprehensive, secure retirement you envision.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.