Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

For many, it’s the dream of a lifetime: retiring “early” and living a long and satisfying life after stopping working. Many people dream of saving a huge nest egg, leaving their job and moving to a warm, vibrant location with lots of opportunities for golf, fishing and year-round recreation.

For those pursuing this dream, it’s important to note that early retirement comes with some challenges. In general, you’ll need to accumulate more money faster than most people are able to. You’ll also need to make sure your nest egg is large enough to last for a longer retirement. To make matters worse, inflation is likely to impact you more with a longer retirement than someone who retires at “normal” retirement age.

However, if early retirement is important to you, and you’re willing to stick to a smart plan, it remains an achievable goal. One of the most important aspects of your early retirement plan will be the selection of smart and high-performing investments. Indexed insurance products also can help you achieve early retirement with an unbeatable combination of loss-protection and guaranteed income for life.

To get a feel for the challenges of early retirement, it’s helpful to consider how you’re going to fund your retirement lifestyle. Whether you retire early, on-time or late, you’re going to need to live on some combination of:

The most immediate challenge to early retirement is that you’ll have fewer years to accumulate your nest egg. It’s simple math. If you retire at 60 or 62 instead of 65 or 67, you’ll have anywhere from three to seven fewer years to save for retirement. Given that many people struggle to save anywhere near the amounts they need to retire at full Social Security retirement age, this is quite a challenge.

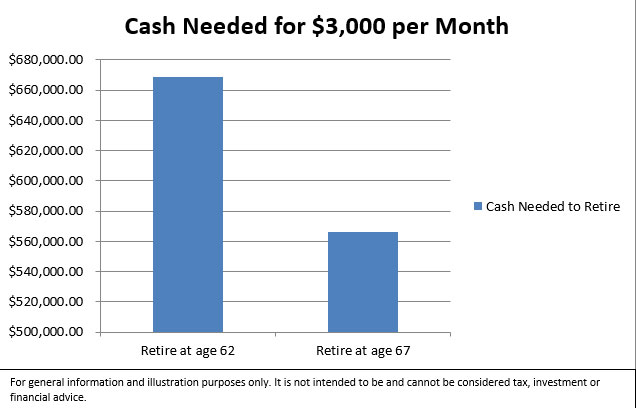

This reduced savings timeline packs a double-whammy since your total years in retirement will also be longer. So, not only will you have fewer years to save, you’ll also need to save more to keep yourself in retirement, as you can see from the table below. In the table the following assumptions are made:

As you can see from the chart, you need just over $100,000 more ($668,700 vs. $566,100) saved in order to pay yourself $3,000 per month from age 62 to 87 versus waiting to age 67.

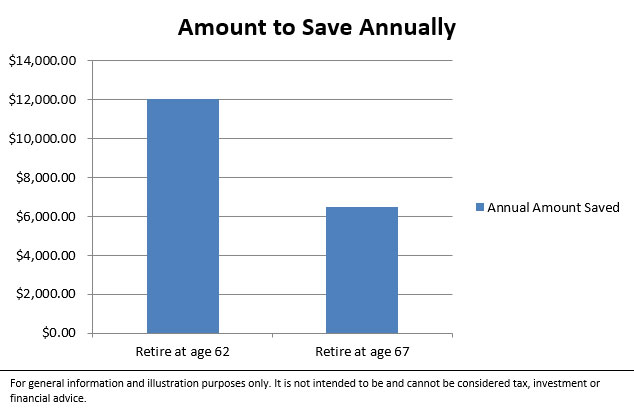

And, remember that you have fewer years to save this money if your goal is to retire early. The second chart shows you the impact of retiring five years early. In this chart, we’ve made the following assumptions:

Looking at this chart, we see that in order to save enough money to pay yourself $3,000 per month until age 87, you’d have to save nearly twice as much per year in order to retire early at age 62. The actual difference is $5,577 per year. To retire at 67 you need only save $6,481 per year. To retire at 62, you’ll have to up that to $12,058.

Of course, this example only gives you a fixed payment of $3,000 per month. You may need more, especially when you consider inflation, which we’ll cover in a bit.

A second and related challenge is that if you draw Social Security before your full retirement age (FRA) in order to fund your early retirement, you’ll be receiving a reduced payment. For instance, if your FRA is 67, and you take Social Security at age 62, you’ll have a permanent 30% reduction in your Social Security payment. Thirty percent is a big reduction, and this will only make it more difficult to pay for your expenses during your elongated retirement.

Of course, the total reduction in retirement benefits is based on how early you claim them. The biggest hit is 30%, but if you draw benefits closer to your FRA, your benefit is still reduced, but by a smaller amount. Whatever reduction you’ll face, you’ll need to make up for it with increased savings.

One potential alternative strategy would be to retire from work early, but not claim Social Security until your FRA. In order for this to work, you’d need to rely on one of two situations:

For those of you who have a pension benefit from an employer, you need to understand that your pension is often based on a combination of your total years of service and your average earnings. If you retire early, your pension benefit may be reduced, just like your Social Security benefit.

Two last considerations for early retirement are inflation and the cost of health insurance. We’ve already seen that you’ll need to save more total money, and you’ll need to save it faster, if you want to retire early. However, our examples looked only at a fixed monthly payment. We totally neglected the effects of inflation. The fact of the matter is that the buying power of that $3,000 will be eroding away each and every year.

Using our $3,000 per month retirement income example, even modest inflation of 1.5% reduces your purchasing power dramatically over time. The table below shows the buying power of $3,000 at age 87.

| Retired at age 62 | Retired at age 67 | |

|---|---|---|

| Purchasing power at retirement: | Retired at age 62$3,000 per month | Retired at age 67$3,000 per month |

| Purchasing power at age 87: | Retired at age 62$2,056 per month | Retired at age 67$2,217 per month |

Of course, inflation may be higher or lower than 1.5% per year. Even at 1.5%, you can see that you’ll need a bigger nest egg at retirement in order to maintain a $3,000 per month lifestyle.

The last challenge we’ll consider is the cost of health insurance. Based on current law, if you retire at age 65 or later, you and your spouse will be eligible for Medicare. When you’re in Medicare, you can expect to pay some of all of these costs, depending on your coverage choices:

While these items do have some cost, they’re far less than the cost of individual health insurance. If you retire early, before becoming eligible for Medicare, you’ll likely have to purchase individual health insurance policies for you and your spouse. This can be very expensive – much more expensive than having Medicare. And, you’ll have to keep paying for your coverage until you enter Medicare. In this case, early retirement might add upward of $1,000 per month in monthly expenses compared to waiting to retire at Medicare age.

As you can see, you’re dedicated to the proposition. To attain it, you’ll have to manage expenses and have a sound retirement savings plan because there are some significant challenges to retiring early. However, it can still be an achievable goal.

Even if you’re not planning to retire early, you need to make a solid retirement savings plan. To retire early, you need an even better plan, and you must stick to it. To help with this all-important task, you’ll want to work with a reputable financial professional. It’s very important that you discuss your intent to retire early. This will influence how your plan is set up. Remember, you’re going to need a bigger nest egg, and you’re going to need it sooner than if you retire at 65 or 67. In order to attain this, you’ll need to do one or both of the following:

The money has to come from somewhere, and there’s likely a limit to how much you can realistically put away each year. You have to pay all of your living expenses, after all. So if you’re constrained on how much you can save, you’ll have to earn higher investment returns. This sounds great in theory but remember that in order to make higher investment returns, you usually have to take on more risk.

What this generally means is more exposure to the stock market. Stock market returns usually provide most of the investment gains in a portfolio. To earn more money, you’ll need to have more exposure than if you’re planning to retire at age 67. This isn’t without problems, though. What’s the flip-side of high-earning riskier investments? Investment losses.

Investment losses are never welcome, but of course, they are often inevitable. From 1960 to 2020, a total of 61 years, the S&P 500 has lost money 13 times (including dividends), or 21% of the time. This means that on average, the S&P lost money once every five years. In some of those years, the losses were quite steep, including losses of more than 20% twice since 2002.

In other words, if you keep your money in the stock market long enough, you’re going to lose money. And, given that bear markets happen on average every eight years, sooner or later you’re going to have a big loss. Something greater than 20%. Since 1945, bear markets have occurred almost every six years on average.

It would be great if you could make money when the stock market rose, but somehow avoid losing money when the market went down. Although it sounds too good to be true, there are some products that do just that.

Some insurance contracts give you the best of both worlds. Fixed index insurance products come in two forms:

Both of these products earn interest in similar ways. They allow you to designate some portion of your premium payments and accumulated cash values to one or more investment indexes. These indexes are tied to various stock markets and bond indexes around the world. The interest you earn for any given year is directly tied to the performance of your chosen index.

Both indexed annuities and life insurance may have limitations on how much you can earn. These limitations are known as participation rates and rate caps. The participation rate is the percentage of index gain that you’ll share in. For example, if the participation rate for your policy is 80% and your indexes earn 15% for the year, your policy would potentially earn 12% (15% index gain x 80% participation rate).

A rate cap is a hard limit on your interest rate, and it is applied after any participation rate. So for example, if you have a rate cap of 8% and a participation rate of 80%, you will earn 8% interest for the year if your indexes earn 15% (15% index gain X 80% participation rate = 12%, but this is limited by your cap rate of 8%).

You can find indexed products that have 100% participation rates and zero rate caps. This is why you’ll want to work with a financial professional who can be able to find the indexed products that are most favorable for you.

The best part of indexed annuities and life insurance, though, is that they protect you from market losses. If your indexes decline for the year, you don’t lose money. Instead, you simply earn zero dollars for the year.

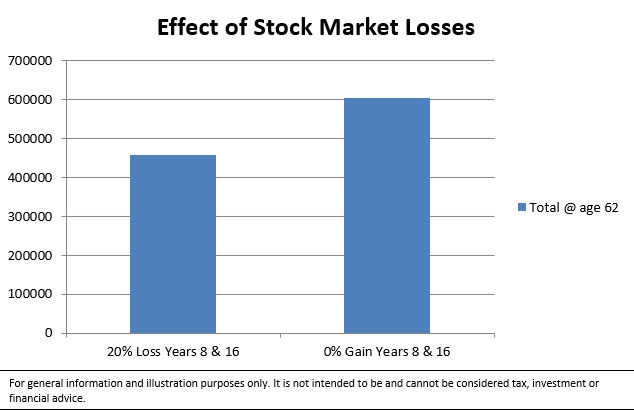

To illustrate the power of this, let’s look at one more chart. We’ll stick with our prior example of saving $12,058 per year from age 40 to age 62. In this example, your money earns 8% (based on money invested at the beginning of each year) every year except that in year 8, you lose 20% and in year 16 you lose 20% again. This is a pretty likely scenario since bear markets tend to happen at least once every eight years. This is what would happen if you had money invested in the stock market.

The other part of the chart shows what happens if your money is in indexed products. In years 8 and 16, you don’t lose 20% like everybody else, you just make 0%. The chart shows you the difference.

Recall that in order to generate $3,000 in income per month starting at age 62 (from our first chart and example) we needed a nest egg of just over $668,700. If you suffer those two years of 20% losses, you’ll come up more than $200,000 short of your goal (your actual nest egg at age 62 will be $457,600). But, if you were in indexed products, you’d still accrue just over $600,000 by age 62, even if you made 0% in years 8 and 16. That’s the true power of indexed annuities and life insurance; it’s not so much the higher interest rates, it’s the protection from losses. Losses have much more impact on your nest egg than gains.

You can see that attaining early retirement comes with some serious challenges, mainly because you have a shorter time horizon to save. Don’t despair, though; it can be done. If this is your plan, you know you have to avoid big losses while also making stock market-based returns. Indexed insurance products can be a perfect fit for you here. To take advantage of these products, make sure you work with your financial professional. You’ll need to be in the products most suited to achieving your goals. While early retirement may be daunting, it is attainable with smart planning, dedication and protection from market losses.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.