Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Social Security plays an important role in any plan for retirement. It pays to keep track of the benefits you’ve accrued, as well as knowing the impact that working an extra year or two could have on your retirement benefits.

Keeping tabs on the benefit that Social Security calculates for you is an important step in staying on-track with your retirement plans. Once you turn 60, Social Security will mail you an annual statement. This statement shows, in tabular detail, all of the reportable earnings for your working career.

Make it a habit to review this document carefully. The numbers on the summary are important for at least two reasons:

If you see any errors, be sure to call Social Security right away. You’ll want to have a copy of the W2 or tax return for the year in question. Social Security asks that you only call if you see an error for a year prior to the last year shown on your statement. The last year reported may be only an estimate.

You need to make sure you have at least the minimum number of credits to qualify for two programs that will help you have a stellar retirement:

In order to qualify for Social Security, you must have worked, and paid payroll tax, for at least 40 quarters. Social Security considers a quarter to be a three calendar-month period in which you earned an average of at least $1,410 (for 2020). For most full-time workers, this means paying payroll tax for 10 years.

This is a crucial concept, because if you don’t have the required number of quarters, you do not receive any Social Security benefit.

Medicare also has a 40-quarter requirement; if you know for sure that you’ll receive Social Security, you can be confident that you’ll also qualify for premium-free Part A as long as you meet any other Medicare requirements.

Given the high cost of health care, any successful retirement strategy will have Medicare coverage as one of the basic tenants. Even if you plan to use a Medicare Supplement Insurance policy, or Medicare Advantage plan, you must first of all be eligible for original Medicare, which means you must have at least 40 quarters of payroll tax history.

My Social Security is an online account you create on the Social Security Administration’s website (ssa.gov). This account is an invaluable tool for staying up to date on your accrued and projected Social Security benefits.

Having an online account means you don’t have to wait to receive your annual statement. In fact, you don’t even have to be 60 years old to view your statement with the online account. This account also makes it easy to order a replacement Social Security card if you should lose or damage yours.

From your online Social Security account, you can see your projected retirement benefit. This amount is payable to you monthly. Reviewing this amount periodically is a great idea. You can also get a feel for whether it might be a good idea for you or your spouse to work a year or two beyond Social Security retirement age. You can do this by using the benefit calculator within your My Social Security account.

You and your spouse should definitely consider working more years if:

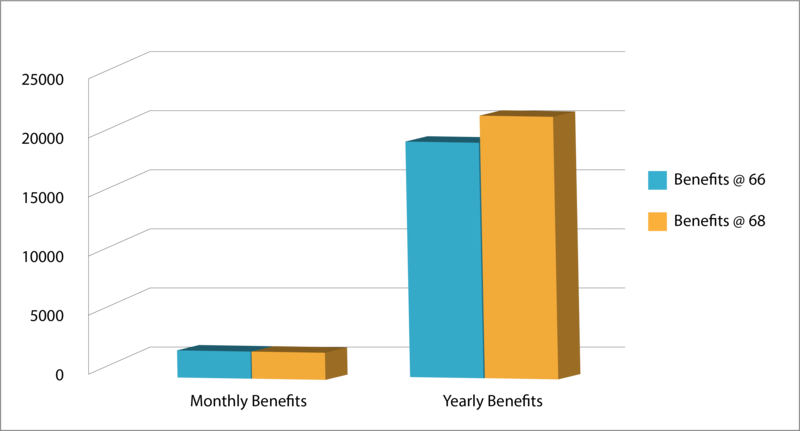

If you were born between 1943 and 1956, your Social Security retirement age is 66. Delaying your benefits until age 68 can have a significant impact on your monthly benefit.

As an example, assume that your average lifetime yearly salary is $40,000, and that you were born in 1950. At normal retirement age of 66, your estimated monthly benefit would be $1,512 per month. If you delayed taking benefits until age 68, your estimated benefit increases to $1,753 per month. If you can wait until age 70, your monthly payment jumps up to $1,995 per month.

Comparing just age 66 and age 68, you can expect to receive $2,892 more per year if you delay taking Social Security. If you live to be age 81 or older, you will receive more over your lifetime, even though you waited two years to draw Social Security.

Additionally, if you’re earning more per year at age 66 and 67 than your lifetime average income, you will be increasing your average during these last two years. Since your Social Security benefit is calculated using your lifetime average income, anything you do to bump that average up will increase your check in retirement.

Even if you’ve accumulated a large nest egg, or are looking forward to a hefty pension benefit, Social Security and Medicare are valuable benefits that should be considered as a part of your retirement strategy. For one thing, you’ve paid for them your whole working life in the form of payroll taxes; you might as well take advantage of what you’ve paid into the system.

The size of your Social Security benefit may affect your choices when it comes to managing your nest egg; you may be able to reduce distributions from your savings, and therefore pass on a greater inheritance to your beneficiaries.

The bottom line is that knowing the details of your projected Social Security benefit is a huge part of retirement planning. It may in fact form the basis from which your plans are made. Be sure to share any updates about Social Security with your retirement advisor.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.