Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Mention the word “retirement” and the first thoughts for many people are how much they’ll receive monthly from Social Security and which Medicare to choose. While those are pivotal retirement issues, of far greater concern is how to finance a period of retirement that could last 20 to 30 years or more.

It’s easy to avoid looking honestly at where we are in our retirement planning – and saving. Yet this is one of those situations where the ostrich approach is not helpful. Much more helpful is to remove all judgment around how prepared we may (or may not) be today, look objectively at where we are and define where we want to be.

The distance between where you are and where you want to be is what you want to understand and master. How quickly you bridge that gap will depend on your creativity, your perseverance and your willingness to seek help where needed.

The secret to building a secure retirement is to take action. But, to do that, you’ll first want to understand all the pieces that make up a retirement plan and how they fit together.

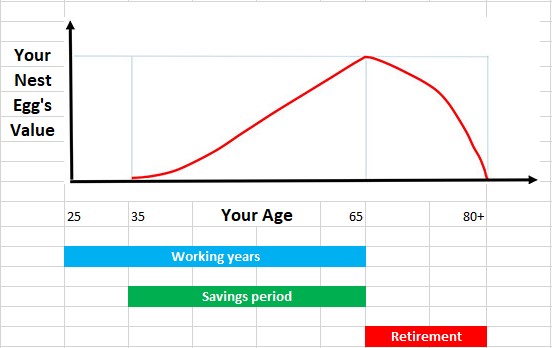

Your retirement picture will have two phases:

Both phases are critical. The wiser you are in designing and implementing each one, the more secure your retirement will be.

Most people will start working in their 20s. Even if they don’t start saving for retirement immediately, the sooner they do so, the easier saving will be because time will be on their side. And they will likely continue saving as long as they are working, which is usually into their mid-60s.

Your nest egg should be at or above your targeted value when you retire. After that, you will be drawing down according to a plan and reaping the rewards of your hard work.

You will be building your nest egg during the first phase “saving for retirement.” This list shows the order in which you might start saving:

Let’s look at each one.

For some, Social Security acts as a forced savings account – one that you’ll be happy to have in your later years. If you earn a salary, the company is required to withdraw a percentage of that salary and send it to Social Security as your contribution. It also has to match that contribution. Those funds accumulate in your name throughout your work life and determine the amount Social Security will pay you for the rest of your life once you claim the benefit, sometime between age 62 and 70.

If you own a company, you will make the employer’s and employee’s contribution based on whatever salary you take, being conscious to fund your Social Security account as generously as you can. You need a minimum of 40 quarters (or 10 years) of contributions to qualify for benefits, and you’ll lose what you did contribute if you fail to reach the minimum.

Retirement accounts are probably the most familiar retirement tools. You put money into 401(k)s, IRAs, pension plans or HSAs and let it grow. But these are not investments themselves; instead, they are accounts that can be funded with stocks, bonds, mutual funds, CDs and other investments.

401(k)s: Your employer might offer these defined-contribution retirement accounts. Your contribution comes right off your paycheck, and your employer may match what you put in up to a specific amount. (That’s like getting free money.)

Individual Retirement Accounts (IRAs): You can set up IRAs as an individual as long as you fund them with earned income. IRAs also exist for specific professions and the self-employed. As is the case with 401(k)s, if you fund IRAs with your earnings before you pay taxes on them (pre-tax dollars), you will pay tax later on these “traditional” accounts when you withdraw your funds in retirement. If you use after-tax dollars to fund the “Roth” form of these accounts, you can withdraw your funds in retirement and not have to pay taxes. Meanwhile, your funds have had a chance to grow.

Pensions: You make contributions to a pension plan that is linked to an employer or organization (such as a union), and your employer may contribute, too. But pension plans are rare today, and most have been replaced by 401(k) plans. You might still have one if you work in the public sector (such as the government, public education, military or police).

Health Savings Accounts (HSAs): HSAs are linked to high-deductible health plans. You contribute pre-tax money to the account. If you don’t use the money for medical expenses that year, what remains is invested in something like mutual funds, where it can grow over the years. Your funds can be spent tax-free on qualified medical expenses, including during retirement.

Our homes: The down payment you make on your home – and the part of each month’s payment that goes toward principal (and not interest) – is what builds equity that becomes another asset available to you in retirement.

Investment real estate: Investment real estate includes multi-family (apartments), retail, office and industrial properties. You benefit from tenants’ rental payments and increases in the properties’ value.

Art and other private investments: You could invest in art, jewelry or other collectibles because you believe they will increase in value over time.

Life insurance: We buy life insurance to replace our financial contribution to our spouse or family if we are gone. It is generally “term” or “whole life.”

Long-term care insurance: After family and friends can no longer care for you – and you can’t care for yourself – you may need in-home skilled care, then assisted living and eventually a nursing facility, which Medicare does not cover. A long-term care policy can cover those ever-increasing expenses. Insurance companies also offer hybrid policies that combine long-term care with life insurance, so your family gets a payout if you die without ever having used your long-term care insurance.

Annuities: Annuities are one of the only ways for an individual to create their own stream of guaranteed income for life. Fixed index annuities in particular are an increasingly popular tool. A fixed index annuity is designed to lock in gains while still allowing the owner to benefit when the market does well. When stocks go up, you make more money – and those gains are locked in no matter how the market performs.

Any funds left over after covering Social Security, retirement accounts, real estate and insurance can go into after-tax investments such as stocks, bonds and fund counterparts.

Stocks: Even as a small investor, the stock market lets you participate in the economy’s large and small companies. You can benefit by receiving dividends on shares or because a share rises in value. Or you can lose if you sell and the share price has gone down.

Bonds or fixed-income instruments: A bond issuer can be a corporation, municipality or the U.S. government that promises to repay the amount of your I-O-U or loan on a specific date, plus a stated rate of return (or interest) for the use of your money.

Fund counterparts, including mutual, exchange-traded and closed funds: Regulated investment companies let you diversify your investments into mutual funds, exchange-traded funds (ETFs) and closed-end funds. You benefit from the expertise of the funds’ professional managers by owning a share in the fund that holds stocks, bonds, money market instruments and other assets.

Once you reach retirement age, you will turn to your savings and investments into income streams to provide the money you need to live. The more “traditional” streams come from Social Security, your pension (if you are lucky enough to have one) and your retirement accounts distributions. All other streams are considered “non-traditional.”

As you developed your retirement plan, you will have defined your financial needs in retirement. You will most likely have divided them between essential and non-essential expenditures.

The goal of retirement planning is for you to live your best life, filled with the pleasures you worked so hard to be able to enjoy. It is not to find yourself in virtual survival mode, where you question your ability to cover the basics of food and shelter.

One way to be sure you can cover all essential expenditures is to classify your income streams into “guaranteed” and “non-guaranteed.”

The importance of this classification is that – to the extent possible – you want to cover at least all of your essential expenditures for the rest of your life with guaranteed income streams, such as Social Security and annuity payments. You will be less affected by events such as market fluctuations. You may have to make some changes to non-essential expenditures, but your essential ones will be ensured.

You will want to look at the tax implications of each income stream you choose to fund for retirement. Some will trigger a tax payment upon withdrawal. You may find you have less money available than expected if part of your income stream has gone to the IRS.

Besides helping you decide the best income streams to fund for retirement, financial planners can make an invaluable contribution by designing a spending plan that maximizes your funds and minimizes your taxes.

Most Americans will have worked enough years during their work life to benefit from Social Security, or they will qualify based on their spouse’s work record. The amount you receive – month after month for the rest of your life – depends on your lifetime earnings and the age you file for benefits.

In 2020, more than $1 trillion was paid to 65 million Americans in Social Security benefits. The average monthly benefit was $1,514, and the most you can earn per month as of 2021 was $3,895 if you wait until age 70 to claim. One crucial fact: Depending on your total income, your Social Security benefits can be taxed up to 85%.

For any traditional retirement accounts you funded with pre-tax dollars, you are required to begin taking required minimum distributions (RMDs) according to a government formula once you turn 72. You can withdraw more than the minimum, but since you pay tax on all withdrawals, they should be part of a careful tax strategy. Your Roth accounts were funded with after-tax dollars, so you can withdraw if and when you like after reaching age 59½. Depending on how they are invested, they might be affected by market forces, so they are considered non-guaranteed.

Your pension may pay out a set monthly amount that the plan guarantees or an amount determined by how well the pension plan invested your contributions and those of the employer. At retirement, you may have the choice of taking a lump-sum payout or a monthly “annuity” payment.

Any funds you have accumulated in an HSA can be used tax-free for any medical expenses, before or after retirement. After age 65, you can use the funds to pay certain Medicare premiums.

Your home can generate funds in several ways. It can store value if you have built up equity, and its value can appreciate. You can access a lump-sum windfall if you decide to sell and downsize; a home equity loan can help cover certain expenses. After age 62, you can take out a reverse mortgage that converts your home’s equity into cash payments. And you can rent out rooms or generate income through Airbnb.

Real estate investments can generate monthly income from tenants, or you can sell the properties if a lump-sum cash infusion is needed.

With art and other private investments, you are unlikely to generate any income other than benefiting from their increased value if you sell them.

Besides the death benefit a life insurance policy pays to your beneficiaries, it can be the source of a loan during your life, repaid out of death benefits. In the case of a terminal illness, you might access part of the death benefit early through a living benefit rider. An accumulated cash value may be available if you choose to surrender the policy.

Your long-term care insurance will start covering expenses when you are unable to perform certain daily living activities. It is not an income stream you will see in cash, but it can cover some costly invoices.

You can tap into investments in stocks, bonds and fund counterparts as needed. However, accessing this income stream calls for monitoring the market to maximize the value and reviewing your tax exposure to minimize the loss to taxes.

If your income streams – including working after you retire – generate more cash than you need, you might consider putting those extra funds into other income-generating vehicles. These could include annuities (such as single-premium immediate annuities or SPIAs) purchased from insurance companies that guarantee payments in regular installments for specific periods. Other possibilities include holding the funds in interest-bearing money market or cash equivalents, or investing in real estate investment trusts (REITs), dividend-paying stocks, peer-to-peer lending, municipal bonds, U.S. Treasury notes and bonds, Treasury inflation-protected securities and others,

As you save for retirement, you likely have loved ones to protect and support as well. In life, they will be part of your expenditures – both essential and non-essential. But in death, their care will be the result of careful estate planning.

Social Security payments will become survivor benefits for your spouse and children. Retirement accounts will go to the named beneficiaries, with special circumstances available for spouses inheriting IRAs. Benefits on pension plans may be paid to your beneficiaries following the terms of the plan.

On your home, how you title the property determines the transfer. Real estate investments and private assets are transferred through your will.

Life insurance policies pay out to beneficiaries as contracted. On a long-term care insurance policy, your spouse may still have access if it includes a shared-benefit rider. If it is a hybrid policy, your beneficiaries could receive death benefits.

Saving for retirement may feel like the most challenging part, but the spending period is the most complicated if you want to get the most out of your money.

And the price of failure is very high. Spending the wrong funds at the wrong time in the wrong amounts can devastate your well-laid plans, both for yourself and your loved ones.

Careful planning can ensure the most efficient use of your funds. It can also help your funds continue to grow and provide income as you age. The large number of moving pieces makes retirement planning one area where asking for help can be invaluable.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.