Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

The cost-of-living adjustment (COLA) for Social Security recipients in 2021 was 1.3%. This amount is as little as $20 per month for many people. In terms of the costs retirees actually face, this amount is a pittance and does nothing to maintain purchasing power. Loss of purchasing power can be attributed to two complementary factors: official measures of inflation tend to undercount inflation, and interest rates are at historic lows, slashing retiree’s ability to earn safe income that keeps pace with true inflation.

Over the long term, these two facts can have a severe impact on your standard of living in retirement. The solution is to implement a well-planned and targeted investment portfolio strategy that is designed to cover the true cost of living. This strategy should be composed of a smart blend of stocks, funds and both deferred and immediate annuities. The right strategy can protect your purchasing power and your quality of life in retirement.

The annual COLA is designed to help people on fixed incomes maintain their purchasing power so that inflation doesn’t slowly reduce them to poverty over time. Fixed incomes are traditionally received from these sources:

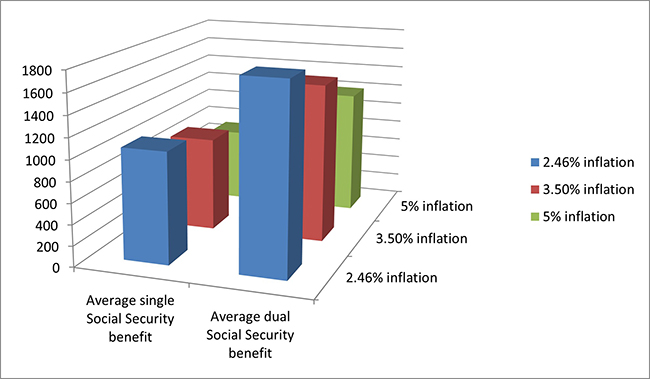

Without COLA adjustments, these payments would remain fixed while the prices you pay increased over time. Average yearly inflation in the United States from 1990 to 2018 was 2.46%. While this is considered fairly low as inflation goes, it does mean that something that cost $100 in 1990 cost $202.40 by the end of 2020. In other words, inflation eroded half of your purchasing power in 30 years.

It’s important to keep in mind that while some payments that you receive have COLAs, some expenses that you pay can also be tied to COLAs. For example, Social Security taxes, Medicare premiums, real estate and local taxes are frequently adjusted to compensate for rising costs of living. And while Medicare premiums are prohibited from rising more than Social Security COLAs, any increase can hurt your purchasing power.

In theory, COLAs counteract the effects of inflation. However, the way COLAs are calculated has some significant consequences for maintaining purchasing power.

The problem with COLAs is that they tend to undercount the reality of inflation. COLAs are based on certain measures of inflation. For instance, COLAs for Social Security benefits are based on the CPI-W, a measure of inflation tied to the urban workforce. The way CPI is calculated drastically understates inflation for many products and services you’re likely to actually use. For instance, the 2021 Social Security COLA was 1.3%, but the price of many necessary goods and services has increased by more than 20% since 2020.

There has been endless controversy about the merits of CPI as well as how it’s calculated. The general feeling is that it undercounts inflation, and sometimes by a large margin. Much of the controversy stems from a particular change in methodology. The result is that CPI no longer measures the cost of a fixed basket of goods, but rather tries to measure the costs of maintaining a fixed lifestyle. The theory is that consumers change their habits in response to changes in price. While this is undoubtedly true, the belief that inflation is undercounted is persistent. The Bureau of Labor Statistics, which is responsible for calculating inflation, denies that their metrics systematically underreport inflation. However, there are a couple reasons why lower reported inflation is useful for the federal government.

First of all, low inflation allows for low interest rates. Interest rates have been falling for decades. This has allowed the government to borrow trillions of dollars, yet pay comparatively little interest on it’s debt. If interest rates rose significantly in response to higher inflation, interest expense on U.S. debt obligations would skyrocket, seriously impacting the federal budget.

Besides low borrowing costs, lower inflation keeps COLA adjustments down. With people living longer than when programs like Social Security began, total outlays on the “old-age” programs have ballooned over time. This is particularly acute now, while we’re in the middle of the baby boomer generation receiving Social Security and Medicare benefits. The strain on the national budget is enormous. Low COLAs lessen the impact of these expenditures.

We just mentioned that prices of some goods and services had increased by over 20% by May 2021. Particularly high inflation is being observed in some categories of prime importance to retirees. For instance, car and truck rental increased over 30% and laundry equipment by more than 24%. Besides this, home prices are rapidly increasing, especially in retirement-friendly areas in the Sun Belt.

The effect of these price changes, and the official measurement of inflation, is that the prices you’re likely to pay are going up much faster than any COLA you’re entitled to. This situation has persisted for decades now, and it is slowly eating away at retiree’s purchasing power. Below is an illustration of how inflation erodes purchasing power over time. Three different inflation levels are shown: 2.46% (reported inflation), 5% (an estimate of true inflation), and 3.5% (the mid-point between 2.46 and 5%). The time period is 15 years (the time from turning age 65 to 80). The results show that inflation of “only” 3.5% will reduce purchasing power by nearly 59% within 15 years.

Small or zero COLAs (the Social Security COLA was $0 in 2015, 2009 and 2010) are bad enough, as we’ve seen. What makes matters worse is that the ultra-low interest rates made possible by low reported inflation also make it very difficult to earn solid fixed income streams from investments like bonds.

For decades, bonds have been a cornerstone of retirement planning and income generation. They’re generally safe from large market losses and pay consistent interest payments that can help fund your retirement. However, as interest rates have dropped in response to policy changes from the Federal Reserve, interest rates have declined substantially. Today, the 10-year Treasury Bond yields only 1.573%, which is below the official inflation rate. When compared to the “true” rate of inflation, this fixed income option looks even worse.

These low interest rates leave only two options for most people:

“Chasing yield” like this can be very dangerous as it leaves you vulnerable to sudden and steep losses in the stock market or other investments. A better way to earn the income you need to combat inflation is to use annuities as part of a smart inflation strategy.

The first step in solving this problem is to understand that it is a problem. Traditional asset allocation relies heavily on bond exposure in retirement years. For the reasons we’ve just reviewed, this is not likely to work for the foreseeable future. Acknowledging this problem, you can work with your financial professional to create a strategy that will work.

Your strategy must incorporate a way to reduce risk while also allowing for higher income. You’ll need more exposure to the bigger gains available in the stock market, both domestic and international. On the other hand, large losses in your portfolio will eat away at your standard of living even faster than inflation, so you must guard against this.

A great solution is to use the power of annuities to both provide a large income in retirement, one that keeps pace with inflation, or even out-paces it, and also protects you against market losses. Though this may sound too good to be true, you can achieve both objectives with fixed index annuities (FIA).

FIAs function just like regular annuities in that they are contracts between you and an insurance company. The contract promises to pay a certain interest rate on the money you contribute. In addition, the contract guarantees to pay a monthly benefit for a stated period of time, generally over your life. The payment is guaranteed based on the amount in your account.

Traditionally, the interest you earned on an annuity was somewhat low (similar to other conservative investments likes bonds or certificates of deposit). For these traditional annuities, current interest rates are quite low. However, the “indexed” component of FIAs offers the exciting possibility for much higher interest crediting.

With an indexed annuity, you allocate some or all of your premium payments and accumulated value to the “indexed account.” The dollars in the indexed account are credited with an interest rate that is determined by the performance of one or more investment indexes. Common indexes include U.S. stock markets and various international stock markets. Every insurance company offers their own blend of indexes.

So, how does it work? Your interest rate is determined based on the performance of your chosen index(es) for your policy year. This return, calculated as a percentage, is adjusted by two other components:

Participation rates vary by company and annuity product. Common participation rates range from 50% to 100%. Cap rates can be any amount, and you’ll want to work closely with your advisor to find the best blend of participation and cap rates.

As an example, assume your contract has a participation rate of 80%. If your chosen index returns 15%, your interest rate for the year is 12% (15% return x 80% participation rate = 12).

It is possible to find 100% participation rate annuities without caps, which obviously allow for the highest interest crediting available. But, even with rate caps and participation rates, you can still earn much higher interest than with traditional annuities, bonds, or CDs. The best part about these indexed annuities is that you are protected against market losses. Unlike with other products (like variable annuities) your money isn’t actually invested in the market, so if your index declines in a year, even by a lot, you just earn 0%. You don’t lose money. This is a huge deal because you really get the best of both worlds: potential for high stock market based interest crediting with protection against losses.

The idea here is that by earning a high rate of return you can earn more in interest than you’re withdrawing in retirement, even if your expenses are rising due to inflation. Depending on how much interest you earn, you might even be able to grow your nest egg, even with withdrawals for living expenses. And, you’ll never lose a third or more of your money in a sudden bear market.

Fixed index annuities are accumulation assets; you’ll deposit money into them and earn interest over the years (ideally many years if you’re able to start early). At some point, though, you’ll want to start receiving that guaranteed lifetime income. This is called annuitizing: It switches your annuity from an accumulation asset to an income stream. You’ll actually have two options here:

It’s very important to keep in mind that annuities have surrender charges, and these charges taper away over time. Most annuities have a 10-year surrender period. You can withdraw all of your money without paying a penalty after 10 years. Because of this, you’ll want to make sure that you can commit to the long haul before purchasing annuities.

Assuming that you’re beyond your surrender period, you might decide to withdraw all your money from your indexed annuity and purchase an immediate annuity for income. This would make sense only if:

You can see how working with a trusted financial professional is imperative; you don’t want to pay any more fees than are necessary, but you also want to maximize the income you can earn each month. Some annuities are better for accumulation, and others are better for income. Your financial professional can help you choose the contracts that best fit your needs. In this way, you won’t leave any money on the table, either in the form of higher fees, or lowering monthly income.

Now that you know how big a problem inflation, inflation calculations, low interest rates and small COLAs are, you can work with your financial professional to craft a targeted investment allocation strategy. You’ll likely have some money directly exposed to the stock market, using a rule like the 100 minus your age allocation method, or some other conservative mix. But, consider using annuities in place of bonds as an anchor against market losses and to earn more interest than bonds or CDs are paying.

Always remember, though, that annuities should only be considered in the context of a long-term plan. If misused as short-term investments, you’ll feel the sting of surrender charges. However, as part of a sound retirement plan, annuities can safeguard your standard of living in retirement, no matter how long that lasts.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.