Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Retirement plans often count on your and your spouse’s Social Security benefits as a foundational part of your monthly income. But some assumptions you make about how those benefits work – assumptions that go back generations – could put your plans at risk

It’s not your grandfather’s retirement anymore. You’re not going to work for one company, rise through the ranks, raise a family with the company’s benefits, then retire at 55 or 60 with a gold watch. Instead, on average, you’ll work for more than a dozen companies during your career, according to the federal Bureau of Labor Statistics.

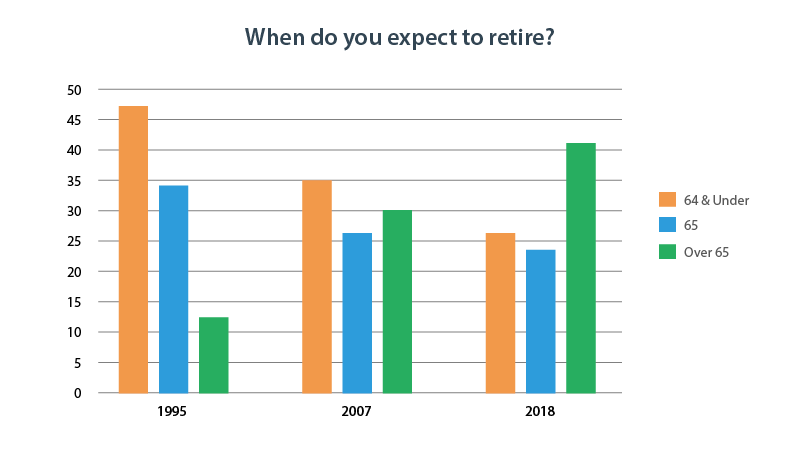

You’ll probably also work much longer. According to a 2018 Gallup Poll, in 1995, only 12% of non-retirees expected to work beyond age 65, but by 2018 that percentage had risen to 41%. While in 1995, 47% figured they would be retired before their 65th birthday, only 27% thought that by 2018.

With so many extra work years, you might retire from one career and start a second one. And having two careers can mean going from the public sector to the private sector. Or vice versa.

For example, say you start teaching in a school system at age 25. You stay within the same state and teach for 30 years. Then you retire from teaching and go to work for a company for another 10 years where you contribute to Social Security through FICA payments.

You’re now 65 years old. You know the best thing to do is to wait at least a year or two until you reach Social Security’s “Full Retirement Age” (FRA) when you receive 100% of your earned benefits. Your FRA depends on what year you were born, but it will be somewhere between ages 66 and 67 for anyone born after 1943.

As you think about retirement, things look rosy. You have qualified for a pension from the school system. And by working in the private sector for 10 years (the equivalent of 40 “quarters”), you also qualify to receive Social Security retirement benefits.

Each year, you check the Social Security website to see what your retirement benefit is projected to be – at age 62, at FRA or 70. Those numbers become an integral part of the dreams you paint of retired life.

There’s only one problem: That’s not what you’re going to receive.

What you weren’t counting on was something called the Windfall Elimination Provision (WEP). Another retirement disruptor could be the Government Pension Offset (GPO).

Let’s look at the two of them to see if you might be affected by either one.

To be affected by WEP or GPO, you have to have two retirement systems interacting: the one related to Social Security and a pension from some non-Social-Security-covered employment. (Those are referred to as “covered” and “non-covered” retirement systems.) The interaction could be within your own work history or between yours and your spouse’s.

Who might earn a non-covered pension? Public workers such as professors, teachers, first responders, federal employees and many state, county and local employees who have their own pension plans. This may also include workers in nonprofit organizations and foreign governments.

If this could be you, read on or check with your financial planner.

On the other hand, if you and your spouse have no interaction between the two systems, you have no reason to read further. But consider sharing this information with anyone who might be affected. Most people are unaware.

WEP can reduce your own Social Security benefit.

When Social Security calculates your benefits, it places greater weight on each dollar earned by low-wage earnings, so greater support can be given to those who will be more dependent on their Social Security checks when they retire. The more you earn during your career, the less those dollars will earn you in Social Security benefits until you hit the maximum cap that Social Security will pay.

But say you also have a non-covered pension. You may have relatively few “earned Social Security dollars,” but you have other retirement income that is not being factored in. You will benefit unfairly from the way Social Security skews its calculations.

Congress decided in 1983 to remove the unfair advantage from those who received two retirement benefits. That’s when the Windfall Elimination Provision came into existence.

If you have a private pension, it will not trigger WEP. Military pensions won’t either because military members pay into Social Security. In the case of federal government workers, those who started after 1984 should not be affected since they paid into Social Security. But if you have a federal government work history before 1984, you should check to see if any of your contributions were made into the earlier, non-covered civil service system. State and local government jobs can vary.

WEP will trigger a recalculation of your Social Security benefits if you meet two conditions:

To calculate your Social Security benefit, Social Security applies a formula that calculates your average monthly earnings over your work career, adjusted for the fact that wages have increased over time. It then separates your average monthly earnings into three portions: (1) the first $996; (2) earnings between $996 and $6,002; and (3) the amount over $6,002 (2021 figures).

How can WEP affect that calculation? Instead of multiplying the first $996 by 90%, Social Security multiplies it by 40%. That makes up for the fact that you have another source of retirement income: your non-covered pension. The second and third portions are not affected by WEP, but the overall impact is a reduction of $498 in your PIA, upon which future benefits are calculated.

The WEP reduction cannot exceed one-half of your monthly non-covered pension.

How much WEP affects the monthly reduction of your Social Security benefit also depends on how many years you have participated in covered employment with what Social Security considers “substantial earnings.” (In 2021, the annual requirement is $26,550.) The $498 reduction calculated above applies for up to 20 years of participation. Each additional year of participation subtracts $49.80 from the reduction. In year 30, the reduction will be $0.

| Years of substantial earnings | Percentage |

|---|---|

| Years of substantial earnings30 or more | Percentage90% |

| Years of substantial earnings29 | Percentage85% |

| Years of substantial earnings28 | Percentage80% |

| Years of substantial earnings27 | Percentage75% |

| Years of substantial earnings26 | Percentage70% |

| Years of substantial earnings25 | Percentage65% |

| Years of substantial earnings24 | Percentage60% |

| Years of substantial earnings23 | Percentage55% |

| Years of substantial earnings22 | Percentage50% |

| Years of substantial earnings21 | Percentage45% |

| Years of substantial earnings20 or less | Percentage40% |

Your non-covered pension may only be activated by a trigger defined within the plan, such as your retirement. If you start receiving Social Security benefits and your pension has not yet been activated, you will receive your Social Security benefits with no WEP adjustment. Once the pension is activated, your Social Security payments will be reduced.

The WEP reduction lessens with the number of years you have of work that pays into Social Security. One planning strategy to minimize the impact of WEP is to continue working until you approach or reach 30 years. (Part-time work counts as long as you meet Social Security’s substantial earnings requirement.)

If you can get rid of the WEP reduction entirely and if you claim benefits at your FRA, it could mean nearly $6,000 ($498 x 12) more per year in benefits. This difference represents $120,000 over 20 years, plus the cost of living adjustments (COLA). If you wait until age 70 to claim your benefits, the difference could be even more significant.

WEP will end with any of these events:

GPO can reduce the Social Security benefit you are entitled to through your spouse: a dependent benefit if your spouse is alive and a survivor benefit if your spouse has died.

Dependent and survivor benefits were initially set up in the 1930s to protect women financially dependent on their husbands because they stayed home to raise families. As women entered the workforce, husbands and wives both earned Social Security benefits more often than not.

Under the dual-entitlement rule, spouses with their own Social Security earnings will have their spousal benefits offset “dollar for dollar” by the benefits they earned of their own. However, until 1977, if a spouse worked in a job that did not contribute to Social Security (such as teaching and most government work), a non-covered pension did not trigger any offset. That’s when Congress passed the Government Pension Offset to end double-dipping in the interest of fairness.

GPO could be an issue for you if you meet two conditions:

As a spouse, you will find that the spousal and survivor benefits you expect to receive based on your spouse’s Social Security work record will be reduced or, in some cases, offset entirely.

Your Social Security benefits may not be affected by GPO if:

GPO adjusts the Social Security spousal or widow(er) benefits you receive from your spouse’s work history when those benefits interact with your non-covered pension. Spousal and survivor benefits are affected similarly. Those benefits can be reduced by two-thirds of the value of your non-covered pension, with Social Security only paying the difference. And that could be $0.

Let’s look at how important this is. Let’s say you have no non-covered pension, and you and your spouse are both receiving Social Security benefits. If your spouse dies, you will receive 100% of the larger of the two monthly benefits, whether that is yours or your spouse’s. But if you receive a non-covered pension instead of Social Security benefits, you might assume you will still receive 100% of your spouse’s benefit. You won’t. Because of GPO, the Social Security survivor benefit will be reduced by the two-thirds rule mentioned above.

Say your non-covered pension from teaching in public schools pays you $2,400 per month. And say you expect to receive a $2,000 monthly survivor benefit from Social Security if your spouse dies. GPO will reduce your survivor benefit by two-thirds of your pension amount, or $1,600. Your survivor benefit from Social Security will be $400, not $2,000.

If your spouse’s survivor benefit is $1,500 instead of $2,000, the GPO reduction will reduce your Social Security survivor benefit to $0.

Just as in the case of WEP, the GPO reduction starts when your non-covered pension is activated. You could be receiving full spousal or survivor benefits from Social Security before your pension begins. But once it does, your Social Security payments will be reduced by two-thirds of the value of your pension from then on.

Social Security allows a workaround called the “Last 60 Months” rule. It requires that you work your last 60 months of employment in a position that contributes to Social Security and that shares retirement plans with your non-covered employment. The requirements are difficult to fulfill, but the potential impact on your lifetime retirement earnings might justify a conversation with your financial planner.

Note that some public-sector employees in some states may be exempt from WEP or GPO. And it is essential to know if the laws apply to where you retire or where you earn your benefits.

Without a doubt, WEP and GPO have added a layer of complexity to retirement planning. If they apply to you, they can significantly impact what you can count on as retirement benefits.

You may choose to investigate your exposure on your own. In that case, the Social Security Administration website www.ssa.gov can be very helpful, primarily in determining WEP exposure. By opening accounts called “my Social Security,” you and your spouse will have access to valuable information and tools.

On the other hand, to ensure that you are preparing “holistically” for retirement – and not piecemeal – you may want to confer with your financial planner. It’s essential that detailed pension and Social Security information on both spouses be included. And if you do so early enough, you may still be able to make strategic career changes that maximize your benefits and minimize the risks to your successful retirement.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.