Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Retirement can be thought of as a 20 or more year period of unemployment. If you want to thrive, rather than just survive this phase of life, it’s crucial to have a plan, and to heed sound advice. With good advice and a solid plan, you can achieve a Vital Retirement that combines financial security with healthy living habits.

Each person would describe their ideal retirement differently, of course. But few would choose a penny-pinching, chronic illness-plagued struggle for survival. These are supposed to be the “Golden Years,” after all.

While some might dream of moving to the tropics and golfing, sailing, or generally living a life of leisure each day, there is a growing awareness that this is

not good for us. Still, it can’t be denied that having a well-funded retirement can ease a great deal of retirement-age anxiety.

While some might dream of moving to the tropics and golfing, sailing, or generally living a life of leisure each day, there is a growing awareness that this is

not good for us. Still, it can’t be denied that having a well-funded retirement can ease a great deal of retirement-age anxiety.

Beyond the financial aspects of retirement, there remains the day-to-day reality: what will you do? Will you be healthy enough to do the things that matter most? What will bring meaning to your life? Thousands of retirees have gone before you, without a clear plan for what life will be like after work.

The result has been dissatisfaction and even depression. Haven’t we all heard of the person who saved like a maniac, working hectic workweeks to gain an early retirement only to discover they hated it? Or, tragically, died soon after they stopped working?

Don’t fall victim to this; a Vital Retirement keeps you filled with a sense of purpose, rather than an aimless downhill drift into insignificance.

If you’ve given any thought to retirement, or been working with an advisor, you’ve been saving and investing during your prime working career. While almost everyone wishes they could save more, the fact is you’ve accumulated a nest egg of some amount, and it needs to sustain you through retirement.

How much will you need, though? The average American now lives to be 78 years old, and according to the Hamilton Project, more than 60% of men, and more than 70% of women, will live to be age 80. And, a full 34% of women will live to be 90.

When you consider that the average American envisions retiring at age 66, you can see that your nest egg must last 20, 30 or more years.

In your retirement years, your financial plan will change from accumulation and growth to preservation and distribution. It’s time to put that nest egg to work, getting retirement income from it. Working with a trusted advisor, you’ll manage your hard-earned nest egg to:

Needless to say, the safety of your money is paramount. High-risk investments could be perilous to your well-being at this stage in your life. Instead, your plan will include products that offer guaranteed income for your entire life, like annuities, which are also protected from market losses.

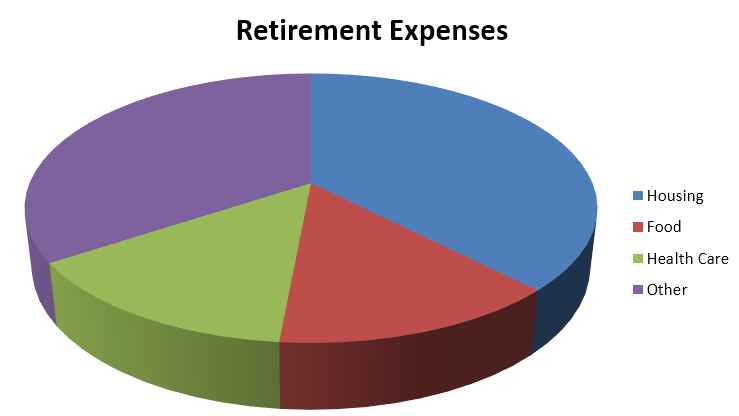

In addition to managing the well-being of your nest egg, and the associated income it generates, your plan will also address your budget. You’ll need to consider the likely expenses you’ll face in your retirement, and what can you do to minimize them.

Nerdwallet estimates that the average retiree spends $3,800 per month, and housing expense is the single biggest item in retiree’s budgets.

The “other” category includes items such as transportation, non-health insurance premiums, entertainment, and charitable giving. Your Vital Retirement plan should take into account ways to lower or even eliminate some of these expenses, allowing you to focus on what matters most to you.

If you think you might have to keep working to cover some of these expenses, don’t worry, you won’t be alone. Many retirees are choosing to work after their official “retirement.” Working beyond retirement age is a growing trend and has many health benefits.

Harvard Medical School has reported that choosing to work beyond traditional retirement age can improve vitality and health. The increased mental stimulation and continued social engagement from keeping a job during retirement leads to reduced chance of chronic disease.

Working beyond a traditional retirement age can allow your nest egg to accumulate more funds, potentially allow you to delay Social Security (and receive a larger benefit down the road), and can even keep you more mentally sharp and socially engaged.

We’ve already discarded the old notion of relocating to a retirement haven, blissfully living a life of leisure, as being unrealistic and possibly even bad for your health. What do retirees want to do instead? According to the AARP, a large majority of retirees want to stay right in their current community, and even in their own homes.

Instead of playing golf or entertaining an endless stream of visitors, many retirees are getting more active in their communities through volunteering. According to Aging in Place, 35% of the nation’s volunteer force is made up of those aged 55 and older.

There are thousands of meaningful ways to volunteer. Some of the more common volunteer opportunities are:

Volunteering has similar positive effects to working beyond retirement. Volunteering can counteract the effects of anger, stress, and anxiety.

Also, volunteering minimizes isolation and depression, which can affect many retirement-age people.

Volunteering has similar positive effects to working beyond retirement. Volunteering can counteract the effects of anger, stress, and anxiety.

Also, volunteering minimizes isolation and depression, which can affect many retirement-age people.

Spending your time serving others, or working, in your retirement helps you continue to grow as an individual. Remember, the new goal in a Vital Retirement is to avoid coasting downhill until the end of your days. Not only can you help others grow, but you will benefit, too.

Your retirement won’t be made up entirely of working or serving, of course; you’ll want to participate in hobbies you’re passionate about. Retirement is an ideal time to get started in that hobby you’ve always wanted to pursue but haven’t had time for. Or, to get back to something you were once passionate about years ago.

You’ve got a lot to do in the 20 or 30 years of your planned unemployment: Make sure you can accomplish all that you’ve set before you by fueling your body properly.

We’ve seen a huge shift in what the optimal diet should look like in recent years (think of how USDA nutrition guidelines have changed over the last few decades). Are you up on all the latest research into the importance of our diets?

Diet is now considered to be a leading cause of several chronic ailments, and a huge contributor to a general feeling of sluggishness and mental dullness. This aspect of your life needs a proactive plan just as much as your finances or lifestyle goals.

There is much debate about the optimal diet (see Paleo, Keto, intermittent fasting, etc.), but as with many other aspects of life, moderation may be your best guide. You don’t need to become a nutritionist, but you should be aware of the growing consensus that we need to change our thinking about:

Understanding that food is fuel for your mind and body, and choosing your food to that purpose, is a huge part of living an active, satisfying life in your retirement. Don’t overlook this crucial component in your retirement planning.

A Vital Retirement is the successful blending of financial and lifestyle planning. In this stage of life, you’re free of financial anxiety. You’re healthy and able to do everything that you love to do. You’re living a life of significance; your skills, experience, and personality are having a positive impact on others.

It all starts with a plan. During your working career, a plan that’s geared toward saving and investing. Approaching retirement, you’ll need to plan for your new lifestyle, setting goals for what you’ll accomplish in your golden years. You’ll need an updated financial plan to make your retirement dreams a reality, a plan utilizing new investment products designed for financial safety, while minimizing risk.

Don’t miss out on the Vital Retirement by failing to plan. Get started today. You’ll never regret it.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.