Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Over the past couple of decades, our world has changed dramatically – in some ways, for the better, and in other ways making life a bit more challenging. Take, for instance, longer life expectancy. Back in the year 1900, the average male and female in the U.S. did not typically reach their 50th birthday. But today (in 2020), average life expectancy in the United States is nearly 79.

While living longer means that you could spend more time in retirement, though, it also requires that you have a plan for generating income that will keep pace with rising prices, and that will last as long as you need it to.

Although some things remain in tact over time – like an apple pie recipe that’s been handed down through several generations – the strategies for planning a successful retirement have changed.

In fact, several of the more common methods that generated a comfortable, reliable income for yesterday’s retirees could actually end up causing the depletion of assets in a portfolio while they are still needed.

Years ago, many investors followed one or more specific retirement “rules” for reducing expenses, generating income, and growing the remainder of their portfolio. These strategies included the:

Debt-free rule

As its name suggests, the debt-free rule entails wiping away loan balances in order to reduce monthly (or annual) expenses in retirement. This being the case, lower expenses can equate to a lower income need in the future, which can allow your income-generating assets to last longer, too.

But the downside to this is using cash to pay off the debts that could otherwise be used as an income-generation base. For instance, if you have a $40,000 balance on an auto loan and your monthly payment is $736.66 for the next five years (assuming an interest rate of 4%), you could wipe away that payment if you use cash to pay off the loan.

But, even though your monthly expenses will be decreased, you will also deprive yourself of $40,000 that could otherwise be added to your income-generating assets (not to mention the growth that could take place on that $40,000 before you convert it to income).

4% rule

The 4% rule is another traditional retirement income strategy. Here, a retiree takes 4% out of their portfolio every year to use for paying living expenses, and the remainder of their funds remain in the portfolio to grow.

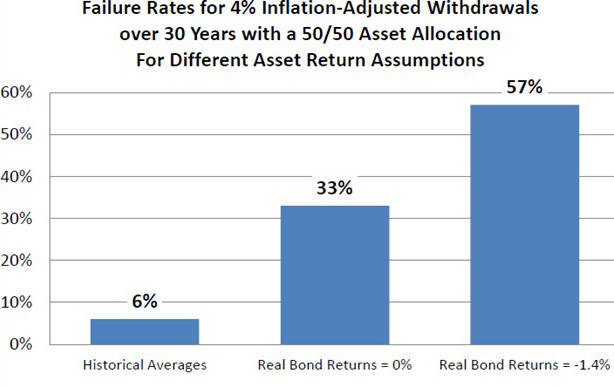

For many retirees in the past, a portfolio that contained roughly 50% stocks and 50% bonds would suffice for the remainder of their lifetimes. But given today’s volatile stock market and historically low interest rates, many experts believe that a 4% withdrawal rate is risky and could lead to depletion of the portfolio while the retiree still needs the funds.

One of the other primary downfalls of the 4% Rule is that the concept is based on historical rates of return – and because of that, there is no guarantee that future returns will match these. In addition, this outdated strategy also doesn’t consider inflation rates or the changing interest rate environment – which can be two of the most detrimental risks to a retirement portfolio.

According to economist Wade Pfau, today’s “safe” withdrawal rate is actually closer to just 2.4%. With that in mind, given a portfolio of $1 million, taking out 2.4% each year would only allow for $2,000 per month (or $24,000 per year).

Would this amount be enough for you to maintain your current lifestyle?

Source: "The 4% Rule is Not Safe in a Low-Yield World", by Michael Finke, Ph.D., CFP; Wade D. Pfau, Ph.D, CFA; David M. Blanchett, CFA, CFP. 2013.

70% rule

One of the other common “rules of thumb” for planning retirement income is to assume that you will need future incoming cash flow that is equal to 70% of your gross final earnings before leaving the working world.

Unfortunately, though, this rule won’t work for most of today’s (and tomorrow’s) retirees, either. Based on a study from the Stanford Center on Longevity, the biggest reason why the 70% rule no longer works is because older workers have not been able to accumulate enough savings to retire at age 65 with even 70% of their pre-retirement income level.

This study went on to show that the median account balance of baby boomers who were saving for retirement was approximately $200,000. But the amount of lifetime income that can be generated from this $200,000 base would only be in the range of $8,000 to $12,000 per year – not nearly enough to match 70% of a retiree’s prior earnings.

Rather than relying on hypothetical “rules” when you’re creating a retirement income plan, there are some better avenues you can use that could help you to better “customize” the right strategy for your specific needs.

The first step is to determine how much income you will need for your essential living expenses, such as housing, utilities, health care and food. Then add in an estimate for non-essentials, like fun, travel and/or entertainment.

Once you have done so, you can work on designing an income “floor” for paying your necessary living expenses. Ideally, this income will be generated from a reliable, guaranteed source that will continue paying regardless of how long you may need it. Some possible options here could include Social Security and/or an income annuity.

After you have “replaced” the income you’ll require for your necessities, you can then develop an income plan that may be used for the items and services that would be nice to have, but that won’t cause a complete change in lifestyle if they are not attained. In this instance, you could consider mutual funds and/or other growth-related financial vehicles that offer the opportunity for a higher return (but that also present more risk).

While traditional “rules of thumb” might be easy to follow, they don’t necessarily provide you with the most benefit – especially when it comes to designing an ongoing, reliable income in the future.

With so many different financial tools available in the marketplace today, it can be overwhelming to determine which may work best for you. So, it is recommended that you discuss your objectives with a retirement income specialist before you make a long-term commitment to any of these vehicles.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.