Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Designating beneficiaries for your qualified investment accounts is a critical aspect of retirement planning. You can name beneficiaries strategically to accomplish your goals and keep them up to date as life circumstances change.

Beneficiary designations refer to the act of naming beneficiaries – the people or entities – that will receive the proceeds from your qualified account in the event of your death. Each qualified account must have a named beneficiary, or beneficiaries.

In the past, beneficiary designations were made using paper forms, but these days most retirement plan administrators and IRA custodians will record and maintain electronic designations.

An account is qualified if it has a tax benefit. The tax benefits of qualified accounts vary, depending on the account, but can include:

The most common types of qualified accounts are:

There are several other qualified retirement plans. An annuity that is in an accumulation phase also has tax privileges and requires a beneficiary designation, although it is not a qualified account. The same is true of life insurance.

The primary reason you'll want to name a beneficiary for your qualified accounts is to maintain the privileges associated with them. If you pass away, and you have a named beneficiary, then the account balance, or retirement benefit in the case of a pension, will pass directly to your beneficiary.

The qualified assets in this case do not pass through your estate. They are not subject to estate taxes, or probate, so these assets are shielded from creditors. Your rights to receive distributions from the qualified account are generally preserved, so if you had the right to lifetime income from it, your beneficiary may also.

Beneficiary designations are an important part of estate planning. For most people, your spouse is likely to be the optimal beneficiary. However, numerous circumstances can alter this: children from a previous marriage, and whether you are utilizing a trust to pass assets down to younger generations are two common reasons your spouse may not be the most efficient beneficiary.

You have many options. The requirements and consequences of them are so stark, it's vital that you choose and name your beneficiaries as a part of your overall retirement plan.

The biggest benefit to naming a beneficiary is to ensure that you and your heirs have the ability to make strategic tax decisions. By using a beneficiary designation, you can ensure that you don't subject your heirs to any more tax than is necessary. This also gives them options to spread taxes out over a longer period of time.

If the account owner names individual beneficiaries, the minimum speed with which the account must be distributed and taxed varies based upon the relationship of the beneficiary to the account owner. (Like the account's owner, a beneficiary can always withdraw more than the minimum.) If the beneficiary is the owner's surviving spouse, the surviving spouse can either treat the account as their own, called a spousal rollover, or receive the same treatment as a non-spouse beneficiary. If a spousal rollover is done, the surviving spouse treats the deceased spouse's account as their own. In this circumstance, the required minimum distributions are based on spouse's own life expectancy.

If the beneficiary is not the owner's surviving spouse, the account will be distributed, and taxed, at a much faster rate than the minimum amount required while account owner was alive. Under the Setting Every Community Up for Retirement Enhancement Act of 2019 (the SECURE ACT), non-spouse beneficiaries must distribute the entire amount in an inherited retirement account within 10 years of the account owner's death and not over the beneficiaries' generally longer life expectancy. Certain exceptions may apply. No annual minimum distributions are required for an inherited retirement account and the entire account balance can be withdrawn in the 10th year. The beneficiary can also take periodic distributions throughout the 10-year period.

A number of exceptions exist to the SECURE Act's 10-year distribution requirement. If an exception applies, the beneficiary's life expectancy, and not the 10-year rule, will partially determine the amount of minimum annual distributions for the following types of beneficiaries:

Even if you must name your spouse as beneficiary, you can still lower the tax hit if they're younger than you. Their RMD will be based on their life expectancy, instead of yours. If your spouse's life expectancy is greater than five years, you will save money on taxes.

In short, by naming a beneficiary you're making it very easy, and as low cost as possible, to pass your qualified assets directly to the person you desire, with no unnecessary delays or fees.

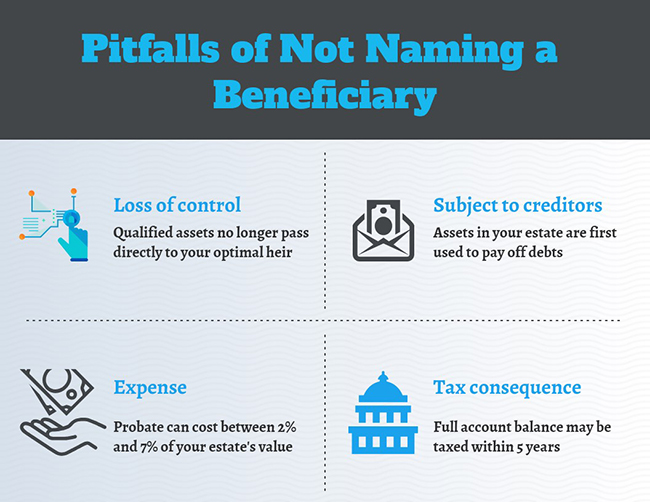

When you die without a named beneficiary, or if your beneficiary is dead when you die, your qualified account balances pass on to your estate. This will subject your accumulated tax-privileged assets to probate, which can add cost and delay to the process of giving your assets to your heirs.

Probate can also expose qualified assets to creditors, which negates one of the biggest benefits of qualified savings. As a part of probate, your outstanding debts get settled, and all the assets in your estate are available to pay them off.

Probably the biggest repercussion to passing qualified account assets into your estate is that it can cause a major tax liability. In fact, failing to name your beneficiary can invalidate a sound estate and retirement plan.

Every tax situation is unique, and much depends on your age at death (i.e. have you begun receiving RMDs?), but when there is no known beneficiary, and your assets pass to your estate, the entire amount can be considered taxable income in as few as five years.

Your carefully crafted retirement plan may have called for taking distributions over the expected life of a younger spouse, which could mean smaller taxable distributions, and therefore lower taxes, over 10, 20 or more years. Without a beneficiary designation, your heirs may pay taxes on all of it within five years.

If your beneficiary dies before you, you need to designate a new beneficiary right away. Also, be sure to inform your advisor so that you can choose the optimal beneficiary for your retirement planning.

This is also a good reason to name a contingent beneficiary. A contingent beneficiary can be thought of as a backup. If your primary beneficiary dies before you, or at the same time, then your contingent beneficiary will receive your qualified account assets, preserving the bnefits discussed above.

If you divorce a spouse who was your named beneficiary, you may want to work with your advisor to find a new beneficiary. Your ex-spouse may be entitled to some of your qualified assets as a part of the divorce settlement, but beyond that court-ordered amount, you can give the rest to a new beneficiary.

The same would go for any other beneficiary; if the relationship changes and you no longer wish them to receive the money, you need to update your beneficiary designations. The last valid designation will determine the recipient, so be sure to update your beneficiary as your retirement plan and life circumstances change.

The bottom line is that if you plan and monitor your beneficiary designations, you have many options for optimizing your retirement and estate plan. Otherwise, you may jeopardize the years of hard work and sacrifice that went into accumulating your nest egg.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.