Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

A crisis like a pandemic has the power to really bring things into focus, especially for older adults. Amidst some of the reflection and introspection that comes with this unique time in history, many find themselves thinking about the legacy that they will leave. A legacy means different things for different people, but regardless of the types of lasting impressions you want to leave, it’s important to take time to think about and plan for it.

As you consider your legacy, keep in mind that your legacy doesn’t just happen. Instead it’s something that comes as the result of intentionality, planning and focus.

A legacy is simply something that an individual leaves behind to be remembered by. Each person’s legacy will look different based on what and who they value. For some people, a legacy is focused on heirlooms or sentimental objects, for others it’s quality time, while for some it’s focused on financial gifts.

While it’s easy to associate a legacy with simply financial assets, it’s actually a much broader concept and includes everything – tangible and intangible – that you leave for future generations.

It’s helpful to plan for your legacy just as you planned for aspects of your retirement. Your retirement didn’t just happen. Instead, you thought carefully about what you needed to do to retire when and how you wanted. With that in mind, you put a plan in place to reach those goals.

You should go through a similar process when planning for your legacy. This process can be as simple as starting with a pen and paper and listing out what you value most and why. With those values in mind, you can then think about the specifics of the legacy you’d like to leave.

Some experts suggest that as you plan for your legacy, you should consider four different categories. These categories are broadly:

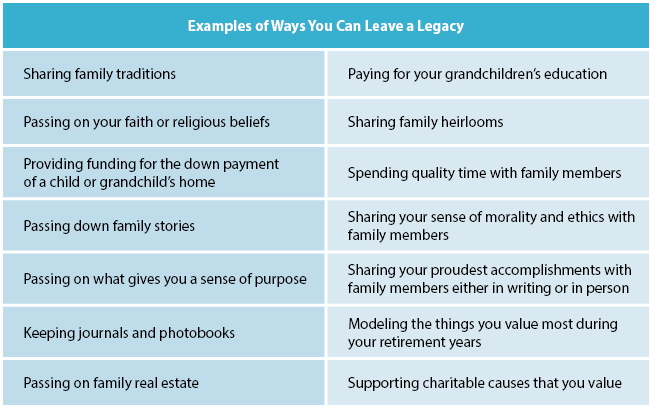

While you don’t have to stick with these four categories, they provide a good place to start and can help guide you through the planning process. Considering each category should help to give you some ideas about the type of legacy you’d like to leave. Here are some additional examples to help guide you through the planning process:

Once you’ve considered what you want your legacy to be, you need to create a plan to help realize your goals. The action plan will be unique to you based on what you want to accomplish, but there are some things you’ll want to consider as you put a plan in action. First, it’s important to ensure that all necessary legal documents are completed and up to date. These include an advance directive (living will), beneficiary designations, a power of attorney for finance and a power of attorney for health care. If you haven’t completed these documents or updated them recently, schedule a meeting with your attorney as soon as possible to ensure that all of these documents are in order.

Second, plan for anything you need to do during your retirement years to build your legacy. This could include spending time with family, sharing stories or values with grandchildren, volunteering in your community or even helping with your grandchildren’s education.

Third, consider any other logistics that need to be included as you work to leave your legacy. For example:

You might need to get creative but consider any logistics necessary to leave the legacy that you’d like and plan to ensure that all necessary logistics get done.

Thinking about your legacy can be a daunting task, but it should be one that’s inspiring and rewarding. While your legacy can include financial gifts, don’t limit your legacy to just this. Instead, take some time to think more broadly about your legacy and about what lessons, memories, traditions or values you want to pass to future generations.

It’s a good feeling to think about the ways that you can impact your children, grandchildren and future generations. In times of crisis, when it can be hard to not think about your own mortality, work to find some encouragement by thinking about what your legacy means to you. Doing so can bring positivity during a difficult time and can help to focus your retirement years on what you value most. Most importantly, this intentionality and planning will help to ensure that you leave behind a legacy that you’re proud of.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.