Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Providing for your final expenses is an important but often neglected job. Failure to plan properly can cause severe hardship for your surviving relatives during an emotional and difficult time. Poor planning for final expense management happens for three main reasons:

While a failure in planning for final expenses, or poor execution of a good plan, can lead to stress and financial difficulties, a good, a well-executed plan is easy to implement. One of the best options available is an irrevocable funeral trust (IFT). An IFT can provide for immediate funding of final expenses and also allow you to shield some assets from Medicaid spend-down restrictions.

On one hand, it’s hard to understand why final expense planning is so easily overlooked. After all, we spend a lot of time planning so many other aspects of our retirement years. We work with advisers to plan our optimal cash flow and income in retirement. We agonize over maximizing our Social Security income, minimizing taxes and when to retire. How much time is dedicated to planning and executing asset allocation in investment accounts? For those of us with multiple children or grandchildren, we probably spend a lot of time deciding how we want our assets to be divided to our heirs upon our passing. So, why not plan specifically for final expenses?

The reason is probably psychological. Final expenses are by definition tied to our passing, which can be unpleasant to consider. It’s also less “fun” than thinking about our children enjoying some prized possession. After all, planning for a funeral is somber at best and depressing at worst.

Simply because of the nature of the topic, we can avoid planning for final expenses. Plus, these costs are actually relatively small compared to some of our other estate planning needs, so they can “slip through the cracks” to a certain extent. It’s easier to spend time planning college educations or endowments to favored charities. It’s also easy for advisers to get bogged down helping you plan for the “big things” in your retirement, like missing the trees for the forest.

Even if we do think about final expenses and make an effort to fund them, we frequently underestimate what these costs will truly be. Inflation is everywhere, and final expenses are no exception. When you consider that your final expenses have a major bearing on how your family grieves together, and hopefully celebrates and moves on together, you can see how final expense providers are able to command premium pricing for their services.

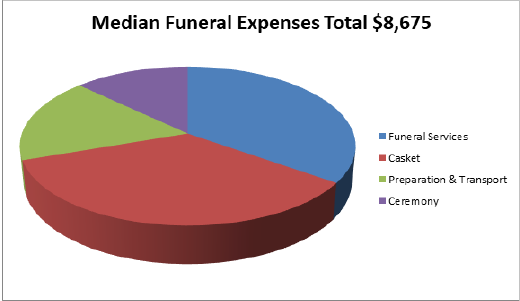

So how much do final expenses cost? The average across for funeral services is $8,000 to $10,000. These funeral expenses cover many standard services like:

These costs represent average expenses. A bigger funeral with a lavish reception would cost more, as would more intricate caskets, headstones and other items. Other potential costs not already discussed include grave liners or vaults and maintenance of your plot for future years. Often, these costs are built in to the cost of your plot, but sometimes they show up as extra charges. You might wish to be cremated instead of buried, but this doesn’t always save as much money as you might expect. Cremation services can cost up to $6,000, and again, depending on what kind of memorial and reception is chosen, you can spend even more.

Unfortunately, these aren’t the only costs to consider. These are just those associated with your funeral, burial, cremation and memorial service. There are many expenses that we rack up in the last year of our lives before we die. Most of these have to do with health care, hospice care and other aspects of our physical needs as we die.

Critical illnesses and emergency care like staying in ICU can cost up to $10,000 per day. Besides this kind of care, you might also require palliative care, which often is given simultaneously with life-preserving services and procedures. Palliative care can cost more than $3,000 for a hospital stay at the end of your life. This is in addition to hospice care.

You’ll receive hospice care once life-saving treatments are stopped. If you transition to hospice care, this will likely replace the palliative care you were receiving in the hospital. But it still costs money, especially depending on where you receive care and what level of service you require. Hospice care can add up to more than $11,000 on average.

Fortunately, Medicare, Medicaid and private insurance options like Medicare supplement insurance can cover a large portion of these expenses. But, these final year costs may still be high, especially if you rely on Medicare Advantage or remain in original Medicare without adding supplemental coverage.

If you consider both the costs of funeral, whether you have a burial or cremation, together with costs related to illness in your final days, you get what some people call the "cost of dying." This is the total cost of the final year of your life, and it can be a big number. The average for the U.S. is now almost $20,000. Pay close attention to the end-of-life costs. These are important because what they do is deplete resources that would be otherwise available for funeral expenses.

You might have a nice reserve of cash available that could be used for your funeral. But, if you burn through that in the last months of your life, what will your heirs do then? This brings to mind the bigger problem faced by people who have thought about final expenses. It’s the third problem we identified: lack of liquidity.

Liquidity is a reference to “liquid assets” – like cash in a savings account or assets that are easily and quickly converted to cash. You absolutely need liquidity when it comes to final expenses. Why? While you can delay having a memorial or funeral service, you definitely need to make decisions on embalming and interment or cremation right after death, usually within two days. This will start the entire funeral process, and it’s when your heirs typically will first meet and engage with a funeral director. This is also where your heirs begin accruing expenses. Generally, funeral homes require payment in full and up-front. This is where the need for liquidity comes into play.

It’s shocking to think about, but a person with a net worth of millions might not have $20,000 in cash readily available if their money is tied up “working” in investment accounts, annuities or real estate. Even products designed around death, like traditional life insurance, can take up to 60 days to pay a claim. This is way too long to pay for a funeral upfront. Annuities, another insurance product you might well have in your nest egg, experience similar time lags in paying cash to beneficiaries.

Other accounts, like brokerage accounts and CDs may have to pass through probate before your heirs will have access to them. It depends on how the accounts are set up and titled. If they must pass through probate, the process can take several months, or as many as six in some circumstances. Other assets like real estate may have to pass through probate and then be liquidated to raise cash. Obviously, this is a months-long process at best.

You can see the point: Even if you die well-off financially, your heirs might be pressed for the cash needed for your final expenses. If cash is not readily available, your heirs might be faced with unpleasant options like:

Your passing will be an event that causes sadness at least, and possibly grief and depression. This is not a situation where optimal decisions are made. It would be far better to make sure you had your final expenses set aside, ready to pay cash right away when needed. Fortunately, you can do this with something called an irrevocable funeral trust (IFT).

An irrevocable funeral trust is a formal trust arrangement designed to fund your final expenses. An IFT has a few benefits that make it the perfect tool for covering your funeral expenses:

Irrevocable funeral trusts are regulated at the state level in the sense that each state can impose its own limits on funding. A common limit in most states is $15,000. There are a few regulations you should be aware of when it comes to IFTs.

An IFT, once implemented and funded, can’t be closed or terminated. The assets in the trust remain in the trust until your death. This means that any assets placed in the trust must be designed and intended to stay there. You'll fund the IFT with the sole purpose of paying for your funeral.

An irrevocable funeral trust isn’t an informal arrangement you can sketch out on a pad of paper. You’ll need a formal, legal document spelling out the terms of the IFT. Some of these terms may be standard legal terms, but others may allow for some customization as to specific expenses to be paid. You must have a trustee

Every IFT will have a named trustee. The trustee is responsible for the operation of the trust and managing the assets held by it. In almost all cases, the trustee is either an insurance company or a funeral home, but it may also be a bank or other trust company. You (the person creating the trust and moving money into it, the “trustor”) choose the trustee. How is an irrevocable funeral trust funded?

The most common way to fund an IFT is with life insurance. And, since you’re trying to pay for your final expenses quickly, you’ll want to make sure you use an insurance policy designed to pay benefits fast. For this reason, final expense insurance is often chosen.

It’s important to use permanent life insurance for this purpose. Generally this is also called whole life. This kind of life insurance doesn’t have a fixed “term.” Term insurance, on the other hand, is not a good fit. Term life insurance typically has a level premium for the term of the policy (usually 10, 20, or 30 years). Once the term expires, though, you’ll have to pay a premium based on your actual age each and every year. These premiums are high, and they obviously go up each year as you age. It’s far better to use whole life insurance if you absolutely must have insurance coverage in place until your death. You’ll probably pay higher premiums in the early years, but you’ll save big time in the later years of your life.

There’s one more big benefit to using an IFT for your final expenses: protection from Medicaid spend-down rules. If you end up needing long-term care, and you’re close to qualifying for Medicaid, any assets in your IFT are ignored for calculating your eligibility.

This is important because long-term care through Medicaid is only available to people with limited assets. For 2019, the limit was $2,000. If you have more assets than this, you’ll have to spend it, which is where the term “spend down” comes from. This can be painful, and is one reason why you might consider buying long-term care insurance (LTC), but if you don’t buy an LTC policy, you might need to get long-term care through Medicaid. If you do, you’ll still be able to fund your final expenses because assets in irrevocable funeral trusts are not counted in Medicaid eligibility.

Like with so many other aspects of life, choosing and funding an IFT takes careful planning. You’ll want to work with your estate planning professionals to decide if one is right for you. Since an IFT will probably result in the purchase of life insurance, you’ll want to make sure you’re committed to the strategy for the long haul. If you are, then you’ll be able to save your family from stress and turmoil when it comes time to pay your final expenses by using an IFT.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.