Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Interest rates remain near historic lows. The stock market is recovering from the COVID-19 market crash in early 2020. Now is a good time to review your portfolio with your financial professional to see if reallocation is called for. Making changes now can help you profit from further market gains, or protect you from future turmoil.

Interest rate risk can be a complex topic, but for our purposes, we’ll define it as the risk of financial harm to you arising from changes in market interest rates. Changes in interest rates can affect the value of your portfolio as well as the income you receive from it. During the 2020 market selloff, interest rates plummeted, resulting in:

The general result of plummeting interest rates was to reward investment in riskier assets like stocks and bonds, and further reduce your ability to earn significant interest income.

This could be a great time to work with your financial professional to assess the current and projected interest rate environment. Specifically, you should work together to project the impact on your portfolio of:

If interest rates should decline further, you face two potential risks. For one thing, even lower interest rates will reduce interest income on interest rate sensitive investment accounts. These would include:

These investment risks are characterized by reduced income; in general, the principal of these accounts would not be threatened by lower interest rates.

The other risk you face with a further reduction in interest rates is missing out on gains in fixed income investments. Since bond prices move in the opposite direction to interest rates, you can expect bond prices to rise if interest rates go lower. If you’re not positioned to take advantage of this, you risk missing out on this opportunity.

Interest rates may stay mostly where they are. Of course, they’ll edge up and down, but what if they mostly just stay low? In this case you are again facing a reduction in interest income from the interest rate-sensitive accounts mentioned above. If rates stay where they are, you would not expect bond prices to rise substantially, so you likely wouldn’t be at risk of missing out on an increase in bond prices.

If interest rates were to rise significantly from here, you can expect these results:

Those near or beyond retirement age could be particularly exposed to an increase in interest rates. Conventional wisdom urges a growing exposure to fixed income investments like bonds as you approach retirement age. Normally, these investments are considered safer than stock-market exposure. However, with interest rates at historic lows, any kind of snap back in interest rates could deal a heavy blow to the values of bonds and bond funds.

On the flip side of this, more secure investments like fixed annuities, CDs and newly issued bonds (paying the higher interest rates) could produce substantially more income than currently.

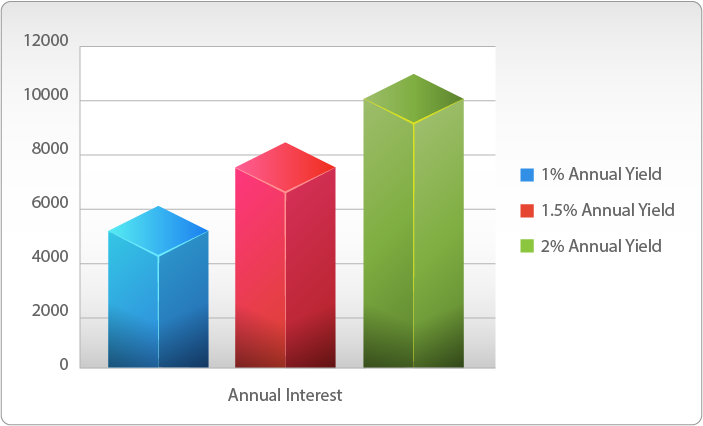

You can see the effect of interest rates on these kinds of accounts in the chart below. The chart shows the annual interest received on an account of $500,000 at three different interest rates. Note that interest shown is simple interest.

During your portfolio review, talk to your financial professional about changing your allocations to indexed insurance products like fixed index annuities and indexed universal life insurance (IUL).

These indexed insurance products allow you to earn money if the financial markets go up, but protect you from market losses. Since indexed annuities and life insurance allow for many indexing options, you can choose to reduce exposure to fixed-income options like bonds if you fear an increase in interest rates. On the other hand, you can add to your fixed income exposure if you and your financial professional believe that interest rates will decline further.

In either case, you’re protected from being wrong; you won’t lose money in these indexed accounts. The wildcard here is stock market performance. The relationship between interest rates and stock prices is not as precise as it is with bonds.

Once again, fixed index annuities and life insurance can help you here. You can set your indexing strategy to benefit from rising stock prices while having peace of mind that your portfolio won’t suffer if the stock market plunges.

Indexed universal life insurance could be a useful tool if your overall estate plan requires the use of life insurance. In this case, you can have the insurance in place that you need to fund your estate if you were to die unexpectedly, but potentially grow cash values in the policy along the way. The cash can be withdrawn or borrowed against as dictated by your estate and retirement plans.

The importance of a trusted, financial professional can’t be overstated. Especially in the current environment, you want to get the best advice possible. With the current pause in the both the interest rate environment and stock market, use this as an opportunity to assess the future. Make changes to your allocations, particularly into fixed index accounts if this is part of your plan, to maximize your chances for a successful retirement.

Make sure that you’re comfortable with any changes your financial professional recommends. “Reaching for yield” is often a recipe for disaster. Don’t make changes to your investments without consulting with a professional; keep them in the loop on your investment ideas.

Alliance America is an insurance and financial services company. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.