Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Over the past decade or so, identity theft has skyrocketed into one of the fastest-growing types of crime in the United States and around the globe. Its victims include both consumers and businesses – and many of today’s incidents go far beyond just illegally using stolen credit card numbers to make fraudulent purchases.

In fact, as the criminals become more sophisticated, unsuspecting targets can have a whole host of other issues to deal with, such as compromised medical information, tax returns and even arrest warrants for crimes that were committed in their names.

While there is no way to guarantee you won’t become an identity theft victim, there are some steps that you can take to reduce your chances of being in this situation. There are also several items that are imperative you do if you discover that your information has been stolen. Otherwise, the financial – and emotional – losses could be devastating.

Identity theft is by definition “the fraudulent acquisition of someone’s private information, typically for the purpose of financial gain.” While many criminals still have financial gain as a motive, though, today there are other motivators for identity theft, too, such as “free” health insurance and medical care, avoidance of traffic citations or arrest and worldwide travel using someone else’s passport.

In 2020, approximately 47% of Americans experienced some form of identity theft, which accounted for losses of over $712 billion – a 42% increase from the 2019 figures. Of these victims, more than one-third were the target of application fraud – which is the unauthorized use of another person’s identity to apply for bank, credit card and other accounts.

Similarly, one-third of identity theft victims also had existing accounts taken over by criminals who gained access to their information.

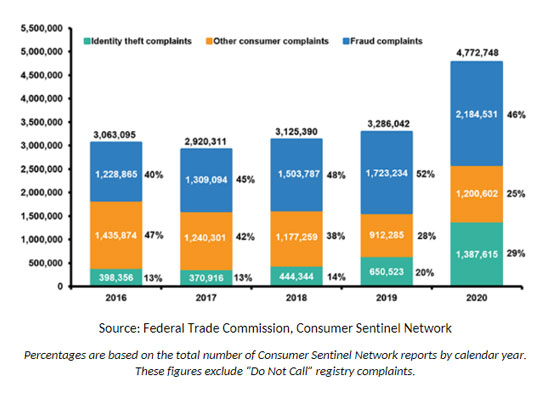

The U.S. Federal Trade Commission (FTC) tracks consumer fraud and identity theft complaints that have been filed with federal, state and local law enforcement agencies, as well as with private organizations.

There are numerous ways that you could become a victim of identity theft – and they don’t all involve participating in online transactions. For instance, if given the opportunity, many criminals will take bills and other items directly out of mailboxes in order to obtain bank and credit card account numbers. If you leave bills and other mail in a box for pickup, check numbers could also be obtained. Some identity thieves will even go through trash that is left out on the curb to obtain these details.

Another way that you could have your sensitive information illegally taken and used is if a company you do business with becomes the victim of a cyberattack. For instance, if you’ve made purchases at a restaurant or retail store that has your credit or debit card number on file, you may be at risk.

Likewise, even physical records – like paper files at your doctor’s office – could be compromised by a disgruntled employee or member of an after-hours cleaning crew. Once this information is “sold,” it could be used for any number of purposes.

This could even include combining some of your information with details from another individual in order to create a “new” identity that can apply for loans or credit, make purchases and file a tax return to receive a fraudulent refund. With that in mind, it is important to ensure that you take precautions to protect yourself both online and off.

Although anyone, anywhere can become a target of identity theft, the top five U.S. states, based on the number of reports per population (between 2016 and 2020), include:

Regarding fraud and other complaints (aside from pure identity theft), the top five U.S. states during the time period of 2016 to 2020 were:

Gone are the days when criminals only target credit card numbers to go on illegal shopping sprees. Over the past several years, not only have identity related crimes become more widespread, but they are also more difficult to detect, meaning that victims oftentimes don’t even know that they’ve been targeted until a significant amount of damage has been done to their credit (and correspondingly, their credit report), as well as financial accounts, government benefits and medical records.

Some common – and costly – forms of identity theft include the following:

As its name implies, credit card and debit card fraud occur when someone else uses a card without the owner’s permission. With a myriad of online shopping opportunities, it isn’t even required for a criminal to have your actual card in hand, as long as they are privy to your PIN or security code.

Oftentimes, when an identity thief has your debit or credit card details, this information could be used to gain access to your other accounts. Unfortunately, if your credit card balance rises, it could harm your credit report and cause your credit score to fall, in turn, making it more difficult for you to obtain loans, rent a home or office space and purchase contract-related items like cable TV and cell phones.

The good news is that if you are able to catch this fraud quickly enough, the credit card companies may only be able to hold you accountable for up to $50 of the bogus charges. You might not be so lucky with a debit card, though, as criminals could gain access to your checking and/or savings account balance and drain the account(s).

The most prevalent form of medical identity theft is when someone poses as another individual so that they can obtain health care services. These could include anything from an annual checkup to major surgery – and for the victim, it could result in the receipt of bills for appointments, procedures and prescription medications that were never received.

In 2015, Anthem Blue Cross, the second-largest health insurer in the United States at the time, was a victim of a cyber attack where the criminals breached the company’s servers and stole as many as 80 million customer records that contained Social Security numbers and other personal information. It is estimated that this attack went on for two months before it was noticed, thus giving the thieves plenty of time to confiscate sensitive details.

Getting ahold of your driver’s license could be like hitting the jackpot for an identity thief. That’s because it contains a long list of details, including your name and address, as well as possibly your Social Security number.

There are many ways that your license getting into the wrong hands can harm you, such as receiving speeding and other types of traffic-related tickets based on someone else’s wrong-doing, and possibly even having an erroneous warrant out for your arrest if the criminal who is holding your license commits a more serious crime.

Another “pot of gold” for identity thieves is your Social Security number. This is especially the case if they also have your personal information, like name and address, which can allow them to open credit cards, posing as if they were you.

Once these cards have racked up a sizeable balance – and the bills have gone unpaid – it can have a negative impact on your credit report and score. If you discover that this information has been compromised, report it to the Social Security Administration as soon as possible, as well as to your state’s tax office.

Seniors can be particularly vulnerable when it comes to identity theft. In this case, the criminals will often pose as an “official” representative from Medicare, the Internal Revenue Service or the Social Security Administration.

Once they have gained the victim’s trust, the thieves can more easily collect personal and financial details, as well as other pertinent information like passwords. In some cases, the criminal may even pose as a grandchild or other relative who is in trouble and needs money as soon as possible.

Identity theft crimes against seniors can take many different forms, such as:

According to the Federal Trade Commission, older consumers who experience this type of fraud oftentimes incur larger financial losses as compared to younger people.

Armed with a loan number and Social Security number of a mortgage holder, an identity thief could do some substantial damage to homeowners, including taking out a home equity loan or line of credit – and then not paying it back.

Home title fraud is a related crime that is becoming more common, as well. This occurs when a criminal gains access to the title of your home or other property – and then transfers the ownership out of your name.

If this occurs, you may receive foreclosure notices from the bank or lender. If you suddenly stop receiving information from your mortgage company, as well as your property tax bill, it could be a sign that you’re a victim of home title fraud. If this is the case, report the information to your county deed office.

Malware – which stands for “malicious software” – is a type of software that is designed for damaging, disrupting or gaining unauthorized access to a computer system. One of the most dangerous types of malware is ransomware, which will typically block access to a computer system until a sum of money (i.e., ransom) has been paid.

An example of ransomware was the WannaCry virus that swept the global marketplace in 2017. It is estimated that within just the first several days, approximately 200,000 computers – spread throughout 150 different countries – were infected.

In this case, the criminals demanded that their victims pay $300 in bitcoins. If this “ransom” was not paid, the amount would double every three days. Then, after a short period of time, if the money was not received by the thieves, all of the files and data on the victim’s computer would be deleted.

Many years ago, people had electronics and appliances that only had a single function. But today, televisions, smart phones and even refrigerators may be synced up to the internet and linked to one another. This is referred to as the “internet of things,” where computing devices are embedded in everyday objects and in turn, allow them to send and receive data.

But even though receiving a message from your fridge letting you know that you’re almost out of milk can be convenient, it can also open you up to becoming a victim of identity theft because these devices are typically connected to other types of accounts, such as your credit card, bank account and email address. With that in mind, it is recommended that you regularly check your account statements and balances.

According to the FTC, the top five types of identity theft in the U.S. in 2020 included the application and receipt of government benefits, new credit card accounts, miscellaneous identity theft (such as online shopping, email and social media fraud, insurance and securities account fraud, medical services and other types of ID theft), applying for and receiving loans (both personal and business) and tax fraud.

| Type of Identity Theft | Number of Reports | Percent of the Total Top 5 |

|---|---|---|

| Type of Identity TheftGovernment benefits applied for/received | Number of Reports394,324 | Percent of the Total Top 532.0% |

| Type of Identity TheftCredit card fraud (new accounts) | Number of Reports365,597 | Percent of the Total Top 529.7% |

| Type of Identity TheftMiscellaneous identity theft | Number of Reports281,434 | Percent of the Total Top 522.9% |

| Type of Identity TheftBusiness/personal loan | Number of Reports99,667 | Percent of the Total Top 58.1% |

| Type of Identity TheftTax fraud | Number of Reports89,391 | Percent of the Total Top 57.3% |

If you become a victim of identity theft, it can take an immense amount of time and effort for you to recover – and in many cases, targets of this type of crime may never fully recoup everything that was taken. Added to this is the emotional turmoil that victims can experience after having sensitive, personal information compromised.

The good news is that there are some things you can do to help reduce your odds of becoming victimized, or to at least make it more difficult for the criminals. These can include:

Even if the most stringent of precautions are taken, there is no surefire way to fully insulate yourself from identity theft. Therefore, if you find that you have become a victim, there are some things you should do as soon as possible, such as:

If you would like more details on how to keep your personal information safe, and in turn, to protect your financial security, talk with an Alliance America financial professional today who can guide you through the process of securing your savings – and your financial future.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.