Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

For years, we functioned under an outdated definition of retirement.

It was clear that no one had one-company careers anymore, nor did they leave with a pension and a gold watch. Retirement was no longer just a few years that had to be filled once one's working life ended. And the arrival of the free-thinking, never-get-old baby boomers added their unique spin on the concept.

So, the question became: What does the “new” retirement look like?

In 2019, a think tank called Age Wave with expertise in the aging process agreed to work with Edward Jones and The Harris Poll to pinpoint how the attitudes and behaviors of Americans had changed when it came to defining “living well” in retirement.

The results of their five-generation survey were published in a report called “The Four Pillars of the New Retirement" in mid-2020, amid the early chaos of the COVID-19 pandemic.

The decision was made to extend the study to reflect the pandemic. Those results appeared in June 2021 in “The Four Pillars of the New Retirement: What a Difference a Year Makes.” While the virus is still present, its impact can already be seen.

By exploring the results of these studies, we have new tools to help successfully plan for and live well in retirement. Whether we plan on our own or with the guidance of a planner, the structure that emerged can increase our odds of finding happiness.

Long before the survey began, traditional retirement was already under pressure from several directions:

An Insured Retirements Institute (IRI) study "Boomer Expectations for Retirement 2019,” reported that 45% of baby boomers had nothing saved for retirement. In a Stanford study, among those who had saved, older boomers (born 1948 to 1953) had a median balance of $290,000 saved, while somewhat younger ones (born 1954 to 1959) had $209,000. With 20 to 30 years of life yet to finance, these amounts were low.

The oldest boomers started retiring a couple of years after the Great Recession of 2008, so they may have lost part of their investments and housing values at that critical time. Or they could have been poor savers. In either case, the prospects for affording their pre-retirement lifestyles were not good.

Yet, despite the somewhat dire statistics, in the same IRI study, a surprising 55% of boomers said they were satisfied with their lives in 2018. That was up from 47% in 2017 and 43% in 2016.

The findings of the “Four Pillars” studies will help explain that optimism. In short, it’s not just about the money. Each pillar is essential to thriving in the new retirement.

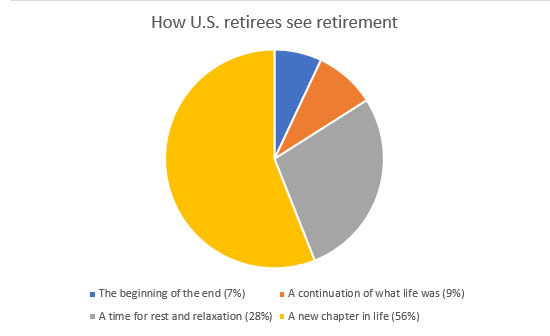

Whether someone retires at 62 or 65 or 70, today they know they have two or three decades ahead of them. To start, here's how thousands of American retirees who participated in the second Edward Jones survey defined “retirement.”

Whatever the impact of the pandemic, a surprising number of retirees felt they were free from many of the earlier stressors. They could explore the possibilities of this new chapter in their lives and enjoy the families they had raised. This change in viewpoint reflected a transformation of retirement itself, from its timing to its meaning.

While finances play a decided role in influencing the quality of life retirement, the study found that it is joined by three other interdependent “pillars”: health, family and purpose.

Looking at each one might be helpful when thinking about and planning for retirement.

Good health is an underpinning of the quality of life at any age. But, unfortunately, whereas our psychological and emotional health improves as we age, our physical health naturally declines. And for Americans, that fact raises a significant concern since we face more health issues than aging populations in other nations.

Healthy aging is often measured by the difference between our total life expectancy and the number of healthy years we live. (Healthy years are defined as being in full health and free of disability.) According to the World Health Organization, the gap in the United States is 12.4 years. Canada, France and Japan all have longer life expectancies, but they have shorter less-than-healthy gaps (between 1.5 and 2.0 years shorter than ours.)

COVID-19 was most dangerous to older populations, especially the many with co-morbidities. Suddenly, all aspects of people’s lives were being scrutinized to shore up immunity and increase the chances of survival.

People learned about good nutrition and supplements as they prepared meals at home during the lockdown. As a result, awareness grew of the direct impact they could have on their own health.

Mental health is also a priority for retirees. Although fears of getting the virus ran high, in May 2020, retirees said they feared Alzheimer’s more than COVID. And by December 2020, their fear of Alzheimer's outranked COVID, cancer, strokes and heart attacks.

The costs related to health care are also a significant concern for retirees. Those surveyed were actually less concerned about the recession caused by COVID – and the risk of outliving their savings – than they were about paying for medical and long-term care. A couple is estimated to need $300,000 in retirement for out-of-pocket medical expenditures and $156,000 for long-term care. Few couples factor $456,000 into their retirement planning calculations unless they undergo a formal planning process.

A growing portion of the retiring population is focused on eating healthily, sleeping well, getting ample exercise and reducing stress to reflect the importance of health to a happy retirement. Good health offers choices; bad health takes them away.

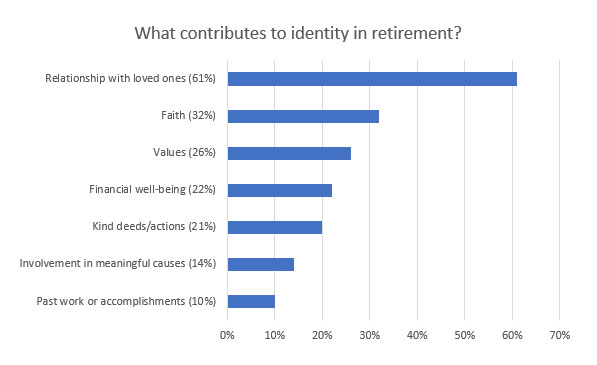

In pre-retirement, our work and achievements consume so much of our thoughts, time and energy. They identify who we are. But, when retirees in the survey were asked to select the two most important factors from a list of seven, their past work fell to the bottom. Their relationship with loved ones topped the list, followed by faith and values.

The pandemic reinforced the importance of family and friends, providing newfound comfort and purpose for many retirees. Tireless efforts were made to bridge the distance created by lockdowns and social distancing. Technology saved the day for people of all ages with Zoom, FaceTime and Skype.

However, the lockdowns and distancing highlighted one aspect of aging that is too often overlooked: the heartbreak of isolation. Grandparents couldn’t see their children and grandchildren. In the extreme, no one was able to visit sick and dying loved ones.

The value of friendship also grew stronger during the pandemic, with 20% of all Americans and 25% of retirees crediting their friends as the primary source of meaning, purpose and fulfillment during COVID. For many, the term “family” expanded to include their friends.

The pandemic also triggered a new generational generosity. One-third of Americans loaned or gave money to friends or family who suffered from the pandemic, even if it meant sacrificing their own financial security. In addition, many recognized that passing down their life lessons and values was more critical than leaving behind money and real estate.

Having close friends or family is a crucial ingredient for a happy and healthy retirement. Maintaining those bonds needs to be factored in when planning our futures.

When workplaces and schools closed and sent people home, there was a marked loss in their sense of purpose. Many were able to work or study from home. However, the locked-down lifestyle provided lots of time to think about how they had been living their lives. Particularly among the adult population, that thinking led to redefining how they would prefer to spend their lives. (What remains to be seen is how many follow through with those redefinitions.)

Retirees found a new purpose when providing emotional comfort to loved ones or filling in with teaching duties with home-bound grandchildren. In addition, they discovered their neighbors and provided services for those at higher risk.

The power of feeling useful isn’t lost on retirees. Whether that usefulness is in the form of kind actions or supporting meaningful causes, being useful makes them feel more valuable and connected. It can also lead to better health by reducing the risk of cognitive decline, heart issues and depression.

As crucial as purpose is to a successful retirement, actions speak louder than words. For example, if purpose comes from volunteering, only one-quarter of retirees volunteer each year. But whether it’s volunteering or some other activity, any related expenses need to be added as discretionary retirement income to regular fixed expenses during retirement planning.

Most pre-retirees do not accumulate wealth for the sake of wealth, but to have the freedom and security they need to fulfill the retirement they saved and invested for. Successful financial preparation calls for a holistic view of how retirement will be lived instead of just the dollar amount needed.

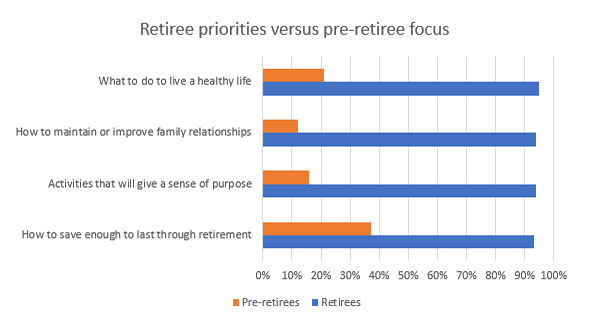

Yet, there is a disconnect between what retirees report as essential and what pre-retirees over age 50 give much thought to, which explains some of the lack of preparation for retirement.

The pandemic served as a financial wake-up call for Americans of all ages. Age Wave reports that COVID-19 caused nearly 68 million adults to alter their retirement timing. Many moved timelines out to be better prepared, while some planned earlier retirements for health reasons or to spend time more meaningfully.

About 20 million stopped contributing to their retirement accounts, making funding their later years even more precarious. (Some have since restarted.)

The most significant financial impact has been on those who lost jobs, particularly on low-wage workers in service jobs for whom work from home wasn’t an option. Younger generations (Gen Z and millennials) were the hardest hit. In contrast, the older ones (the Silent Generation of age 75 and over) were protected by their safety nets of Social Security, Medicare and other resources.

As retirees transition from being savers to being careful spenders, many wish they had focused more on the non-financial aspects of retirement. And, as time passes, they may have to learn to deal with the financial implications of both expected and unexpected shifts in their four pillars.

In many people’s minds, retirement planning is a number-crunching exercise that results in a plan to ensure enough money to cover their financial needs until the end of their lives. However, good planners take a more holistic view and don’t restrict their work with clients just to numbers.

Numbers may provide the milestones to measure progress towards a fully funded retirement. However, those numbers should come from a deep, meaningful dialog between client and planner to achieve three things:

The concept of four pillars and the results of the studies by Edward Jones and Age Wave may provide you with a framework that facilitates discussions with a financial professional. If you haven't considered them during your retirement planning discussions, you might want to. And if you have, after over a year of the COVID pandemic, you might want to revisit your assumptions.

If nothing else, the four pillars will expand your dialog from “just numbers” to those essential factors beyond finances. According to the survey, over three-quarters of those who plan to retire wish more resources were available to help them do that.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.