Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

For anyone looking to maximize their retirement savings, deferred annuities offer many advantages, especially tax-deferred growth. In this article, we’ll review what annuities are, what their tax benefits are and how they can help you achieve your retirement goals.

People can find annuities confusing, so we’ll spend a minute or two reviewing what they are. A deferred annuity is a contract issued by an insurance company. The contract promises to pay a stream of income at some point in the future. The income is calculated by the insurance company using life expectancy tables, as well as the value of the contract.

Because deferred annuities pay a benefit in the future, they can accommodate the payment of ongoing deposits (called premium payments). These premium payments accumulate with interest credited by the insurance company.

Deferred annuities have a number of desirable benefits as a retirement vehicle, including:

All of these make them a great fit for funding your retirement, but in this article we’ll focus on the tax advantages offered by annuities.

Annuities offer two major tax benefits:

Annuities accumulate interest on a tax-deferred basis. This means that all the interest you earn over the life of your annuity contracts is shielded from taxes as long as it remains in your annuity. You can earn interest for decades without having to pay taxes on your gains. If you utilize indexed annuities, you can really rack up impressive amounts of interest.

In contrast, any earnings in taxable accounts, like brokerage or savings accounts, are taxable in the year in which they are earned. In this case, you’ll be paying taxes each year that you earn any money. As your nest egg grows, so will your tax payments.

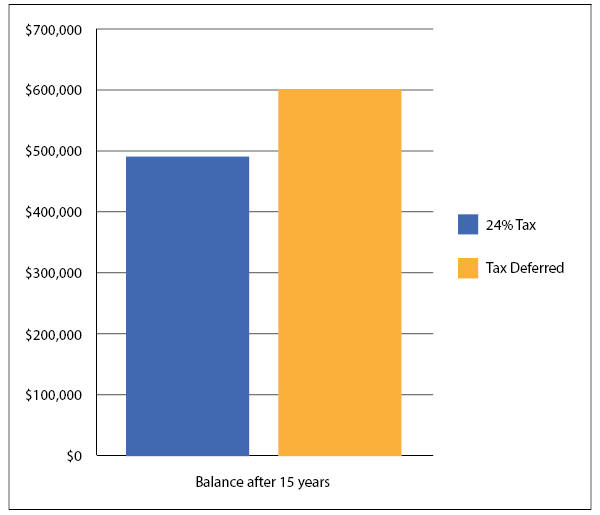

Tax-deferred growth allows you to build a bigger nest egg than if you had to pay taxes on your earnings as you went. If you have a nest egg of $250,000 and earn 6% annually, the tax-deferred growth versus taxable growth is substantial even over just 15 years.

If you had to pay 24% income tax on the investment gain each year, you’d end up with $488,000 after 15 years. On the other hand, if you deferred taxes on all the interest for 15 years, you’d have $599,000, a difference of more than $100,000.

Note that your tax performance could be different due to your actual tax bracket as well as the impact of long-term capital gains taxes on your taxable accounts.

When it comes time to receive payments from your annuity, part of your payments will be composed of the premiums you’ve been contributing, and part of your payments will be made up of the interest you’ve earned. You’ll have to pay taxes on the portion of your annuity payments that include earned interest. In effect, you get to spread out the taxes you would have paid on your interest over the rest of your life.

You can use the guaranteed income for life feature of annuities to structure your income in retirement with an eye to lowering your taxable income. For starters, only part of your annuity payments is taxable, as we just discussed. Second, you probably won’t begin receiving annuity payments until after your stop working, so you might only receive annuity and Social Security payments. This move will put you in a lower tax bracket than during your working career.

You can further reduce the tax impact of annuity income by electing to receive joint and survivor or period-certain payments. With joint and survivor payments, the insurance company pays you a smaller monthly payment, but they guarantee to pay it to you for the rest of your life plus the rest of your spouse’s life if you predecease them. This can be a tremendous benefit if you’re more than a few years older than your spouse. Since these monthly payments are smaller than for a traditional, or straight life, annuity, your tax liability will be lower, too.

A period, or term-certain, annuity payment protects your estate in the event that you die early. Again in exchange for lower monthly payments, which mean lower taxable income, the insurance company agrees to pay your monthly benefit for 10, 15 or 20 years – even if you die.

There is endless debate about whether owning annuities in qualified retirement plans – like 401(k) or profit sharing plans – is a good idea or not. Those who oppose this strategy generally argue that many of the advantages of annuities (tax deferral, creditor protection) are redundant – they’re available to any kind of asset you hold in the qualified plan (like stocks, bonds and mutual funds).

This is definitely true. However, stocks, bonds and mutual funds are capable of losing money, unlike fixed index annuities, so if you like the advantages of fixed index annuities don’t be afraid to use them in qualified plans, too.

As with all aspects of your retirement and estate planning, work with a professional to utilize annuities. You want to make sure that you’re committed to your annuity for the long term. You will also need to use your financial professional to find the best annuity available, especially if you want to incorporate the indexing option. Your agent can help you pick an annuity with the best rate cap and participation rate for your needs. While they take some advance planning and commitment for the long term, annuities can be an excellent tool in your retirement planning.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.