Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Retirement is an exciting and intimidating time. As people approach retirement, they seek the best solution to their financial situation to ensure that they and their families can continue to thrive. There is no cookie-cutter approach to retirement investments. Every individual has led a unique life that creates unique financial situations. When you approach retirement age, you are faced with the daunting prospect of what happens next. Consulting with a retirement income planner helps determine how to best arrange your finances, which should include annuities, to ensure that you have sufficient income and savings to last a lifetime.

A retirement portfolio will look quite a bit different from a growth portfolio of someone just starting out, say in their 30s. While people are still working, they typically contribute to an employer retirement plan, like a 401(k). They save and save,

deferring money from each paycheck into their “retirement plan.” These investments options are typically very aggressive in nature and seldom include annuities.

Equity mutual funds, bonds mutual funds, target date funds and exchange traded funds are just a small sample of investment you might find in a traditional retirement fund like a 401(k). These are all great for accumulating assets or growing your nest egg. The hardest mindset shift for any investor is when you move from an aggressive growth mindset to an asset preservation and decumulation mindset. That’s when including an annuity position in your asset allocation model can be an extremely beneficial decision that will pay dividends in the future.

There are various types of annuities, which are insurance contracts with an insurance company to provide benefits to the owner or annuitant. Annuities can be variable, fixed or indexed, and they can be pre-tax or after-tax, and they are designed to protect and grow the premium deposit while providing a guaranteed source of income at a point in time in the future.

A well-rounded retirement portfolio will include at least a portion of a portfolio allocated to indexed annuities.

Annuities are not created equal, and there are many types of annuities to choose from. Annuities can address several concerns and solve many issues facing American investors today. The key to having success is knowing the benefits your annuity offers and understanding how it fits in your overall portfolio.

For example, if you have adequate income now and for the foreseeable future, you may not need to pay the additional cost to have an income rider added to your annuity contract. This would be a reason to consider an exchange to a new annuity. There are several reasons to consider an income-tax free exchange of your current annuity contract.

While personal preferences may vary, a popular expression says, “Only two things in life are certain: death and taxes.” The date of one’s passing is not known, so it is hard to gauge if you will outlive your nest egg. Should you survive your financial resources, and you haven’t planned for another lifeline of income, you may find yourself in a difficult financial position and physically unable to re-enter the workforce.

Taxes are also another measure to consider when planning retirement. No one wants to pay more in taxes than necessary, especially when dealing with such precious resources meant to last an unknown number of years. When the time comes to transfer or exchange your assets, it is essential to approach these transactions with financial intelligence to reduce the risk of losing money.

Another important factor to consider is your current annuity and when you purchased the contract. If your current annuity is more than five years old, chances are you may be able to find a better option in the annuity marketplace today. Annuities have changed considerably over the last few years and can now offer more than just guaranteed income and protection from market risk.

Some individuals may feel that an annuity purchase is a one-time transaction. They purchase the annuity, keep it until its maturity and then receive then receive the cash-surrender value.

However, annuities have built in options to conduct a 1035 exchange or trustee-to-trustee transfer of the account’s cash value for a new annuity – without incurring any current taxes.

There are times when it is beneficial or even necessary to transfer an annuity.

If your annuity is set up pre-tax, this non-qualified annuity may be subject to income tax when any gain is withdrawn. However, Section 1035 of the IRS code allows for a tax-free exchange of a like-kind contract. Other considerations include early withdrawal fees that are penalties for withdrawing before age 59½.

Retirement savings plans often benefit from tax-deferred growth to ensure a healthy return until the account value is needed to live on. Still, these benefits are not always easy to protect when transferring or exchanging funds from an older annuity to a new one.

So how do you transfer an annuity and still maintain the tax benefits that benefit maintaining annuities?

The right solution for transferring an annuity will depend on the tax classification of the annuity. While there are several types of annuities that vary depending on fixed or variable rates, from a transfer or exchange perspective there are only really two – “qualified” or “non-qualified.”

Qualified plans are accounts that were funded with “pre-tax” dollars. This means the money invested in the account has not been taxed yet. These accounts are typically IRAs and could have started as a 401(k) that you rolled over from your employer when you retired or left. This means these plans are funded through your income that has not yet been taxed. The income tax on qualified annuity plans is deferred until you are ready to or required to withdraw it.

A non-qualified annuity is an annuity you purchase with “after-tax” dollars. These plans are typically funded with cash from a bank account, CDs or brokerage accounts.

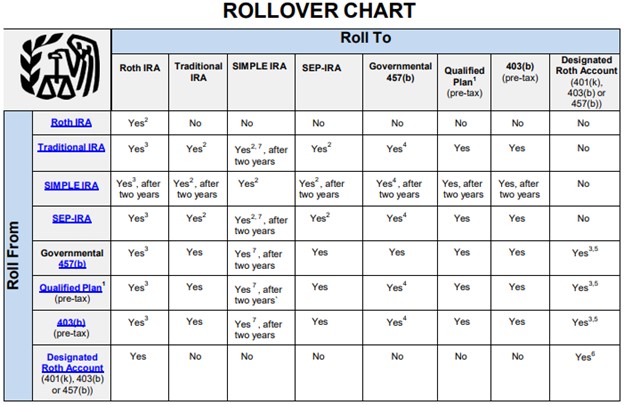

The transfer of a qualified annuity, such as an IRA, can be accomplished through the use of a trustee-to-trustee transfer. In other words, the funds go directly from one financial institution to another financial institution. A trustee-to-trustee transfer occurs when you transfer one IRA into another IRA without taking any distribution from the fund. Trustee-to-trustee transfers are not reportable on your taxes because you are not receiving a distribution of funds. This will avoid tax penalties or fees on the annuity. This type of transfer only works when moving from one type of IRA to the same type of IRA.

For instance, you cannot move funds from a traditional IRA into a Roth IRA via the trustee-to-trustee process. A Roth IRA is an after-tax IRA, so it is not the same type of account as a traditional IRA, which is pre-tax.

If you are moving from one retirement plan to another that is not the same as your existing plan, you can work with your plan administrator to execute a direct rollover. If your plan administrator can execute this transfer, they will likely send a distribution of your annuity directly to the new account. In this rollover, there was not direct disbursement of funds to you, and you will not be subject to taxes.

If your annuity is paid directly to you, you can deposit it into another retirement plan within 60 days. However, this type of transfer can be risky because the 60-day rollover option is only available one time per year. The Internal Revenue Service provides information on rollovers and transfers that are allowable, based on your plan type.

If you have a non-qualified annuity, the funds invested were after-tax contributions. Reasonably, one would not wish to pay taxes on their gains more than necessary. Non-qualified annuities are designed to accrue gains on a tax-deferred basis, a built-in benefit of annuities. Fortunately, the U.S. tax code allows an opportunity to transfer your annuity without paying taxes or penalties on these gains. Section 1035 of the tax code will enable you to transfer your annuity to a new annuity without paying taxes on gains until you start taking withdrawals.

Think of an annuity as your personal residence. Under Section 121, an individual homeowner, under certain circumstances, is able to exclude up to $250,000 ($500,000 for married filing jointlly) of gain from income tax after they sell their home. This is a way for a homeowner to preserve their investment. It’s not exactly like an annuity, but the concept is the same. You are able to transfer or exclude the gains in your annuity from income tax until you start taking withdrawals.

Section 1035 allows you the opportunity to transfer your annuity without tax on the deferred gains. Still, it will not protect you from fees associated with your original annuity contract agreement. Some insurance companies will assess a surrender charge if you move money prematurely. The time frame during which one may be assessed a surrender charge can be up to 10 years.

Annuities are a great option for anyone who wishes to protect their nest egg and allow the cash value to grow on a tax-deferred basis. However, they can be rather complex cash vehicles, for even some of the savviest investors.

The struggle to understand the finite details of annuities is not new. That is why investment professionals are required to obtain licenses to work with annuities. It is important to trust and work with a financial professional who is extremely knowledgeable and able to explain to you the way an annuity works.

Once you understand the basic understanding of annuities, you will be well on your way to understanding the true benefits these wonderful cash vehicles will offer you.

Alliance America is an insurance and financial services company. Our financial planners and retirement income certified professionals can assist you in maximizing your retirement resources and help you to achieve your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.