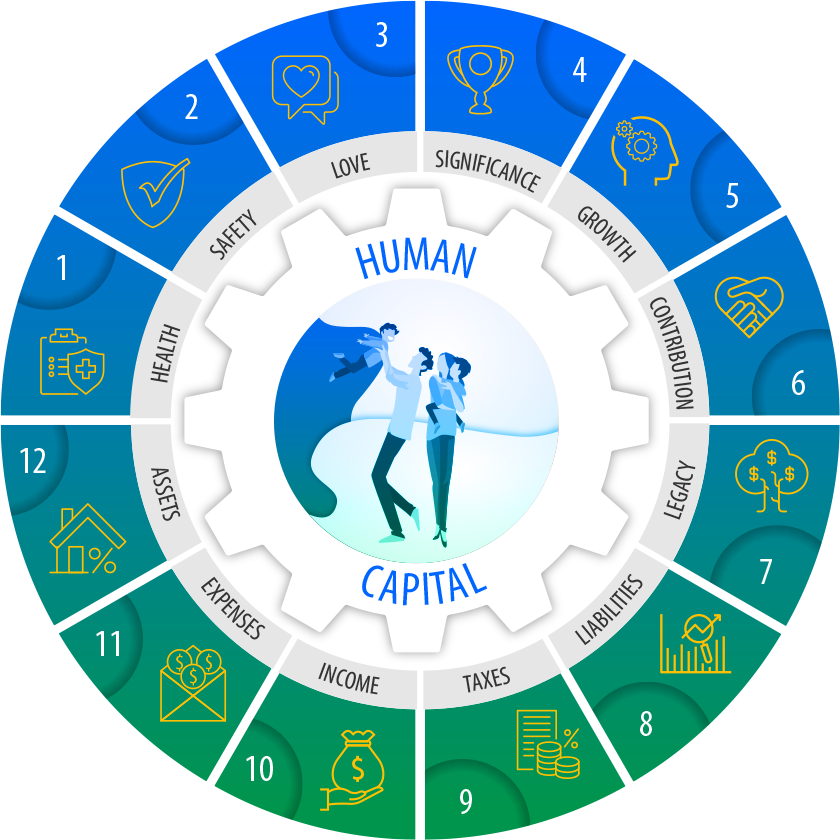

We need to pursue an active lifestyle with proper diet, exercise and psychological engagement that contributes to our physical and mental well-being.

We need to pursue an active

lifestyle with proper diet,

exercise and psychological

engagement that contributes

to our physical and

mental well-being.

We need protection, security

and peace of mind in a

world often threatened

by social, political and

environmental instability.

We need relationships,

family, affection, trust

and companionship to

give us a purpose.

We need to feel unique, important,

needed and productive in our

work, homelife and

social existence.

We need to expand our capacity,

capability, creativity,

understanding, sense of self

and financial rewards as we

progress through life.

We need to help others as

part of self-actualization

and finding a purpose in

life that is greater

than us as individuals.

Your legacy is vastly more than

an amount of money left to your

surviving beneficiaries. Part your

legacy can be the example of a life

well-lived that's achieved

through proper planning.

Too many people enter retirement

with burdensome mortgages, car

payments and credit-card debt.

Proper management of these liabilities

is an integral part in the success

of your financial future.

Taxes have a significant impact on

your finances and can siphon

assets unless you have a

prudent approach to meet your

objectives.

Sources of income - whether

derived from investments,

Social Security or ongoing

employment - are pillars of a

sustainable and successful

financial plan.

When you reduce expenses, you

can increase your income and

decrease the risk of having

inadequate financial resources

during retirement.

Your assets require the attention

of a fully qualified professional

to provide for

your needs in life.

Alliance America is redefining the way we approach life and income planning. After all, being retired means more than living off your life savings. And financial planning is more than just having money. All the money in the world has little value unless our essential needs are fully addressed.

Over the past two centuries, experts have identified a core set of needs that motivates us in our quest for a fulfilled life. Every person has an individual path to take and unique priorities to meet these needs, making each and every retirement plan different. If Life's Essential Needs (LENs) are not met, financial stability alone won't provide the fulfilling retirement you've worked so hard to realize. Meeting LENs is an integral part of the retirement lifestyle planning process at Alliance America. We help people retire to something - not from something - and enjoy a fulfilling lifestyle for the long term.

Your relationship with Alliance America means more than just working with a

single financial professional. As an Alliance America client, you have the entire

professional staff at Alliance America available to assist you with your

retirement income planning. Every Alliance America agent has a case

manager who is a financial professional located in our home

office. Case managers are focused on getting your plan in place as

quickly and efficiently as possible. Many financial plans include

multiple elements, companies and products. Your case manager's

responsibilities include assisting you with the initial setup of your

plan, application submissions, monitoring the progress of your plan's

implementation and working with your agent to finalize your plan.

Whether you are working on a 401(k) rollover or exchanging an annuity or

a life insurance policy for a new product, your case manager is

dedicated to assisting with the entire planning process and is readily

available to answer your questions.

Your relationship with Alliance America means more than just working with a

single financial professional. As an Alliance America client, you have the entire

professional staff at Alliance America available to assist you with your

retirement income planning. Every Alliance America agent has a case

manager who is a financial professional located in our home

office. Case managers are focused on getting your plan in place as

quickly and efficiently as possible. Many financial plans include

multiple elements, companies and products. Your case manager's

responsibilities include assisting you with the initial setup of your

plan, application submissions, monitoring the progress of your plan's

implementation and working with your agent to finalize your plan.

Whether you are working on a 401(k) rollover or exchanging an annuity or

a life insurance policy for a new product, your case manager is

dedicated to assisting with the entire planning process and is readily

available to answer your questions.

![]() Alliance America has earned a reputation for its professionalism,

excellence and delivering results. That's because our core principles

were developed with a strict focus on the client's needs as a person.

Alliance America has earned a reputation for its professionalism,

excellence and delivering results. That's because our core principles

were developed with a strict focus on the client's needs as a person.