Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

At some point in their lives, many women will manage their money solo. This could be due to divorce, death of a spouse or not marrying at all. Regardless of the reason, there can be significant hurdles when it comes to planning for future financial security with retirement for women.

Nearly 50% of U.S. adults are single, according to the U.S. Census Bureau - and since 1950, the number of divorced women has risen, as has the number of females who have never been married.

With an average life expectancy of over 81 years for women in the United States today, it is essential for females to plan ahead for retirement. Otherwise, they could run out of money at a time when they need it most.

But with the right plan in place, there are ways to generate an ongoing stream of income for the remainder of your lifetime - regardless of how long that may be. There are also some sources of cash flow that many women are not aware of, but that could make a significant difference in creating a more worry-free retirement.

While the national population in the U.S. is fairly evenly split between men and women, the singles demographic shows women making up 53% and men 47%. This equates to approximately 86 unmarried men in the United States for every 100 unmarried women.

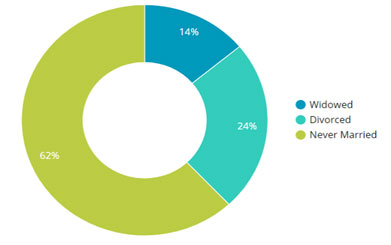

Status of single individuals in the United States

There are several reasons why retirement for women is different from the planning that is done for a married couple or even for single men. One of these is because women can face a variety of financial planning issues that could make future financial security somewhat challenging - at least without a good, solid plan in place.

Contrary to what many people might believe, the growth of the single population is not centered solely on older individuals. In fact, the percentage of singles has nearly tripled in the age 25 to 44 age range since the 1960s.

On the other end of the spectrum, there are roughly 17 million unmarried seniors in the U.S., which accounts for approximately 16% of all singles in the country. In any case, it is never “too early” to plan ahead for retirement. Likewise, even if a woman is currently married, it is essential to cover a long list of “what ifs,” just in case she finds herself single in the future.

According to the Age Wave/Merrill Lynch study, women are more than three times more likely than men are to lose their spouse - and roughly half of all widows experience a household income decline of 50% or more after the death of their husband. The study also notes that nearly 70% of widows say that becoming the sole financial decision maker was their top financial challenge in the case of their widowhood. But it doesn't have to be this way.

So, how does retirement for women and men differ?

There are actually many ways retirement for women is different. For instance, women may have a lack of confidence or comfort when they are heading into retirement due to several societal challenges that can make financial planning more difficult. According to the Alliance for Lifetime Income, these can include the following factors:

Although more people are aware of it, the gender pay gap is still an issue that can put women in a more vulnerable position when it comes to retirement income planning. According to the 2021 World Economic Forum Study, women earn just 82 cents for every dollar that their white male peers earn. The wage gap endures across every occupation and level of education.

Not only does this make meeting current expenses more difficult for women, but it also leads to lower female savings rates. In addition, women are more likely to work in part-time jobs that do not offer or qualify for inclusion in a company-sponsored retirement plan.

While there are a number of causes of the wage gap, they can primarily be attributed to the following:

Overall, these factors not only lead to less savings for retirement in the future, but also to the fact that women experience higher rates of poverty than men.

Women are more likely than men to be out of the workforce - even if its is for just a short period of time. Typically, females have fewer years in the working world due to caregiving for children, as well as for older relatives. This can take a toll financially, physically and mentally.

Lost wages for women - many of whom are the primary or sole income earner in their households - can have a dramatic impact on their economic security throughout their entire lifetime. In fact, the challenges can compound over time.

For instance, throughout the course of a 40-year career, the wage gap can cost women who work full-time, year-round approximately $417,400. In fact, it is estimated that over a career, women could lose between $400,000 and $1.2 million due to the gender wage gap.

When women work fewer years - and in turn, contribute less toward their retirement - it can result in lower savings for the future. Coupled with females having a longer average life expectancy than men, this could create some substantial financial hurdles going forward.

As an example, if 100% of the loss in earnings due to the wage gap were invested over a 40-year career, women who work full-time, year-round could amass nearly $1.6 million in retirement savings.

But even lower rates of saving and investing could usher in significant retirement assets for women. For instance, investing just 20% of those lost wages could potentially bring more than $300,000 in savings.

Statistically, women live longer than men. American men live an average of 76.1 years, while women in the United States, on average, can expect to live 81.1 years - a five-year difference over their male counterparts.

While a longer life expectancy can certainly have many benefits, it can also equate to facing financial risks - like stock market volatility - longer. In addition, longer lives can also mean more health care expenses for a more extended period of time.

So, without a way to ensure that retirement income will last as long as it is needed - and that the amount of that income will also rise with inflation - retired women may have to cut back on their future lifestyle. Depending on the situation, they may even have to choose between paying for food or prescription medication - but not both.

When women are older, their health care costs can be higher, on average, than men's. This, too, can cause a discrepancy in how much money females have available for other spending needs in retirement.

Women tend to incur greater health care costs than men across their lifetimes. For instance, health spending during women's child-bearing years (approximately between age 19 and 44) is much higher when compared with men's health spending. According to a Health System Tracker study, in 2019, average annual health spending for women ages 19 to 34 was $4,709 - more than double the average of $2,261 for men.

Since women live longer, they are also more likely to need long-term care. Approximately 64% of Americans aged 85 and over are female. Likewise, 80% of Americans who live to 100 years old are women.

This increased longevity can also mean that chronic health problems are more likely to occur for women. While females live longer than males, those extra years are not necessarily lived in good health. For example, women are more likely than men to develop debilitating conditions like arthritis, depression and fall-related fractures.

Further, women are more likely than men to live alone in their older age - and because of that, there is nobody in their home to provide assistance that they may need with significant health issues, or even more “custodial” issues like dressing and bathing.

If women must rely on a paid caregiver - either at home or in a facility - it can be expensive. In 2021, the average monthly cost of a home health aide was more than $5,100. A private room in a skilled nursing home facility was in excess of $9,000 per month. So, the need for long-term care can quickly chip away at retirement savings.

| In-home care | Community and assisted living | Nursing home facility |

|---|---|---|

| In-home careHomemaker services: $4,957 | Community and assisted livingAdult day health care: $1,690 | Nursing home facilitySemi-private room: $7,908 |

| In-home careHome health aide: $5,148 | Community and assisted livingAssisted living facility: $4,500 | Nursing home facilityPrivate room: $9,034 |

Women provide most of the caregiving for children and aging relatives. But doing so can cost them in terms of retirement savings and income. Females make up the majority of unpaid caregivers in their families. The consequences of this can be devastating.

For example, the cost of child care amounts to nearly one-third of the average woman's income, which in turn can force many out of the workforce during their prime working years. At the same time, one-fourth of early child-care providers need to take on multiple jobs in order to make ends meet due to their low pay.

The lack of paid family and medical leave programs can make this even worse. There are far more women caregivers than men. It is estimated that in an average year, women in America cumulatively lose more than $7 billion because of unpaid or partially paid parental leave and over $2 billion because of unpaid or partially caregiving leave.

Married women are often caregivers for their husbands first. By the time women become sick or unable to care for themselves, they are widowed and need to rely on family members or professional - and costly - caregiving services.

Many women of retirement age are, or at some point will be, widowed. In fact, according to a 2018 NBER study, there is a 63% chance that a female will outlive her male partner by an average of 12 years.

According to a study conducted by Age Wave and Merrill Lynch, a full 53% of widows say that they have no plan in place for costly care needs in the future, as well as for how they will continue their current lifestyle.

The same study indicated that 50% of those women who lose a spouse also face a 50% reduction in income. In fact, many widows and recent female divorcees find that the day-to-day financial pressures are so great that they forgo setting aside money for the future.

Financial fears can paralyze nearly anyone from making decisions about money. But for many women, money matters can be particularly terrifying. One reason for this is because many women still see investing and money management services as an industry that is geared towards men.

This can leave women feeling intimidated and concerned about how financial professionals will treat them. Making matters worse, financial literacy is not typically taught in school, and many families perpetuate the money “taboo.” So, if financial advisors use a lot of technical “jargon,” it can be difficult to understand what to anticipate from various investments and/or financial strategies.

Therefore, many women end up in investments and other financial vehicles that are not right for them because they are afraid to ask for clarification or more information about how and why various products are put into their portfolio.

As with planning for any other individual or couple, there is no single right answer to how much a single woman needs for retirement. But there are some strategies that can help to narrow it down.

The first one is to come up with an estimate of future expenses. These should ideally be broken down into essential and non-essential costs. For essentials, the items will typically include:

Non-essential (but “nice to have”) items may include:

After coming up with an approximate total for future expenses, the next step is to determine where retirement income will come from. For women, it is important to factor in the fact that upon divorce or death of a spouse, some or all pension income may disappear, as well as a portion of retirement benefits from Social Security. With that in mind, women who are currently married should have an income replacement plan in place, just in case.

There are many ways for women to generate retirement income. The most common of these include the following:

Although most employers have done away with the traditional pension, there are still some that pay out benefits. Depending on the plan, some will continue to generate income for the lifetime of the retired worker, but then stop when the individual passes away.

In other cases, when the primary benefit earner dies, income will continue from the pension - either in full or in part - for the surviving spouse. With that in mind, it is essential to know how a pension benefit is set up, as a survivor could lose a substantial amount of retirement income when benefits from a pension plan stop.

Due to lower income amount and/or a shorter time in the workforce, women usually generate less than men in Social Security retirement income benefits. For an average wage earner, Social Security can replace about 40% of pre-retirement income. But there are a lot of factors that can go into the amount received, such as:

For instance, those who are eligible for Social Security retirement benefits may file as early as age 62. However, if benefits are claimed at any time before reaching full retirement age, the amount will be reduced - and it will remain reduced throughout the lifetime of the recipient. This can also impact the amount of spousal benefits that are generated for the spouse of a retired worker.

| Year of birth | Minimum retirement age for full benefits |

|---|---|

| Year of birth1937 or before | Minimum retirement age for full benefits65 |

| Year of birth1938 | Minimum retirement age for full benefits65 + 2 months |

| Year of birth1939 | Minimum retirement age for full benefits65 + 4 months |

| Year of birth1940 | Minimum retirement age for full benefits65 + 6 months |

| Year of birth1941 | Minimum retirement age for full benefits65 + 8 months |

| Year of birth1942 | Minimum retirement age for full benefits65 + 10 months |

| Year of birth1943 to 1954 | Minimum retirement age for full benefits66 |

| Year of birth1955 | Minimum retirement age for full benefits66 + 2 months |

| Year of birth1956 | Minimum retirement age for full benefits66 + 4 months |

| Year of birth1957 | Minimum retirement age for full benefits66 + 6 months |

| Year of birth1958 | Minimum retirement age for full benefits66 + 8 months |

| Year of birth1959 | Minimum retirement age for full benefits66 + 10 months |

| Year of birth1960 or later | Minimum retirement age for full benefits67 |

Women whose husbands were receiving Social Security retirement income benefits may be eligible for survivor's, or widow's, benefits. For instance, when an eligible Social Security benefit recipient passes away, family members - such as his or her surviving spouse, as well as their children, and/or dependent parents - could be eligible to receive Social Security survivor's benefits.

A surviving spouse can be qualified if they are:

The other possible benefit recipients of Social Security survivor's benefits can include:

The number of your work credits that are required for family members to be eligible for Social Security survivor's benefits will depend upon the worker's age when they pass away. In this case, the younger the worker is when they die, the fewer work credits are needed for their eligible survivors to qualify. In any case, though, nobody is required to have more than 40 work credits for their loved ones to receive survivor's benefits from Social Security.

Today, roughly half of all marriages in the United States end in divorce. What many divorced women do not realize is that qualifying divorced spouses can receive a benefit that is equal to roughly half of their ex-spouse's full Social Security retirement benefit if they start receiving benefits at their own full retirement age.

If they start these benefits prior to their full retirement age, though, the dollar amount of each payment will be less - similar to claiming one's own benefits early. There are several criteria that a divorced individual needs to meet in order to qualify, including:

It is important to note that if a single woman is receiving Social Security benefits based on her ex-spouse's work record, and she subsequently remarries, she generally will not be allowed to continue collecting these benefits - unless her later remarriage also ends (either by death, divorce, or annulment).

Further, if her ex-spouse has not yet applied for retirement benefits through Social Security, but he can qualify for them, she can receive benefits on her ex-husband's work record if they have been divorced for at least two years.

As an example, Sherry and John were married for 15 years, and then they got divorced. Sherry is eligible for Social Security divorced spouse's benefits at age 62, provided that she does not re-marry (unless that marriage also ends).

John does get remarried to a woman named Stephanie. They have four children together. When John becomes eligible to collect his Social Security retirement benefits, the amount that Sherry collects will not reduce the amount that Jim or Stephanie can receive when they file for Social Security.

Working with a retirement income specialist who is also well-versed in Social Security planning strategies can help to come up with the best plan, based on an individual's objectives, situation, time frame, and risk tolerance.

Another way for single women to generate income in retirement is through interest and/or dividends from personal savings and investments. Given the volatility of the stock market, though, it is essential to keep principal protection in mind.

Otherwise, market losses could quickly diminish savings, and in turn, the “base” for producing income in the future - and this can lead to running out of money in retirement earlier than anticipated.

Annuities can provide retirement income security because these financial vehicles are designed for paying out a known stream of cash flow for either a pre-set amount of time - such as 10 or 20 years - or even for the remainder of an individual's lifetime.

Because of that, annuities are oftentimes used as a way to provide an income “base.” That way, regardless of what happens in the stock market - or even in the overall economy - a known amount of income will continue.

Annuities can provide other benefits, too, such as:

There are many different types of annuities, though, and they can all have a myriad of “moving parts.” Therefore, it is important to work with a financial professional who knows how annuities work, and which ones will - and will not - be a good fit for given situations.

When spouses or partners retire, an income plan is oftentimes determined, based on both of the individual's savings, Social Security and other financial resources. But, when one of them passes away, a significant amount of income could die along with them.

This is why it is critical for women to have income replacement strategies in place - even if they are currently married. Some strategies for ensuring that income will continue - even upon the loss of a spouse - can include the following:

Although most people do not like to think about it, being a single retiree is not only possible, but probable. Because of that, it is essential to have plans in place that will allow a survivor to continue without facing significant financial struggle.

Retirement for women can be challenging. In addition to a volatile stock market, inflation, and low interest rates, females can face a host of added barriers to financial success, such as lower wages and more time out of the workforce. So, financial planning for women is a must - especially as retirement age approaches.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.