Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Retirement planning was never supposed to be “set it and forget it,” especially if you started at the ideal time: your 20s or 30s. Of course, your priorities changed in the interim. Everyone expects that. But what they don't expect is how priorities might also be affected by all the physical and psychological changes that come with aging.

As you watched your parents age, you were sure those changes would never happen to you. But either they did or they will.

Retirement has continued to evolve from the cliché of working in just one company and being sent off to a well-deserved time of leisure with a retirement party and a pension. Over time, the financial responsibility of retirement has shifted from corporations to the individual – from pensions to 401(k)s and IRAs. Workers are expected to manage their own finances and investments, with more and more falling back on their monthly Social Security checks and – possibly – some other form of income to supplement it.

Life expectancy has also increased. Today, by retiring at the traditional ages of 62 or 65, we’re left with 25 to 30 more years to finance. At the same time, phrases like “70 is the new 50” reflect the fact that we have far more energy at retirement age, thanks to healthier living and medical advances. We have too many good years left ahead of us and, in many cases, prefer to remain relevant by staying fully engaged.

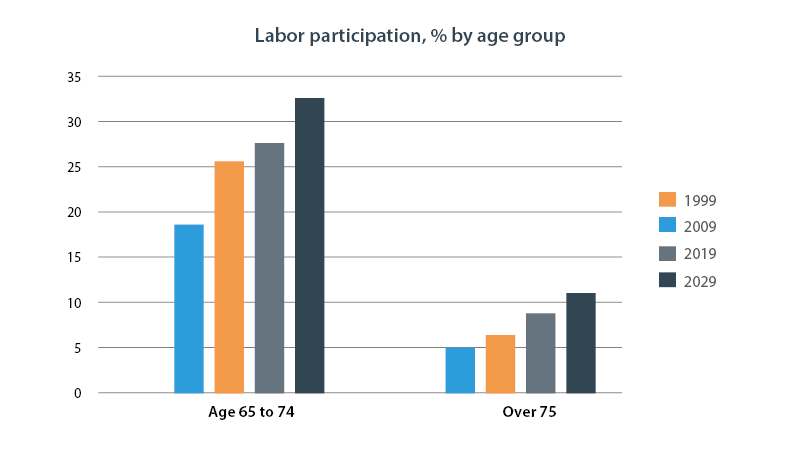

On average, the age at which people retire has been increasing. According to the Bureau of Labor Statistics, those in the 65-to-74 age group who still work rose from 18.3% to 27.8% over the 20 years between 1999 to 2019. The BLS projects 33.2% for 2029. In the same period, the group of over-75 workers has almost doubled (from 5.1% to 9.1%) and is projected to reach 11.8% by 2029.

In short, both the timing and look of retirement are in flux.

The pandemic has probably had the most significant impact on baby boomers, the generation that considered itself strong and ageless. Suddenly, those over age 65 (the exact midpoint age of that generation) were declared the most vulnerable. And the statistics of those lost to the virus have confirmed that vulnerability.

But for people of all ages, the year or more of lockdowns has also provided ample time to evaluate where their lives are and where they want them to go. Retirement decisions are part of that reflection. Will they quit working to spent more quality time with loves ones? Or will they stay engaged to push back against the newfound vulnerability? In any case, the pandemic has led to an increased financial awareness for nearly everyone.

It has also accelerated companies’ acceptance of remote work. This has given some workers a taste of more time at home, for better or for worse. Others have been introduced to the concept of freelancing, which allows them to keep earning an income while pacing the energy and time they dedicate to work.

And for others, the lockdowns and closures have meant lost income, making retirement difficult – or even impossible.

Whatever the impact has been for you, the pandemic has most likely given you the chance to revisit your life plans.

Americans tend to fall into one of three groups as they look toward retirement. They might:

| Financial Reasons (62%) | Personal Reasons (38%) |

|---|---|

| Financial Reasons (62%)Can't afford retirement - 37% | Personal Reasons (38%)Still enjoying work - 45% |

| Financial Reasons (62%)Supporting the family - 23% | Personal Reasons (38%)Working out of boredom - 18% |

| Financial Reasons (62%)Paying off debt - 19% | Personal Reasons (38%)Enjoying job, but part-time - 16% |

| Financial Reasons (62%)Paying off mortgage - 13% | Personal Reasons (38%)Working to fill the time - 12% |

| Financial Reasons (62%)Saving for a major expense - 4% | Personal Reasons (38%)Working out of loneliness - 6% |

| Financial Reasons (62%)Other - 3% | Personal Reasons (38%)Other - 1% |

A study of more than 1,000 older Americans shows more detail. Their ages were between 65 and 87 (average age 67), and they were still working, either full-time or part-time. One-third of them said they had no interest in being retired, 20% said they'd prefer to work fewer hours, and the rest said they would rather already be retired.

Why were they working? Financial needs explained 62%. The personal reasons that explained the remaining 38% included enjoying their work, avoiding boredom, filling time and avoiding loneliness. (They missed the camaraderie.)

Everyone needs to plan, regardless of what group they belong to. Those who need planning the most are likely the ones who plan the least: those who have not saved enough and cannot retire. Maybe the process needs to be called “later-life planning” since they may not relate to “retirement planning.”

Whether you retire or not, everyone will be required to deal with some personal finance decisions. Some of those are Medicare, Medicaid, Social Security and required minimum distributions (RMDs) if you have tax-advantaged accounts.

And a later-life plan will help you make the best possible decisions, especially if resources are scarce.

As you approach retirement age, if you have accumulated the resources to retire but don’t want to, your options are vast. You could:

But whichever path you choose – even if you’re convinced you won’t retire – life almost always intervenes. Technology could make you obsolete. An economic crisis could close down your (or your employer’s) business. You could face illness or family caretaking responsibilities.

You could also be motivated to retire to fulfill an old dream: the book you never wrote, the political activism you never had time for or the bucket list you never checked off.

Or you could give in to a change that almost always starts taking place in your late 50s or early 60s: a recognition that life isn’t only about achieving; it’s also about purpose and legacy.

Whatever your reason for a change of heart, you want to know you have the financial security to follow it.

Whatever your retirement intentions, the safest strategy is to design – and fulfill – a traditional plan with an accrual phase up to a designated retirement date, followed by a spending phase. By fulfilling the accrual phase of the plan, you will be ready for almost anything when you get to your “go-no go” retirement date. (Ideally, all your essential living costs should be covered by guaranteed income sources such as Social Security, a pension and income annuities.)

If you should happen to continue working after your designated retirement date, it’s the equivalent of extending your accrual phase. All it means is more (or more secure) resources for whenever you choose to stop.

Your decision to not retire can affect various aspects of your personal finances:

Social Security: If you continue working, you can probably afford to increase your monthly Social Security benefits by waiting at least until your reach your full retirement age (FRA, which is between ages 66 and 67) to file your claim. And each year you wait beyond your FRA, up to age 70, will increase your payments by 8%. Your claiming strategy should be explored carefully to reflect your specific circumstances. For example, you might compare the payments you forgo (while delaying your filing date) with how much more in total you might receive by the time you die. The decision is particularly important if you are the highest earner in the household: By waiting until age 70, you maximize the survivor benefit you leave for your spouse.

If you decide to claim your Social Security benefits before you reach your FRA, you may face having part of your benefits withheld if you earn more than the earnings limit. However, you don’t lose what gets held back. When you reach FRA, Social Security will roll what it withheld back into its calculations at that time. And once you’ve reached FRA, there will be no withholdings, regardless of how much you earn.

Health care: If you are employed, your employer-provided health care might qualify you to postpone your Medicare benefits’ start date without incurring late penalties. (Check carefully with your plan administrator on how to sign up for Medicare at 65 without making Medicare your primary insurer, so you don't cancel out your employer's coverage.) You might save money by paying employer-plan premiums rather than Medicare premiums as long as you continue working with coverage.

Medicare premiums are determined by your adjusted gross income two years prior. If you are a high earner, IRMAA (Income Related Month Adjustment Amounts) could add considerably to your Part B (medical insurance) and Part D (prescription drug) premiums. For example, in 2021, your Part B monthly premium could potentially be raised from the standard $148.50 to a maximum of $504.90 per month, or over $1,000 for a couple.

Tax-advantaged accounts: The 2019 SECURE Act removed the age limits on contributing to traditional IRAs, as long as the funds come from earned income and you comply with specific income limits. These accounts make sense if you believe your tax bracket will be lower when you reach age 72, the age when you have to start taking RMDs.

With Roth IRAs, you face income limits but no age limits. Again, you need earned income. With Roth IRAs, you are not confronted with taking RMDs, and you leave tax-paid funds to your beneficiaries.

You might be able to avoid taking RMDs from your current employer’s 401(k) plan for as long as you continue working, assuming you don't own 5% or more of the company.

Savings and investments: The longer your accumulation phase, the shorter your spending (or post-work) phase and the less you’ll need in retirement savings if you stop. By not retiring, you can continue building your nest egg, and what you’ve saved will have that much more time to grow.

You also may be able to increase the annual rate at which you can withdraw funds without running out of money. Suggested withdrawal rates tend to run 4% or lower. If you retire in your mid-60s and have 30 years to finance, a 4% rate may be too high. But if you work further on in life, you can estimate your life expectancy and most likely withdraw at a higher rate if you stop.

Working longer may also let you lower the market risk you take with your investment portfolio. If you are trying to generate a greater return on your investments, you may be taking uncomfortable risks. But if working longer results in a larger nest egg and a shorter post-work period, you may be able to reallocate assets and not take as much risk.

Legacy: By continuing to work instead of retiring, your net worth is likely to grow. You will not only be able to protect your loved ones better, but it also allows you to build a meaningful legacy.

By accumulating greater wealth, you can meet one of life’s universal goals: giving back or contributing positively to the world. But “giving” is not as simple as it sounds. Whatever your desired legacy – however you want to be remembered – there is value in planning your philanthropy strategically to be sure you make the greatest impact while staying within the ever-changing tax laws.

The fact that you don’t retire does not lessen the importance of planning. Instead, it gives you a series of aspects to consider. And, because those aspects cover so many facets of your finances, you may want to seek some counsel to be sure you get the most out of making that life choice.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.