Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

While building up your savings and investments is a key component of securing your financial future, the heart of a successful retirement is having one or more income streams in place that you can count on for the remainder of your lifetime – no matter how long that may be.

The retirement planning landscape has changed a great deal over time, and today’s – as well as tomorrow’s – retirees are in many ways on their own in terms of generating a reliable incoming cash flow for life. An added challenge is making sure that assets and income aren’t depleted, even in a volatile stock market and low-interest rate environment.

With the right financial tools in place, though, you could create your own “personal pension plan” that continues to pay you (and your spouse) a set amount of income in any type of market or economic environment, provided that you’ve taken the necessary steps to set it up.

In the past, many retirees could count on income in retirement from three primary sources – an employer-sponsored pension, Social Security and interest and/or dividends from personal savings and investments. This is what was commonly referred to as the three-legged stool.

Defined benefit employer-sponsored retirement plans are often referred to as traditional pensions, where an individual’s former employer provides a regular stream of income to its retired employees. With these plans, the employer bears all of the investment risk, and it must cover any of the funding shortfalls, which is often done by dipping into its revenue.

Because of this, defined benefit pension plans are very expensive to operate – especially given that people, on average, are living longer now, so companies are required to keep paying these benefits for a longer period of time.

Although defined benefit plans were common many years ago, this is not the case anymore. In fact, starting in the 1980s, employer-sponsored retirement savings options started to change dramatically – and many companies moved from defined benefit pensions to defined contribution plans, the most popular of these being the 401(k).

Unlike defined benefit plans, defined contribution plans do not automatically generate an income stream when an individual retires from the employer. Rather, it is up to the individual employee/participant to fund defined benefit plans, as well as to “convert” the money to an income stream in retirement.

With defined contribution plans, the employee/participant takes on all of the risk, including stock market volatility and negative returns. It is also up to the individual to ensure that the income that is generated from these funds last as long as they are needed – a time frame that is unknown.

Given that, today, living “too long” is the biggest threat to your financial security in retirement – not only because income may have to last for several decades, but also because your assets are subject to all of the other financial risks – like stock market volatility, low interest rates and inflation – for a longer period of time.

So, unless you have an ongoing income plan in place, you could end up watching the “gauge” on your portfolio move closer to empty, and in turn, missing out on the enjoyable and relaxing retirement that you had hoped for.

But there are solutions available to help alleviate this risk of running out of money in retirement. One is creating and customizing your own personal pension plan.

Because so many current and future retirees don’t have a lifetime income stream from their former employer(s), it has become necessary to create one (or more) on their own. Otherwise, without a guaranteed income stream in place, you run the risk of fully depleting your portfolio while you still need income in retirement.

The good news is that there are strategies you can use to not only create income in retirement, but also to maximize it so that you (and your spouse, if applicable) can count on incoming cash flow and keep your purchasing power on pace with future inflation.

There are three steps involved in setting up a personal pension plan. These include the following:

Step 1: Delaying your Social Security retirement income benefits until you are age 70.

Step 2: Creating a “bridge” to fill in any income “gaps.”

Step 3: Converting your savings into an ongoing stream of income for life.

The end result of properly positioning your sources of retirement income is the creation of an incoming cash flow stream that you cannot outlive – just like a “traditional” employer-sponsored pension plan. So, it is important to understand and implement the following three steps in order to create a reliable income – and lifestyle – for the entire term of your retirement, even if it goes on for many years.

The first step in creating your own personal pension plan is delaying your claim for Social Security retirement benefits until you are age 70. According to the Social Security Administration, income from this source can replace approximately 40% of an average wage earner’s pre-retirement earnings. But this figure can vary – and for higher wage earners, the percentage of pre-retirement income replacement is usually less.

In order to receive the total benefit that you qualify for from Social Security, you must first reach your “full retirement age,” or FRA. Depending on the year of your birth, Social Security full retirement age can be between 65 and 67.

| Year of birth | Minimum retirement age for full benefits |

|---|---|

| Year of birth1937 or before | Minimum retirement age for full benefits65 |

| Year of birth1938 | Minimum retirement age for full benefits65 + 2 months |

| Year of birth1939 | Minimum retirement age for full benefits65 + 4 months |

| Year of birth1940 | Minimum retirement age for full benefits65 + 6 months |

| Year of birth1941 | Minimum retirement age for full benefits65 + 8 months |

| Year of birth1942 | Minimum retirement age for full benefits65 + 10 months |

| Year of birth1943 to 1954 | Minimum retirement age for full benefits66 |

| Year of birth1955 | Minimum retirement age for full benefits66 + 2 months |

| Year of birth1956 | Minimum retirement age for full benefits66 + 4 months |

| Year of birth1957 | Minimum retirement age for full benefits66 + 6 months |

| Year of birth1958 | Minimum retirement age for full benefits66 + 8 months |

| Year of birth1959 | Minimum retirement age for full benefits66 + 10 months |

| Year of birth1960 or later | Minimum retirement age for full benefits67 |

However, those who qualify for Social Security retirement income can opt to claim these benefits as early as age 62. In this case, though, the dollar amount of the benefit payment is reduced – and it will remain reduced for the rest of your lifetime (even after you reach your full retirement age).

As an example, if your full retirement age is 66, and you would be eligible to receive $1,000 per month at that time, claiming your benefits at age 62 would reduce your payment by 25%, or down to $750 per month.

This equates to a “loss” of $3,000 per year ($250 per month X 12 months = $3,000). So, over a long period of time, the amount of your “lost benefits” can really add up.

| Year of Birth | Full Retirement Age (FRA) | Months Between Age 62 and FRA | Retirement Benefit is Reduce By | A $1,000 Benefit Would Be Reduced By |

|---|---|---|---|---|

| Year of Birth1943-1954 | Full Retirement Age (FRA)66 | Months Between Age 62 and FRA48 | Retirement Benefit is Reduce By25.00% | A $1,000 Benefit Would Be Reduced By$750 |

| Year of Birth1955 | Full Retirement Age (FRA)66 and 2 months | Months Between Age 62 and FRA50 | Retirement Benefit is Reduce By25.83% | A $1,000 Benefit Would Be Reduced By$741 |

| Year of Birth1956 | Full Retirement Age (FRA)66 and 4 months | Months Between Age 62 and FRA52 | Retirement Benefit is Reduce By26.67% | A $1,000 Benefit Would Be Reduced By$733 |

| Year of Birth1957 | Full Retirement Age (FRA)66 and 6 months | Months Between Age 62 and FRA54 | Retirement Benefit is Reduce By27.50% | A $1,000 Benefit Would Be Reduced By$725 |

| Year of Birth1958 | Full Retirement Age (FRA)66 and 8 months | Months Between Age 62 and FRA56 | Retirement Benefit is Reduce By28.33% | A $1,000 Benefit Would Be Reduced By$716 |

| Year of Birth1959 | Full Retirement Age (FRA)66 and 10 months | Months Between Age 62 and FRA58 | Retirement Benefit is Reduce By29.17% | A $1,000 Benefit Would Be Reduced By$708 |

| Year of Birth1960 and later | Full Retirement Age (FRA)67 | Months Between Age 62 and FRA60 | Retirement Benefit is Reduce By30.00% | A $1,000 Benefit Would Be Reduced By$700 |

Conversely, you could wait until after you have surpassed your full retirement age to claim Social Security retirement income. In this case, the longer you hold off on filing for your benefits, the higher the monthly dollar about will be when you start receiving them.

This “delayed retirement credit” can boost your benefit amount by 8% per year, for every year that you wait before filing for Social Security. So, for example, if your full retirement age is 66, and your benefit amount at that time would be $2,000, you could essentially give yourself a “raise” of 32% by delaying your claim until age 70.

(Note that you can wait until after age 70 to file for Social Security retirement benefits, but the 8% delayed retirement credit stops accruing at that time).

| If your full retirement age is 66 and you take your Social Security retirement benefits at age: | The monthly benefit amount would be: |

|---|---|

| If your full retirement age is 66 and you take your Social Security retirement benefits at age:66(FRA) | The monthly benefit amount would be:$2,000 |

| If your full retirement age is 66 and you take your Social Security retirement benefits at age:67 | The monthly benefit amount would be:$2,160 |

| If your full retirement age is 66 and you take your Social Security retirement benefits at age:68 | The monthly benefit amount would be:$2,320 |

| If your full retirement age is 66 and you take your Social Security retirement benefits at age:69 | The monthly benefit amount would be:$2,480 |

| If your full retirement age is 66 and you take your Social Security retirement benefits at age:70 | The monthly benefit amount would be:$2,640 |

When collecting Social Security benefits, you may also receive an annual cost-of-living adjustment, or COLA. This is an increase in the dollar amount of your benefit, based on the prior year’s CPI (Consumer Price Index).

Cost-of-living adjustments can help these benefits to keep better pace with the rising prices of the goods and services that you need to buy in retirement. While COLAs are not guaranteed, Social Security benefits have increased almost every year since 1975.

| Year | COLA % | Year | COLA % | Year | COLA % |

|---|---|---|---|---|---|

| Year1975 | COLA %8.0 | Year1991 | COLA %3.7 | Year2007 | COLA %2.3 |

| Year1976 | COLA %6.4 | Year1992 | COLA %3.0 | Year2008 | COLA %5.8 |

| Year1977 | COLA %5.9 | Year1993 | COLA %2.6 | Year2009 | COLA %0.0 |

| Year1978 | COLA %6.5 | Year1994 | COLA %2.8 | Year2010 | COLA %0.0 |

| Year1979 | COLA %9.9 | Year1995 | COLA %2.6 | Year2011 | COLA %3.6 |

| Year1980 | COLA %14.3 | Year1996 | COLA %2.9 | Year2012 | COLA %1.7 |

| Year1981 | COLA %11.2 | Year1997 | COLA %2.1 | Year2013 | COLA %1.5 |

| Year1982 | COLA %7.4 | Year1998 | COLA %1.3 | Year2014 | COLA %1.7 |

| Year1983 | COLA %3.5 | Year1999 | COLA %2.5 | Year2015 | COLA %0.0 |

| Year1984 | COLA %3.5 | Year2000 | COLA %3.5 | Year2016 | COLA %0.3 |

| Year1985 | COLA %3.1 | Year2001 | COLA %2.6 | Year2017 | COLA %2.0 |

| Year1986 | COLA %1.3 | Year2002 | COLA %1.4 | Year2018 | COLA %2.8 |

| Year1987 | COLA %4.2 | Year2003 | COLA %2.1 | Year2019 | COLA %1.6 |

| Year1988 | COLA %4.0 | Year2004 | COLA %2.7 | Year2020 | COLA %1.3 |

| Year1989 | COLA %4.7 | Year2005 | COLA %4.1 | Year2021 | COLA %5.9 |

| Year1990 | COLA %5.4 | Year2006 | COLA %3.3 | Year2022 | COLA %8.7 |

There are actually a multitude of ways to go about claiming your Social Security retirement income benefits. So, it is important that you have a good understanding of the strategies that are available to you.

Because the representatives at the Social Security Administration are not allowed to recommend specific methods of benefit receipt, it is critical that you discuss your particular needs and goals with a retirement income planning specialist. That way, you will be in a better position to narrow down the best alternative for you.

Step 2 in the personal pension plan creation process is to establish a “bridge” for filling in any income “gaps.” For instance, even though waiting until age 70 to claim Social Security can greatly enhance your benefit amount, it is possible that you will want to retire before you reach age 70.

Therefore, putting an income-generating “bridge” in place can allow you to receive regular incoming cash flow if you opt to leave the working world “early,” but you still have some time before your Social Security benefits begin.

This step involves structuring part of your IRA (individual retirement account) and/or employer-sponsored retirement plan – such as a 401(k) or 403(b) – as an income generator until your Social Security benefits start paying out.

There are many ways that you could generate income here, such as:

If the income that you generate through your retirement plan investments is not sufficient to support your desired lifestyle, there are some other avenues that you could add, such as:

Certainly, one way to generate more income is to continue working on a full- or part-time basis. In addition to bringing in income, you could also receive company-paid health insurance benefits from your employer. This can be particularly beneficial if you are not yet eligible for Medicare coverage.

Reducing your expenses could be as simple as cutting back on meals out, scaling back your cable TV service and finding lower rates on your home and auto insurance policies. Or, you could decide to go big and sell your home and use the proceeds to generate more passive income through an annuity and/or investments.

Freeing up more net spendable income could also be accomplished by reviewing your tax situation and looking for ways to reduce what you owe to Uncle Sam. This is also important because it is estimated that income tax rates will rise in the near future.

The funds that remain in your IRA and/or retirement plan after you’ve constructed your “bridge” in Step 2 can be used for generating lifetime income that either begins right away or starts at a time in the future. You can accomplish this with an annuity.

Annuities are a type of insurance product that can pay out a set amount of income on a regular basis, either for a pre-selected period of time – like 10 or 20 years – or even for the remainder of your lifetime.

There are different types of annuities available, including immediate and deferred. With an immediate annuity, you contribute a lump sum of money – such as funds from an IRA or retirement plan – and income will begin right away (typically within the next 12 months).

However, if you do not need an income stream right away, you could instead purchase a deferred annuity – where income can start at a time in the future – and take advantage of other benefits that these financial vehicles offer, too, such as:

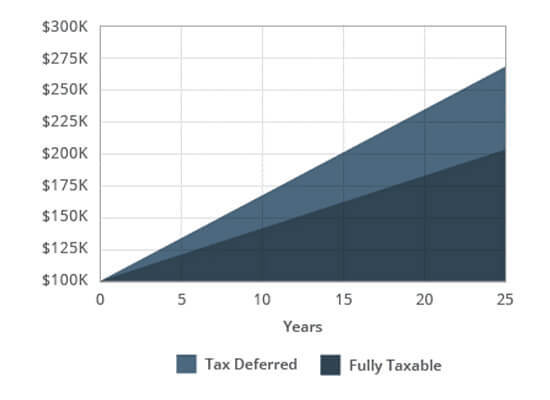

Tax-deferred growth allows you to forgo paying taxes on the gains that take place in the annuity until the time of withdrawal. Because of this, it is possible that your account can grow more than it would if it were fully taxable (with all other factors being equal). This is because your money is generating growth on the principal, as well as growth on previous gains, and on the money that would have otherwise been used to pay gains taxes.

Many of today’s annuities also offer additional features, such as penalty-free withdrawals if you contract a terminal or chronic illness or require long-term care services for at least a certain period of time (such as 90 days or more).

These types of annuities may also include a death benefit whereby, if you do not receive all of your contributions back prior to passing away, a beneficiary (or beneficiaries) can inherit the remainder of these funds.

In addition, with a deferred annuity, you may also be able to add more money into the account over time, which in turn, can increase your tax-advantaged savings. So, for instance, if you have “maxed out” the annual contributions to your IRA and/or employer-sponsored retirement plan, you could still add money to the annuity and get tax-advantaged growth.

Because the income stream with a deferred annuity can be “switched on” in the future, it can essentially provide you with a “safety net” if the money from your IRA and/or retirement plan run out.

Creating an income strategy that works for your specific needs and goals in retirement can require some in-depth planning. Otherwise, you could run into some unpleasant surprises in the future. With that in mind, some of the primary considerations to keep in mind when collecting your retirement income include:

Taxes should be a key factor in all financial-related decisions and plans. That’s because, depending on your tax rate, you could end up netting out less spendable income than you originally anticipated – and this could significantly alter your lifestyle.

Plus, while the U.S. has languished in a low tax rate environment over the past decade or so, tax rates are expected to go up in the future – and nobody knows just how high they will go.

| Year | Rate | Year | Rate |

|---|---|---|---|

| Year2018-2023 | Rate37 | Year1950 | Rate84.36 |

| Year2013-2017 | Rate39.6 | Year1948-1949 | Rate82.13 |

| Year2003-2012 | Rate35 | Year1946-1947 | Rate86.45 |

| Year2002 | Rate38.6 | Year1944-1945 | Rate94 |

| Year2001 | Rate39.1 | Year1942-1943 | Rate88 |

| Year1993-2000 | Rate39.6 | Year1941 | Rate81 |

| Year1991-1992 | Rate31 | Year1940 | Rate81.1 |

| Year1988-1990 | Rate28 | Year1936-1939 | Rate79 |

| Year1987 | Rate38.5 | Year1932-1935 | Rate63 |

| Year1982-1986 | Rate50 | Year1930-1931 | Rate25 |

| Year1981 | Rate69.125 | Year1929 | Rate24 |

| Year1971-1980 | Rate70 | Year1925-1928 | Rate25 |

| Year1970 | Rate71.75 | Year1924 | Rate46 |

| Year1969 | Rate77 | Year1923 | Rate43.5 |

| Year1968 | Rate75.25 | Year1922 | Rate58 |

| Year1965-1967 | Rate70 | Year1919-1921 | Rate73 |

| Year1964 | Rate77 | Year1918 | Rate77 |

| Year1954-1963 | Rate91 | Year1917 | Rate67 |

| Year1952-1953 | Rate92 | Year1916 | Rate15 |

| Year1951 | Rate91 | Year1913-1915 | Rate7 |

It is possible that you may have some income sources that are taxable – such as income from traditional IRAs and retirement plans – and some tax-free from a Roth account. In addition, based on your particular situation, you may have to pay tax on a percentage of your Social Security benefits (in 2023), if you meet the following criteria:

The amount of your combined income is equal to your adjusted gross income plus any non-taxable interest earned, plus one-half of your Social Security benefits.

Another big part of maximizing your retirement income is making sure that you coordinate all of your sources. This also entails narrowing down when to start receiving the cash flow from each incoming cash flow generator.

For example, if your taxable income will put you over the threshold and result in your Social Security benefits being taxed, then you may want to consider switching over to withdrawals from a tax-free Roth instead, at least for a period of time. Doing so can help to reduce the amount of taxable income in the calculation for your combined income.

Many people also wish to leave something behind for their loved ones when they pass on. So this, too, should be a factor in your overall retirement income plan. Based on your objectives, you may want to leave specific assets to your heirs. Otherwise, life insurance can provide a way to leverage what you leave. Further, life insurance proceeds are received by beneficiaries income tax-free.

Generating enough income in retirement for the remainder of your lifetime can literally mean the difference between enjoying your post-employment years or spending time worrying about whether or not your money will last as long as you need it to.

A personal pension can allow you to focus on other important matters in retirement, like spending time with loved ones, taking up new hobbies, volunteering at a favorite charity or just simply relaxing.

If you do not yet have a personal pension plan set up, it is important to get started sooner rather than later. But don’t commit to an annuity until you know it is the right one for you. Not all annuities are exactly the same. So, there isn’t just one single annuity that will work for everyone across the board. With that in mind, the best place to start is by discussing your objectives, risk tolerance and time frame with a financial professional.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.