Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Over the past century, millions of individuals and families have been impacted financially by a wide variety of circumstances - from the Great Depression in the 1920s and 1930s to the Great Recession of 2008-09 and the more recent COVID-19 pandemic that hit the U.S. in early 2020.

These events can have a significant impact on one's thoughts, values and emotions regarding money and can even lead to differences in the approach to financial planning, particularly when it comes to issues of generational wealth.

As you move through the process of setting up an estate plan and transferring generational wealth, it is important to ensure that everyone involved is "speaking the same language of money" to avoid misunderstandings and discrepancies.

Managing estates and family assets can be challenging. Doing so successfully will typically include navigating through a long list of potential risks, such as:

But when you add in the wide variety of different generational life experiences - as well as differing emotional histories - regarding money among family members, it is easy to see why this is so.

In fact, different views about finances can cause a great deal of tension within families. This is why it is essential to understand how views on money compare and contrast across different generations.

A 2022 Money & Family study revealed that individuals from different generations can have vastly different values and ideals when it comes to money and investing. In addition, the study also evaluated the ways in which families communicate (or fail to communicate) openly with one another about their finances.

This study also led to interesting discoveries about family members' willingness to share their views about money and investing, as well as the degree to which family dynamics can have a big influence on investors' behaviors, risk tolerance and attitudes around money.

With that in mind, if you plan to have any in-depth financial conversations about money with your loved ones - or if you already have had such talks, but they have not been productive - it is critical to understand that recognizing generational factors is the first step in helping you to better navigate talks and decisions related to finances and generational wealth.

While generational wealth can mean slightly different things to different people, it is often defined as having at least $500,000 in total assets to pass along to loved ones. Depending on an individuals' generation, though, some feel that it is important to leave money to family members - either during life or after death - while others believe that their family members should be responsible for making their own way without any financial assistance at all.

In this case, the 2022 Money & Family study showed that baby boomers - those in the U.S. who were born between 1946 and 1964 - are more likely than other generations to believe the latter.

Further, while more than 67% of investors overall say that passing generational wealth to their loved ones is important, baby boomers lag behind both Generation X'ers and Millennials in this particular belief.

There are many methods that can be used for building, protecting and transferring generational wealth. These strategies typically include:

Even so, there are some opposing views among the different generations with regard to how and when exactly wealth should be transferred. In this case, for instance, some individuals and families feel that it is important to give away assets while they are still alive versus waiting until they pass away.

This is true regardless of whether assets were going to children and/or other future generations or to charitable organizations and entities. Likewise, the amount of assets that are transferred while the gift-giver is still alive differs dramatically, with a small percentage gifting between $1 million and $3 million, and a much larger number giving between $25,000 and $100,000.

| % of Gift Givers | Amount Given Away While Still Living |

|---|---|

| % of Gift Givers3% | Amount Given Away While Still Living$1 million - $3 million |

| % of Gift Givers7% | Amount Given Away While Still Living$500,000 - $1 million |

| % of Gift Givers20% | Amount Given Away While Still Living$100,000 - $500,000 |

| % of Gift Givers35% | Amount Given Away While Still Living$25,000 - $100,000 |

| % of Gift Givers31% | Amount Given Away While Still LivingLess than $25,000 |

| % of Gift Givers4% | Amount Given Away While Still LivingUnsure of the amount given away |

Source: Money & Family. New research on generational wealth. Ameriprise Financial, Inc. Copyright 2022.

The reasoning for giving away assets during one's lifetime can vary from one person (or couple) to another. However, in addition to the enjoyment of seeing the money and/or other assets being used by others, some of the other primary reasons for gifting during life include the following:

But even though many people enjoy seeing their loved ones use financial gifts while they are still alive, more than half of the Money & Family study participants stated that they have no plans to give away funds while they are living because they might need the money later on in retirement.

This is a valid concern, as life spans are longer now than they have been in previous decades. So, it is oftentimes essential that assets and income are stretched out further so that they aren't depleted. In fact, one of the biggest concerns on the minds of many retirees today is running out of financial resources while they are still needed.

If you plan to give away some (or all) of your assets to loved ones while you are still alive, there are certain strategies that could help to make the process smoother for all who are involved, such as:

The federal estate tax exemption is set at $12.06 million per individual for 2022 and 12.92 million for 2023. This means that an individual may leave up to this amount to heirs and not have to pay federal estate or gift tax.

| Year | Estate Tax Exemption | Top Estate Tax Rate | Year | Estate Tax Exemption | Top Estate Tax Rate |

|---|---|---|---|---|---|

| Year1997 | Estate Tax Exemption$600,000 | Top Estate Tax Rate55% | Year2011 | Estate Tax Exemption$5,000,000 | Top Estate Tax Rate35% |

| Year1998 | Estate Tax Exemption$625,000 | Top Estate Tax Rate55% | Year2012 | Estate Tax Exemption$5,120,000 | Top Estate Tax Rate35% |

| Year1999 | Estate Tax Exemption$650,000 | Top Estate Tax Rate55% | Year2013 | Estate Tax Exemption$5,250,000 | Top Estate Tax Rate40% |

| Year2000 | Estate Tax Exemption$675,000 | Top Estate Tax Rate55% | Year2014 | Estate Tax Exemption$5,340,000 | Top Estate Tax Rate40% |

| Year2001 | Estate Tax Exemption$675,000 | Top Estate Tax Rate55% | Year2015 | Estate Tax Exemption$5,430,000 | Top Estate Tax Rate40% |

| Year2002 | Estate Tax Exemption$1,000,000 | Top Estate Tax Rate50% | Year2016 | Estate Tax Exemption$5,450,000 | Top Estate Tax Rate40% |

| Year2003 | Estate Tax Exemption$1,000,000 | Top Estate Tax Rate49% | Year2017 | Estate Tax Exemption$5,490,000 | Top Estate Tax Rate40% |

| Year2004 | Estate Tax Exemption$1,500,000 | Top Estate Tax Rate48% | Year2018 | Estate Tax Exemption$11,180,000 | Top Estate Tax Rate40% |

| Year2005 | Estate Tax Exemption$1,500,000 | Top Estate Tax Rate47% | Year2019 | Estate Tax Exemption$11,400,000 | Top Estate Tax Rate40% |

| Year2006 | Estate Tax Exemption$2,000,000 | Top Estate Tax Rate46% | Year2020 | Estate Tax Exemption$11,580,000 | Top Estate Tax Rate40% |

| Year2007 | Estate Tax Exemption$2,000,000 | Top Estate Tax Rate45% | Year2021 | Estate Tax Exemption$11,700,000 | Top Estate Tax Rate40% |

| Year2008 | Estate Tax Exemption$2,000,000 | Top Estate Tax Rate45% | Year2022 | Estate Tax Exemption$12,060,000 | Top Estate Tax Rate40% |

| Year2009 | Estate Tax Exemption$3,500,000 | Top Estate Tax Rate45% | Year2023 | Estate Tax Exemption$12,920,000 | Top Estate Tax Rate40% |

| Year2010 | Estate Tax Exemption$5,000,000 or $0 | Top Estate Tax Rate35% or 0% |

Source: The Balance

The annual federal gift tax exclusion allows you to give away up to $16,000 (in 2022) to as many people as you wish, without those gifts counting against your lifetime estate tax exemption. Married couples together may gift away twice that amount, or $32,000 in 2022. In 2023, the amount of the annual federal gift tax exclusion is $17,000 per person.

| Year | Annual Gift Tax Exclusion Amount | Year | Annual Gift Tax Exclusion Amount |

|---|---|---|---|

| Year1997 | Annual Gift Tax Exclusion Amount$10,000 | Year2011 | Annual Gift Tax Exclusion Amount$13,000 |

| Year1998 | Annual Gift Tax Exclusion Amount$10,000 | Year2012 | Annual Gift Tax Exclusion Amount$13,000 |

| Year1999 | Annual Gift Tax Exclusion Amount$10,000 | Year2013 | Annual Gift Tax Exclusion Amount$14,000 |

| Year2000 | Annual Gift Tax Exclusion Amount$10,000 | Year2014 | Annual Gift Tax Exclusion Amount$14,000 |

| Year2001 | Annual Gift Tax Exclusion Amount$10,000 | Year2015 | Annual Gift Tax Exclusion Amount$14,000 |

| Year2002 | Annual Gift Tax Exclusion Amount$11,000 | Year2016 | Annual Gift Tax Exclusion Amount$14,000 |

| Year2003 | Annual Gift Tax Exclusion Amount$11,000 | Year2017 | Annual Gift Tax Exclusion Amount$14,000 |

| Year2004 | Annual Gift Tax Exclusion Amount$11,000 | Year2018 | Annual Gift Tax Exclusion Amount$15,000 |

| Year2005 | Annual Gift Tax Exclusion Amount$11,000 | Year2019 | Annual Gift Tax Exclusion Amount$15,000 |

| Year2006 | Annual Gift Tax Exclusion Amount$12,000 | Year2020 | Annual Gift Tax Exclusion Amount$15,000 |

| Year2007 | Annual Gift Tax Exclusion Amount$12,000 | Year2021 | Annual Gift Tax Exclusion Amount$15,000 |

| Year2008 | Annual Gift Tax Exclusion Amount$12,000 | Year2022 | Annual Gift Tax Exclusion Amount$16,000 |

| Year2009 | Annual Gift Tax Exclusion Amount$13,000 | Year2023 | Annual Gift Tax Exclusion Amount$17,000 |

| Year2010 | Annual Gift Tax Exclusion Amount$13,000 |

Source: The Balance

Before you make a commitment to any type of gifting strategy, it is recommended that you first discuss your plans and objectives with an experienced financial professional who can guide you through the process. Otherwise, you and your loved ones could end up paying more in taxes than is necessary.

While transferring generational wealth is important to many families, there are other related avenues that are equally - or even more - meaningful. One of these is financial values. Based on the Money & Family study, approximately 80% of respondents agree that passing on financial values to the next generation is essential.

Many investors also feel that personal values, memories of experiences that are shared with family and personal items with sentimental (or monetary) value are even more important than generational wealth, too.

One of the ways to promote your financial values is by taking financial action that is in line with what you believe is most important. Another method is by older generations actively discussing financial values with their younger loved ones, including children and grandchildren.

Based on that, roughly two-thirds of parents in the Money & Family study said that they often discuss how their values have shaped their financial decisions. Those in the millennial generation (who were born between 1981 and 1996) are the most likely to talk about these issues, while baby boomers are the least likely to do so.

An even larger number of Millennial parents are likely to help their children and stepchildren understand the reasons why they make (or have made) certain financial-related decisions. This includes having discussions about which charitable organizations and entities they donate to, as well as the amount of money they give.

Some of the steps that investors are currently taking and/or have taken in order to teach loved ones - particularly those who are age 25 and under - about finances include:

Even so, there is still a significant number of people who are not 100% transparent with their loved ones about their finances and estate planning. For instance, while some key information is shared with children and/or other loved ones, there are some details that are kept private. There are several reasons why this is so, such as:

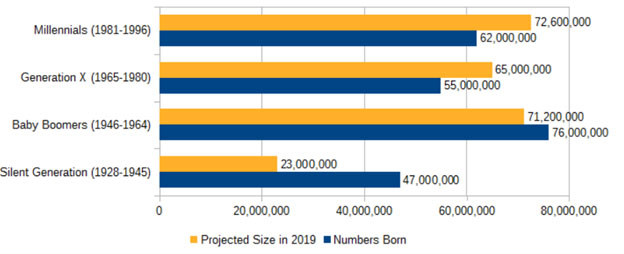

Each generation comes of age during different economic circumstances, which can have a significant impact on their thoughts and actions surrounding money. As of 2022, there were predominantly four generations among us. These are the:

This demographic cohort is generally defined as those who were born between 1928 and 1945.

In the U.S., the Great Depression and World War ll caused people to have fewer children. Therefore, the Silent Generation is (and was) relatively small - especially in comparison to later demographic generations like the baby boomers.

Many of those in the Silent Generation witnessed great economic hardship and financial struggles in their families. Because of that, this generation tends to be thrifty when it comes to spending money. They are also known for not being wasteful and for working hard to earn a living.

The baby boomers encompass those who were born between 1946 and 1964.

This generation of nearly 80 million people is known for leading the way to many changes in the economy and financial markets as they have moved through their life stages. Presently, many baby boomers are either in or approaching retirement. Overall, baby boomers tend to be more growth-oriented with their money.

Part of the reasoning behind this could be due to the time frame of when they began investing (during a predominantly upward moving stock market), which created numerous “401(k) millionaires.” Given the more volatile market of today, though, it is important for many baby boomers to reduce risk and retreat at least some portion of their assets out of the stock market. Otherwise, it is possible that they could deplete their assets while they still need money to live on in retirement.

Generation X (or simply, the Gen X'ers) encompasses those who were born between 1965 and 1979.

Many in this generation are more conservative than baby boomers. A big part of the reason why is because these individuals have seen several periods of stock market slumps, which in turn, has done damage to their portfolios. Those who are in the Gen X generation are also more likely than other generational cohorts to seek the assistance of a financial professional.

The millennials were born between 1980 and 1996.

Millennials have seen a great deal of unrest in the financial markets, as well as in the world in general, having lived through events like the Sept. 11, 2001, terrorist attacks on the United States, as well as the 2003 invasion of Iraq and the Great Recession in the early 2000s. This may be part of the reason why those in the millennial generation are more conservative financially (on average) than those who are baby boomers and Gen X'ers. For instance, as the older Millennials are approaching their early 40s - and are in their prime earning years - a number of these individuals have stated that cash was their “favorite investment,” ahead of stocks, bonds or real estate.

Millennials are also in large part responsible for socially responsible investing (i.e., investing in companies that promote good, as well as avoiding companies that can cause harm, such as pollution and inhumane testing on animals). Given that most millennials have grown up with the internet, investors in this generation will often opt for do-it-yourself investing using online platforms and accessing their own financial research.

Source: Pew Research Center.

*Note that recent cohort sizes may be greater than the number of people born due to immigration.

One of the most important steps in any type of communication is understanding where others are coming from in terms of their thought process about a certain topic. This holds true when discussing monetary issues with loved ones who may be part of a different generation.

Values can play a key role in how many people invest, as well as what they expect from loved ones when passing along their wealth. The good news is that there are ways to leave a legacy, as well as to gift money and/or other assets, and even to maintain some semblance of control when passing down your generational wealth.

Before setting up any type of generational wealth transfer plan, though, it is essential that you discuss your short- and long-term financial goals with an experienced professional who can create a customized plan for you, as well as monitor that plan to ensure that it is regularly kept up to date.

Although everyone may communicate differently with their loved ones, there are some strategies that you could use to pass on your financial values to your future generations. These include the following:

In the latter case, some of the items that you could discuss include financial lessons you have learned, as well as charities and other causes you care about, and how you have invested and added to your nest egg over time.

Do you and your loved ones speak different “financial languages?”

If so, it is not uncommon. Oftentimes, those who wish to communicate with one another work with a language translator. So, if you and those you love speak from different generational and emotional backgrounds regarding financial matters, it can be beneficial to bring an experienced financial professional on board.

That is where an Alliance America financial professional can come in.

At Alliance America, our primary focus is on helping clients ensure that their financial plans do what they are intended for - which oftentimes includes transferring assets and money to loved ones, while they are still alive and/or after their passing.

A plan that is not properly drafted, though, could result in paying higher taxes than necessary and/or your estate going through the expensive, time-consuming, and public process of probate - which could significantly alter what you had in mind for your survivors.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.