Contact

About Us

Articles

Home

Contact

About Us

Articles

Home

Retirement planning is intended to make sure we have future financial security that provides a comfortable lifestyle for us to enjoy during our golden years.

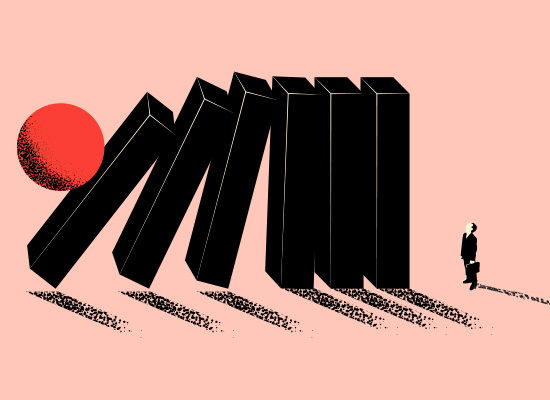

However, amid the complex web of investments, savings and market fluctuations, there are certain risks that can potentially undermine our ability to retire as planned. One such risk that often goes unnoticed but can have significant consequences is known as the sequence of returns risk.

Sequence of returns risk is a crucial concept that plays a significant role in retirement planning. It refers to the order or timing of investment returns, which can have a substantial impact on the long-term financial well-being of individuals in retirement.

Essentially, sequence of returns risk highlights the potential vulnerability that retirees face if they experience negative investment returns early in their retirement years. A major contributing factor is timing — specifically, the timing of market downturns coinciding with periods when retirees need to withdraw funds for living expenses. To put it simply, if an individual encounters poor investment performance during the initial years of their retirement while simultaneously making withdrawals from their portfolio, it can significantly diminish their assets' ability to recover later on.

The main issue with sequence of returns risk stems from its compounding effect over time. Suppose someone faces substantial losses during the early years of their retirement when they are relying on their investments for income. In that case, they not only lose money due to market declines but also withdraw funds from diminished portfolios, worsening the negative impact. This places them at a higher risk of running out of money later in life when there may be fewer options available for recovering financial stability.

To better understand sequence of returns risk, let's consider an example. Suppose two individuals – Alex and Beth – retire at the same age with identical portfolios and withdrawal rates.

Let's say Alex and Beth are both 65 years old and they both retire with a portfolio of $1 million. They both plan to withdraw $40,000 per year from their portfolios.

However, the market takes a turn for the worse, and Alex's portfolio experiences negative returns in the first few years of retirement. His portfolio loses 10% in the first year and another 5% in the second year. This means that his portfolio is now worth only $910,000.

Beth, on the other hand, is luckier. Her portfolio experiences positive returns in the first few years of retirement. It gains 5% in the first year and another 7% in the second year. This means that her portfolio is now worth $1.02 million.

Even though Alex and Beth have identical portfolios and withdrawal rates, Alex's portfolio will likely deplete faster than Beth's due to unfavorable sequencing. This is because Alex has to withdraw money from his portfolio when it is worth less.

In this example, Alex's portfolio would need to earn 11% per year just to break even. This is a much higher return than the market typically averages. Beth, on the other hand, only needs to earn 7% per year to break even.

This example illustrates the importance of sequence of returns risk. Even if you have a well-diversified portfolio and a sound withdrawal strategy, you can still run into trouble if the market experiences a series of negative returns early in your retirement.

Understanding sequence of returns risk illuminates a critical relationship between risk and return when it comes to retirement planning. While investors traditionally focus on achieving higher average annual returns over time for optimal growth, it becomes evident that smooth and consistent returns are equally vital during retirement years when withdrawals are being made regularly.

By recognizing this risk and its implications, individuals can implement strategies to mitigate its impact and secure a more stable retirement income.

Understanding sequence of returns risk is essential because it challenges conventional wisdom about how to structure one's portfolio in retirement. It signifies that strategies solely focused on maximizing investment gains may not be sufficient for long-term stability during this phase.

Instead, retirees need comprehensive planning that takes into account potential down markets and implements strategies to mitigate the potential negative impacts associated with unfavorable sequence of returns. Sequence of returns risk refers to the order or timing in which investment returns occur during one's retirement years.

It emphasizes the critical role played by market performance early in retirement and highlights how negative outcomes during this period can significantly diminish an individual's financial security later in life. Recognizing this risk allows retirees to adopt more comprehensive strategies aimed at managing downside risks while maintaining sustainable income throughout their retirement journey.

Sequence of returns risk is primarily caused by the timing and order of investment returns over a specific period, particularly when you are withdrawing funds from your portfolio. It stems from the fact that the returns received early in retirement can significantly impact the long-term success or failure of your financial plan.

This risk arises due to the unpredictability of market performance, making it challenging to accurately forecast investment outcomes. One factor that contributes to sequence of returns risk is market volatility.

Fluctuations in stock and bond markets can lead to inconsistent investment performance, with periods of substantial gains followed by significant losses. If you experience negative returns during the early stages of retirement, when your savings are at their highest and withdrawals are required to cover living expenses, it can severely impact the longevity of your portfolio.

Another aspect that exacerbates sequence of returns risk is excessive reliance on investment income for retirement funding. When your retirement strategy heavily relies on generating income from investments, you become vulnerable to market fluctuations and their potential negative effects on cash flow.

In such cases, any downturn in markets during the initial years post-retirement could result in a higher rate at which you need to withdraw funds from your portfolio, further eroding its value. Furthermore, inflation plays a crucial role in sequence of returns risk as well.

If inflation rises faster than anticipated during retirement, it can deplete purchasing power over time. To combat this risk effectively, it is essential to strike a balance between investments with growth potential and those providing stable income streams.

Sequence of returns risk is caused by various factors including market volatility, over-reliance on investment income for retirement funding and inflationary pressures. Recognizing these elements allows individuals nearing retirement age to proactively plan for potential risks associated with timing and order of investment returns within their financial strategy.

Managing sequence of returns risk is a critical aspect of retirement planning. By implementing the right strategies, individuals can mitigate the potential negative impact of market fluctuations on their savings and income during their retirement years.

There are several key approaches to managing sequence of returns risk. One effective strategy is diversifying your investments across different asset classes.

By having a well-balanced portfolio that includes a mix of stocks, bonds and cash equivalents, you can reduce the vulnerability to market volatility. Diversification helps cushion the impact of poor market performance on your overall savings, as different asset classes tend to react differently to market conditions.

Another approach is adopting a systematic withdrawal plan. This involves establishing a consistent withdrawal rate from your retirement savings each year, regardless of market performance.

By adhering to a predetermined withdrawal strategy based on your projected expenses and expected lifespan, you can minimize the risk associated with withdrawing larger amounts during periods of poor market returns. This strategy helps maintain a steady stream of income while allowing your portfolio time to recover during more favorable market conditions.

Additionally, considering alternative sources of income can help manage sequence of returns risk. Supplementing retirement savings with additional sources such as part-time work or rental income diversifies your income streams and reduces reliance solely on investment returns.

Having multiple sources of income provides greater stability and flexibility in managing financial obligations during periods when markets might be experiencing downturns. Overall, managing sequence of returns risk requires thoughtful planning and strategic decision-making.

Diversification, systematic withdrawal plans and alternative income sources are effective tools in mitigating the potential negative impact that market fluctuations can have on retirement finances. By implementing these strategies alongside careful monitoring and adjustment as needed, individuals can better navigate the complexities associated with sequencing risks in retirement planning.

For example, during periods of poor market performance, you may choose to reduce or temporarily halt withdrawals from certain investments while relying on other income sources like cash reserves or fixed-income assets. By being flexible with your withdrawal strategy, you can avoid selling investments at unfavorable prices during downturns and preserve capital for potential future growth.

Incorporating guaranteed income sources into your retirement plan can provide a level of protection against sequence of returns risk. Annuities are insurance products that offer regular payments over a specified period or for life.

By purchasing an annuity that provides a reliable stream of income regardless of market conditions, you can create a safety net that ensures essential expenses are covered even if there is volatility in the markets. Guarantees offered by annuities help mitigate the impact of negative investment returns during retirement and provide peace of mind knowing that there is always a steady stream of income available.

Reducing sequence of returns risk requires careful planning and consideration in order to protect yourself from potential financial hardships during retirement. Diversification, dynamic withdrawal strategies and the inclusion of guaranteed income sources are effective ways to minimize the impact of market volatility on your retirement savings.

Understanding the intricate relationship between risk and return is crucial when it comes to making informed financial decisions, especially in relation to retirement planning. In the realm of investments, risk refers to the uncertainty or potential for loss that an investor faces.

On the other hand, return represents the gains or rewards an investor can potentially achieve from their investments. These two concepts are intertwined, as higher levels of risk are usually associated with the potential for greater returns, but they also come with a heightened possibility for losses.

In terms of retirement planning, it's important to strike a delicate balance between risk and return. As individuals approach their golden years and prepare to rely on their savings and investments for income, they tend to have a lower tolerance for risk.

This is because individuals generally have less time available to recover from any potential financial setbacks due to market fluctuations or poor investment choices. However, it's crucial to note that completely avoiding all forms of risk isn't necessarily favorable either.

In fact, taking no risks at all could result in subpar returns that may not adequately support one's retirement needs. Therefore, finding an optimal balance between risk and return becomes essential.

To assess this balance effectively in retirement planning, one must consider various factors such as personal financial goals, time horizon until retirement, expected expenses during retirement years and individual risk tolerance levels. By evaluating these elements in conjunction with market conditions and investment opportunities available at different points in time, one can develop a sound strategy that aims to optimize returns while mitigating unnecessary risks.

Ultimately, comprehending the relationship between risk and return empowers individuals with knowledge needed for making prudent decisions regarding their finances during retirement years. Striking an appropriate balance based on personal circumstances can help secure a stable income stream while minimizing exposure to potential losses – providing peace of mind as retirees navigate through their post-work life stage.

The bucketing approach to retirement income planning is a commonly used strategy to manage sequence of returns risk. This approach involves dividing your savings into different "buckets" based on the time horizon for which the funds will be needed. Each bucket is assigned a specific purpose and investment strategy, ensuring that you have access to the appropriate amount of cash flow throughout your retirement.

The first bucket in this approach is often referred to as the "short-term" bucket. It consists of funds that will be needed within the next few years, typically up to five years.

The primary goal of this bucket is to provide immediate income and cover any necessary expenses during this time frame. To mitigate sequence of returns risk, conservative investments such as cash, short-term bonds, or stable value funds are typically utilized for this bucket.

These investments aim to preserve capital while generating a reliable source of income. The second bucket in the bucketing approach focuses on providing income for the mid-term horizon, usually covering five to 10 years.

This period often represents a critical juncture in retirement planning as it can significantly impact your financial stability during later stages. Investments selected for this bucket may include a mix of conservative assets such as high-quality bonds or bond funds along with some exposure to equities or dividend-paying stocks.

The idea behind including some equity exposure is that it allows for potential growth and inflation protection while still maintaining a certain level of stability. We have the long-term growth-focused bucket which covers expenses beyond 10 years into retirement and aims at preserving purchasing power over time.

In this stage, investors can afford more risk due to their longer investment horizon. Therefore, investments with higher potential returns such as diversified stock market index funds or low-cost exchange-traded funds (ETFs) are commonly used in this portion of the portfolio.

By employing the bucketing approach within retirement income planning, individuals can better manage their sequence of returns risk by aligning their investments with their specific time horizons and objectives. This strategy provides a systematic and disciplined approach to ensure that sufficient cash flow is available throughout retirement, reducing the reliance on the performance of the overall markets during any given period.

Understanding and effectively managing sequence of returns risk is crucial for a successful retirement. By recognizing the impact that the timing of investment returns can have on your savings and income, you can develop strategies to mitigate this risk and ensure a more secure financial future.

By taking into account both investment returns and withdrawal rates, one can better manage this risk. One approach to managing sequence of returns risk is through the bucketing strategy.

This strategy involves dividing your retirement assets into different buckets with varying levels of risk. By having a portion of your savings in more conservative investments earmarked for near-term expenses, you can potentially reduce the impact of market volatility during the early years of retirement.

Reducing sequence of returns risk also requires maintaining a diversified portfolio that aligns with your long-term goals and risk tolerance. By spreading investments across various asset classes such as stocks, bonds, real estate, or commodities, you can minimize the impact that poor performance in any single investment may have on your overall portfolio.

While sequence of returns risk is an inherent part of investing for retirement, it should not deter you from pursuing your financial goals. With careful planning, realistic expectations, and a well-diversified portfolio aligned with your individual circumstances, you can navigate these risks successfully and enjoy a comfortable retirement filled with financial security.

Alliance America is an insurance and financial services company dedicated to the art of personal financial planning. Our financial professionals can assist you in maximizing your retirement resources and achieving your future goals. We have access to an array of products and services, all focused on helping you enjoy the retirement lifestyle you want and deserve. You can request a no-cost, no-obligation consultation by calling (833) 219-6884 today.